- United States

- /

- Professional Services

- /

- NYSE:SKIL

Strong week for Skillsoft (NYSE:SKIL) shareholders doesn't alleviate pain of five-year loss

Over the last month the Skillsoft Corp. (NYSE:SKIL) has been much stronger than before, rebounding by 75%. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. In fact, the share price has tumbled down a mountain to land 87% lower after that period. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The fundamental business performance will ultimately determine if the turnaround can be sustained. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Skillsoft

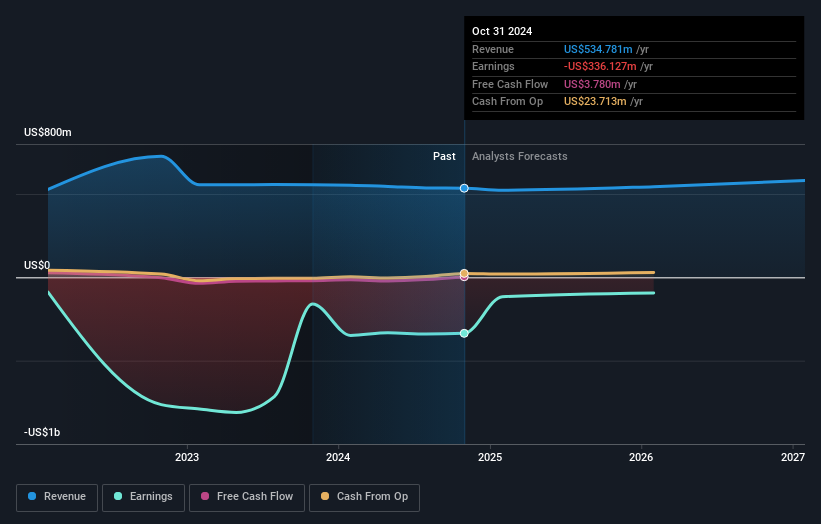

Because Skillsoft made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, Skillsoft grew its revenue at 36% per year. That's better than most loss-making companies. So it's not at all clear to us why the share price sunk 13% throughout that time. It could be that the stock was over-hyped before. While there might be an opportunity here, you'd want to take a close look at the balance sheet strength.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Skillsoft stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Skillsoft shareholders have received a total shareholder return of 71% over one year. That certainly beats the loss of about 13% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Skillsoft better, we need to consider many other factors. For example, we've discovered 2 warning signs for Skillsoft that you should be aware of before investing here.

But note: Skillsoft may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SKIL

Skillsoft

Provides personalized, interactive learning experiences, and enterprise-ready solutions in the United States, Other Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives