- United States

- /

- Professional Services

- /

- NYSE:SKIL

Improved Revenues Required Before Skillsoft Corp. (NYSE:SKIL) Stock's 28% Jump Looks Justified

Those holding Skillsoft Corp. (NYSE:SKIL) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 69% share price drop in the last twelve months.

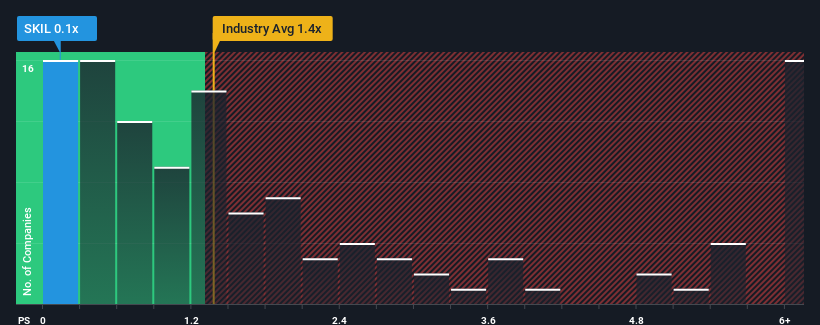

Even after such a large jump in price, considering around half the companies operating in the United States' Professional Services industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider Skillsoft as an solid investment opportunity with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Skillsoft

How Has Skillsoft Performed Recently?

While the industry has experienced revenue growth lately, Skillsoft's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Skillsoft.How Is Skillsoft's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Skillsoft's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. That's essentially a continuation of what we've seen over the last three years, as its revenue growth has been virtually non-existent for that entire period. So it seems apparent to us that the company has struggled to grow revenue meaningfully over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 1.7% over the next year. Meanwhile, the broader industry is forecast to expand by 5.5%, which paints a poor picture.

With this information, we are not surprised that Skillsoft is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Skillsoft's P/S Mean For Investors?

Despite Skillsoft's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's clear to see that Skillsoft maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Skillsoft has 4 warning signs (and 2 which are concerning) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SKIL

Skillsoft

Provides personalized, interactive learning experiences, and enterprise-ready solutions in the United States, Other Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives