- United States

- /

- Commercial Services

- /

- NYSE:RSG

Republic Services (RSG): Evaluating Valuation After Mixed Quarterly Results and a Focus on Future Growth Initiatives

Reviewed by Kshitija Bhandaru

Republic Services (RSG) recently reported second-quarter earnings that topped expectations, even as revenue came in lighter than hoped. The company’s evolving strategy and updated profit outlook are sparking renewed investor questions about its long-term growth drivers.

See our latest analysis for Republic Services.

Republic Services’ shares have mostly held steady in recent months despite the revenue miss, as investors weigh the longer-term benefits of its push into electric vehicles and higher subscription fees. The company’s one-year total shareholder return sits at 14%, showing steady performance and reflecting a market encouraged by its focus on sustainability and consistent capital returns.

If you’re interested in spotting companies that may be poised for similar momentum, now is a great moment to broaden your investing search and discover fast growing stocks with high insider ownership

The question now is whether Republic Services’ recent pullback reflects a bargain for investors, or if the market has already accounted for all future growth in its current price.

Most Popular Narrative: 15% Undervalued

Republic Services’ most widely followed narrative places fair value sharply above the latest closing price, signaling a gap driven by anticipated shifts in technology and sustainability. The rationale behind this outlook is based on bold corporate initiatives powering future margins and growth.

Sustainability efforts such as the development of Polymer Centers and the Blue Polymers joint venture could drive future revenue growth by enhancing plastic circularity and decarbonization. These operations are expected to contribute to earnings starting in the second half of 2025.

Want to know what’s fueling this premium valuation? The foundation of the narrative is a select recipe of profit margin expansion and aggressive revenue ambitions. Which breakthrough assumptions set this stock apart from the rest? Dive in for the projections behind that eye-catching fair value.

Result: Fair Value of $265.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in construction demand or challenges integrating new acquisitions could quickly undermine Republic Services’ appealing growth projections.

Find out about the key risks to this Republic Services narrative.

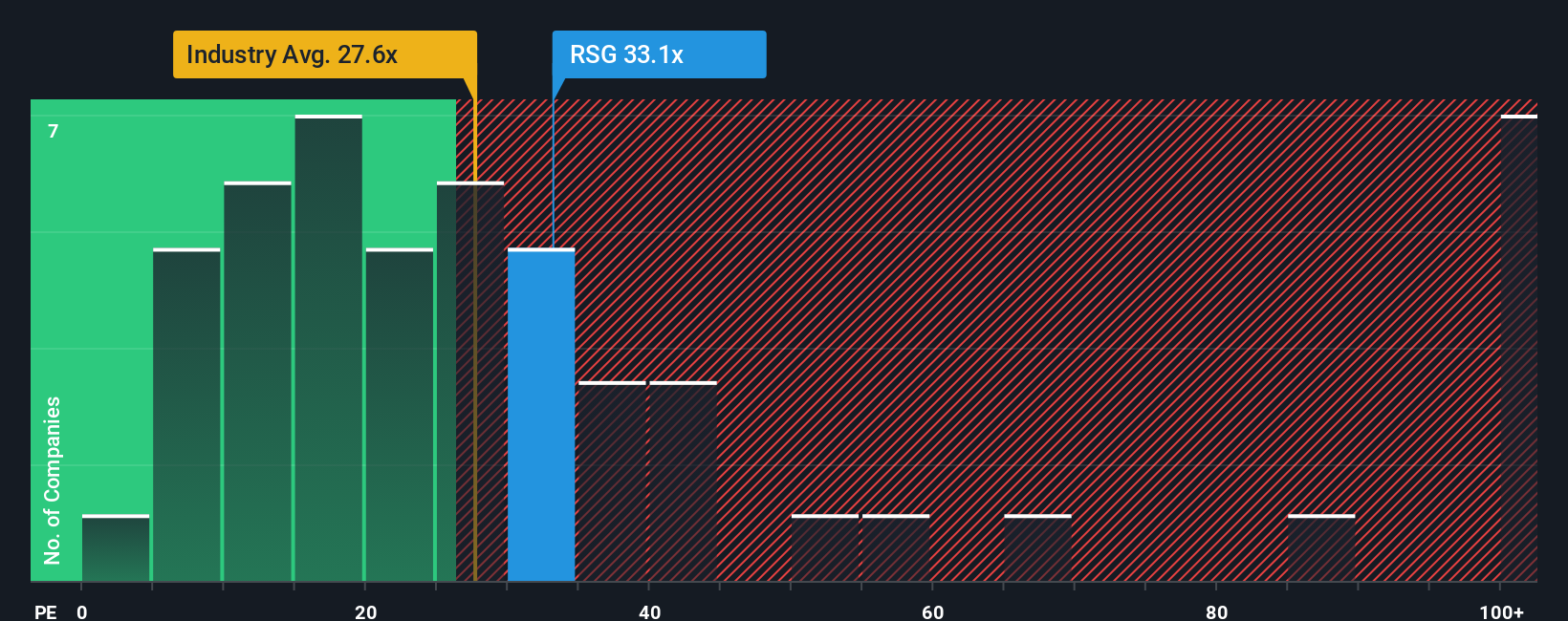

Another View: Peer Comparison by Earnings Multiple

Stepping back from future growth forecasts, Republic Services shares are currently priced at 33 times earnings. That is noticeably higher than the US industry average of 29.8 and even a fair ratio estimate of 31.5. This suggests investors might be paying up for its perceived stability, but also that there is less room for error if growth stalls. Could this premium signal confidence, or an overextension?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Republic Services Narrative

If you want to approach the numbers from a fresh angle, you can build your own take on Republic Services and see what the data reveals. Get started in just a few minutes with Do it your way

A great starting point for your Republic Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Get ahead of the curve and truly set yourself apart by using the Simply Wall Street Screener to zero in on stocks other investors might overlook.

- Unlock the potential of high-yield opportunities by marking your watchlist with these 19 dividend stocks with yields > 3%, featuring companies that offer substantial income streams for steady growth and peace of mind.

- Level up your portfolio by tracking these 24 AI penny stocks, which are making waves at the forefront of artificial intelligence innovation and redefining fast-growing industries.

- Tap into the next generation of digital finance by following these 78 cryptocurrency and blockchain stocks, where forward-thinking companies are pushing boundaries in secure payments and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSG

Republic Services

Offers environmental services in the United States and Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives