- United States

- /

- Commercial Services

- /

- NYSE:RSG

Does Republic Services’ (RSG) Sustainability Push Reveal a New Chapter in Its Growth Approach?

Reviewed by Sasha Jovanovic

- Republic Services recently reported mixed second-quarter 2025 results, with earnings surpassing estimates but revenues coming in below expectations, while also highlighting progress in its recycled plastics operations with a significantly lower carbon footprint.

- The company's consistent dividend increases and focus on electric vehicle adoption underscore its attention to shareholder rewards and environmental impact as part of a broader growth strategy.

- We'll explore how recent developments in recycled plastics production point to Republic Services' continued focus on sustainability within its investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Republic Services Investment Narrative Recap

Owning Republic Services shares means believing in predictable cash flows from waste management, supported by innovation in recycling and sustainability. The recent mixed quarter, with earnings ahead of expectations but softer revenue, has not materially changed the major catalysts or risks: growing demand for sustainable solutions and exposure to cyclical end markets remain at the forefront for the company and its shareholders.

One recent announcement directly connected to the company's long-term catalyst is the rollout of recycled plastic production at its Las Vegas Polymer Center, where the company claims significant reductions in carbon emissions compared to both traditional recycled and virgin plastics. This capacity growth in recycled plastics aligns with the investment case built around sustainability, while also highlighting Republic Services' ability to differentiate itself within a competitive waste and recycling market.

Yet, despite progress here, investors should be aware of the impact that ongoing softness in construction and manufacturing volumes could have on near-term results...

Read the full narrative on Republic Services (it's free!)

Republic Services' narrative projects $19.3 billion revenue and $2.7 billion earnings by 2028. This requires 5.6% yearly revenue growth and a $0.6 billion earnings increase from $2.1 billion.

Uncover how Republic Services' forecasts yield a $265.10 fair value, a 18% upside to its current price.

Exploring Other Perspectives

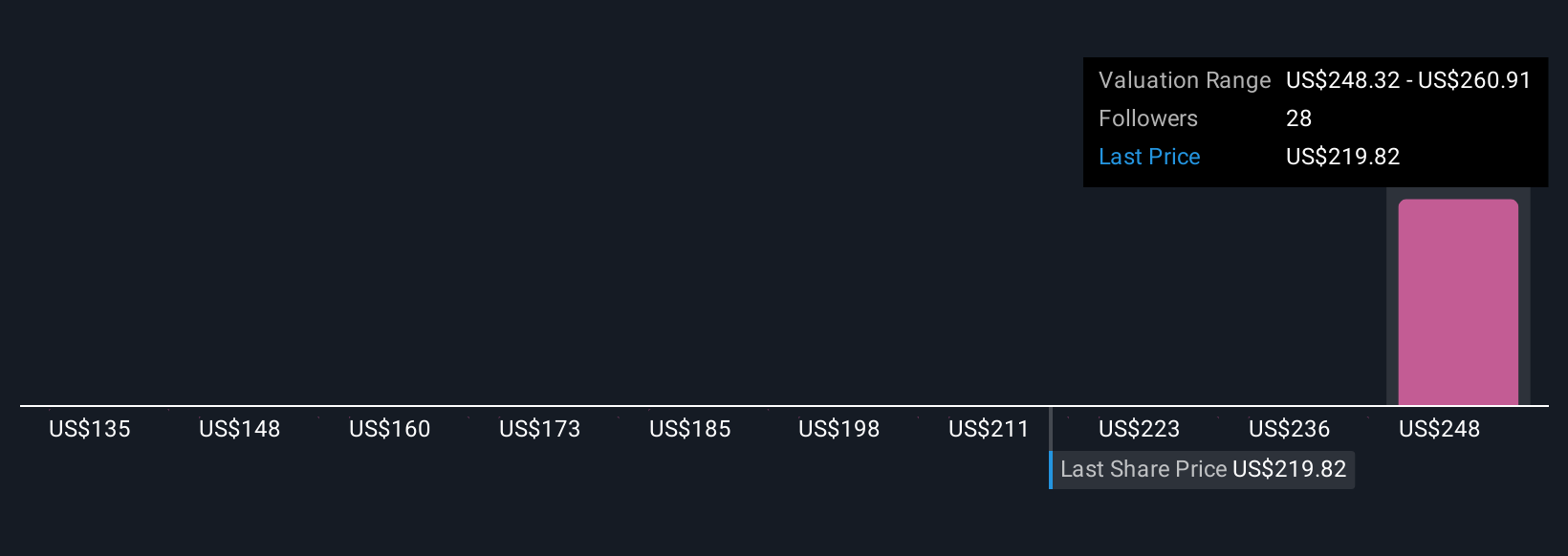

Simply Wall St Community members submitted five fair value estimates for Republic Services, ranging from US$135.00 to US$265.10 per share. With some members forecasting values far below the current share price, it’s important to consider how future shifts in cyclical construction volumes could affect the consistency of the company’s recent earnings growth and your investment outlook.

Explore 5 other fair value estimates on Republic Services - why the stock might be worth as much as 18% more than the current price!

Build Your Own Republic Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Republic Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Republic Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Republic Services' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSG

Republic Services

Offers environmental services in the United States and Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives