- United States

- /

- Commercial Services

- /

- NYSE:ROL

The Bull Case For Rollins (ROL) Could Change Following $200 Million Share Buyback Completion—Learn Why

Reviewed by Sasha Jovanovic

- Rollins recently completed a share buyback program, repurchasing 3,478,260 shares for US$200 million between November 10 and November 12, 2025.

- This move not only signals management’s confidence in the company’s financial health but also reduces the number of shares outstanding, which can affect key financial metrics.

- We'll now examine how the completion of this buyback could influence Rollins' ongoing strategic growth and profitability outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Rollins Investment Narrative Recap

To be a Rollins shareholder, it's important to believe in the company's ability to maintain stable growth through recurring revenue and effective service delivery. The completion of the recent US$200 million buyback modestly supports shareholder value but does not materially shift the most important short-term catalyst, benefits expected from accretive acquisitions like Saela Pest Control. It also doesn't significantly alter the biggest risk right now, which remains exposure to external market uncertainty impacting demand trends.

Among recent developments, the acquisition of Saela Pest Control stands out for its potential to add US$45–50 million in revenue in 2025. This growth-focused move directly relates to catalysts such as expected earnings enhancement and expanded market presence, factors that structurally matter more than the short-term effects of the buyback. But while acquisitions can boost revenue, they can also bring challenges around debt and integration, meaning investors should weigh...

Read the full narrative on Rollins (it's free!)

Rollins' outlook anticipates $4.6 billion in revenue and $686.0 million in earnings by 2028. This projection is based on 8.8% annual revenue growth and a $196.7 million increase in earnings from the current $489.3 million.

Uncover how Rollins' forecasts yield a $61.61 fair value, in line with its current price.

Exploring Other Perspectives

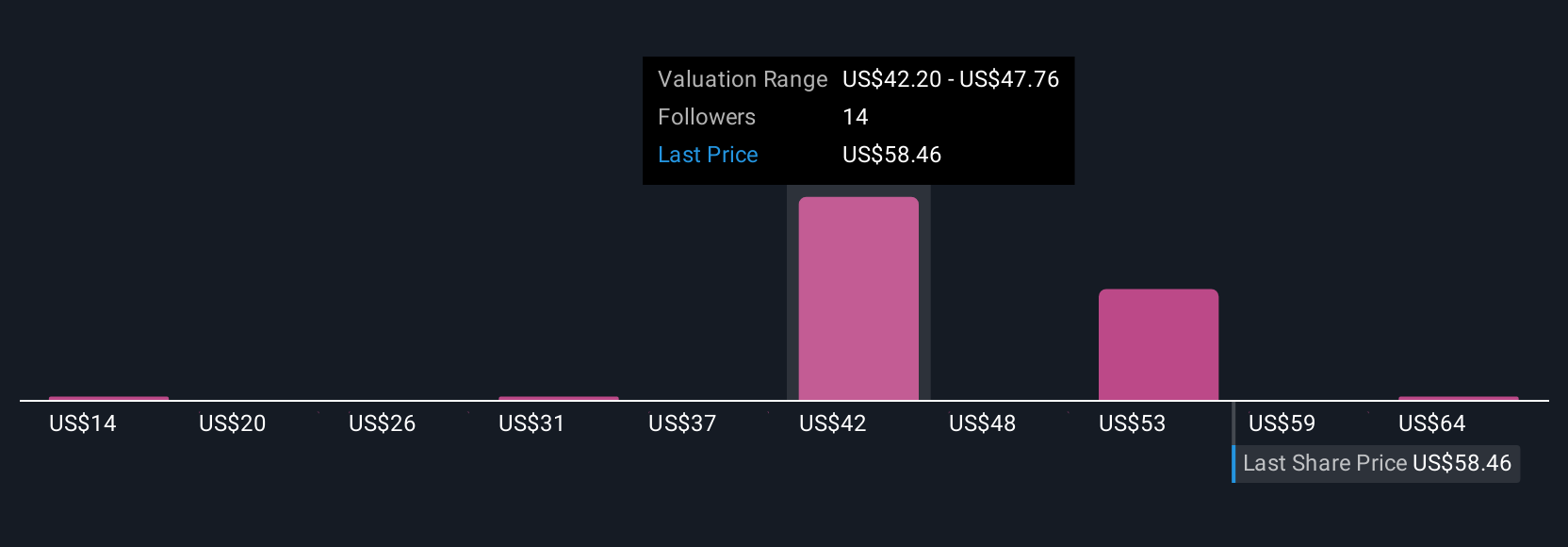

Five individual fair value estimates from the Simply Wall St Community range from US$14.40 to US$72, pointing to a wide span of views. Given ongoing external market uncertainty, it’s worth exploring how these different perspectives relate to Rollins’ growth prospects and potential risks.

Explore 5 other fair value estimates on Rollins - why the stock might be worth as much as 20% more than the current price!

Build Your Own Rollins Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rollins research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Rollins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rollins' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROL

Rollins

Through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success