- United States

- /

- Commercial Services

- /

- NYSE:ROL

Rollins’ (ROL) Steady Capital Return: Confidence in the Model or a Sign to Diversify?

Reviewed by Simply Wall St

- Rollins, Inc. recently reported its second-quarter earnings, showing net income of US$141.49 million and basic earnings per share of US$0.29 from continuing operations, both higher than the prior year.

- The completion of its multi-year share buyback program and the reaffirmation of its regular dividend highlight Rollins' ongoing efforts to return capital to shareholders.

- We'll explore how Rollins' improved quarterly earnings may influence its investment narrative and future performance expectations.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Rollins Investment Narrative Recap

To be a shareholder in Rollins, you need to believe in the company's ability to drive steady earnings growth through recurring service revenue, operational efficiency, and targeted acquisitions. The latest quarter's profit improvement demonstrates ongoing resilience, but near-term catalysts such as successful integration of recent acquisitions still face risks from higher fleet expenses and broader market uncertainty; the recent earnings report does not materially alter these immediate risks or catalysts.

Among the recent announcements, Rollins' reaffirmed quarterly dividend of US$0.165 per share stands out. This continued commitment to shareholder returns is especially relevant for those focused on income, and it aligns with ongoing efforts to strengthen the company’s narrative around reliable cash flows, an important point as investors watch for potential volatility in consumer demand.

Yet, behind these positive signals, investors should also be aware of possible cost pressures threatening net margins, especially if fleet and operational expenses rise beyond...

Read the full narrative on Rollins (it's free!)

Rollins' narrative projects $4.6 billion in revenue and $686.0 million in earnings by 2028. This requires 8.8% yearly revenue growth and a $196.7 million earnings increase from the current $489.3 million.

Uncover how Rollins' forecasts yield a $58.73 fair value, in line with its current price.

Exploring Other Perspectives

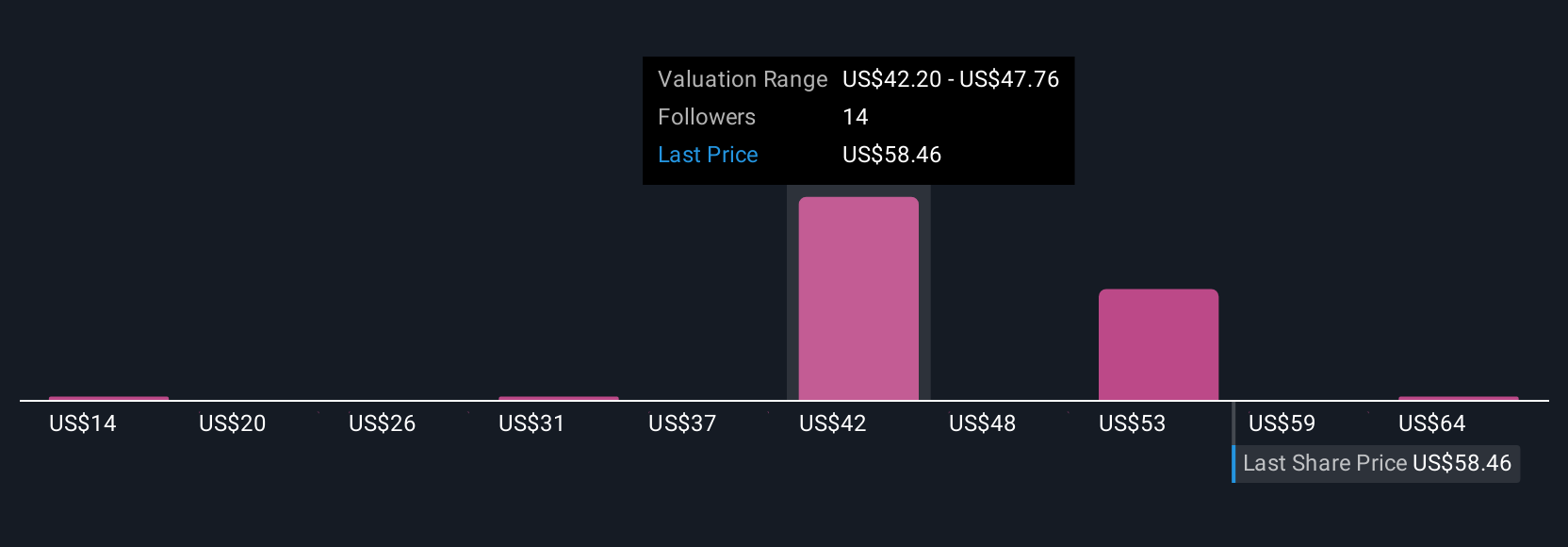

Five recent fair value estimates from the Simply Wall St Community range from US$14.40 to US$70.00 per share. While views diverge significantly, the company’s high operating costs remain a concern that could influence future profitability for all market participants, explore how others assess these risks and opportunities.

Explore 5 other fair value estimates on Rollins - why the stock might be worth as much as 21% more than the current price!

Build Your Own Rollins Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rollins research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Rollins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rollins' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROL

Rollins

Through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives