- United States

- /

- Commercial Services

- /

- NYSE:ROL

Assessing Rollins (ROL) Valuation After New Buy Recommendation on Strong Financial Performance

Reviewed by Simply Wall St

A new investment analysis has put Rollins (ROL) in the spotlight, recommending the stock as a buy because of its impressive revenue gains, healthy gross margin, and steady free cash flow. This vote of confidence could attract more eyes to the company.

See our latest analysis for Rollins.

Rollins has quietly built momentum this year, with a year-to-date share price return of 23.35%. This performance has outpaced many peers as investor optimism grows around its solid financial performance. Its one-year total shareholder return of 23.68% also shows that capital gains and dividends have rewarded those willing to hold for the long term.

If you are looking to expand your search beyond Rollins, now is a great time to discover fast growing stocks with high insider ownership.

But with Rollins trading just below its analyst price targets after strong gains, investors now face a key question: is this a genuine buying opportunity, or has the market already priced in all the future growth?

Most Popular Narrative: 4.8% Undervalued

Rollins’ most widely followed narrative points to a fair value just above its last close, suggesting the shares may hold slight upside from current levels. The narrative frames this as a product of strategic expansion and efficiency investments, which set a course for future growth beyond recent gains.

Strategic acquisitions and a multi-brand approach enhance revenue growth, earnings, and competitive advantage throughout economic fluctuations. Investing in sales, marketing, and operational efficiency drives organic and commercial division growth, boosting margins and recurring revenue.

Curious about the most important assumption that powers this bullish valuation? The core of this narrative relies on a confident blueprint for Rollins’ top-line expansion and a profit trajectory that rivals high-growth players. Want to uncover just how optimistic consensus is on Rollins’ future earnings growth, and what that could mean for shareholders? The underlying numbers behind this story defy the usual sector expectations.

Result: Fair Value of $59.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, market uncertainty and rising operational costs could pressure Rollins' margins and create possible headwinds for its impressive growth trajectory.

Find out about the key risks to this Rollins narrative.

Another View: High Multiple Poses Valuation Risk

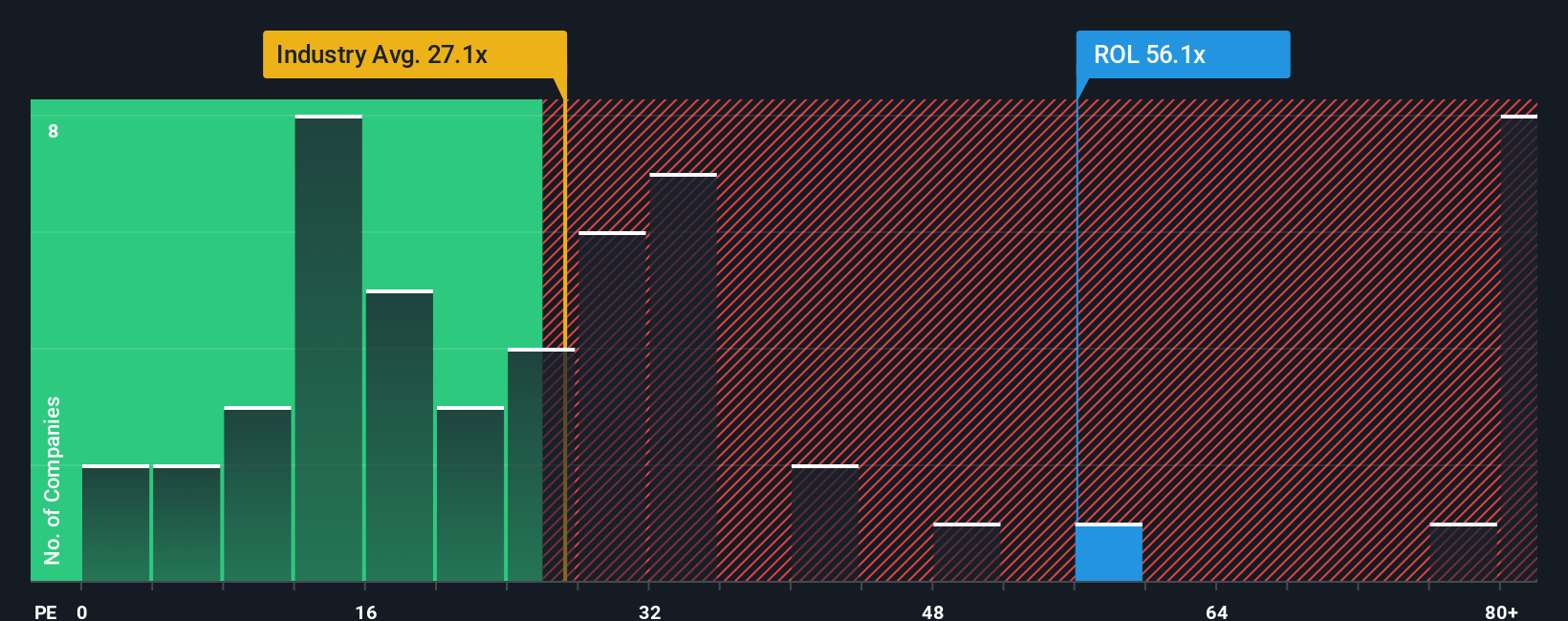

While the fair value approach suggests Rollins may be slightly undervalued, a look at its price-to-earnings ratio tells a different story. At 56.2x, its P/E is not only much higher than the US Commercial Services industry average of 26.8x and peer average of 42.1x, but also well above the fair ratio of 29.5x that markets could eventually settle toward. The gap points to significant valuation risk if market sentiment shifts. Could premium pricing become a vulnerability?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rollins Narrative

If you see the story differently or want to dive into your own research, you can craft a personal narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Rollins.

Looking for more investment ideas?

Do not miss out on the smartest opportunities Simply Wall Street offers. Take action now to find tomorrow’s winners using these handpicked investment paths:

- Unlock the most compelling value plays and seize opportunities that many investors overlook by reviewing these 875 undervalued stocks based on cash flows.

- Capture passive income potential and build a robust portfolio by targeting these 17 dividend stocks with yields > 3% with proven yields above 3%.

- Embrace technology’s next wave by following innovators at the forefront of artificial intelligence, powered by these 27 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROL

Rollins

Through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives