Stock Analysis

- United States

- /

- Banks

- /

- NasdaqGS:PFIS

Top Dividend Stocks To Consider In June 2024

Reviewed by Simply Wall St

As of June 2024, the United States stock market has shown a robust annual growth of 21%, despite a flat performance over the last week. In this context, dividend stocks remain attractive as they offer potential for steady income and could benefit from expected earnings growth in the broader market.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 7.83% | ★★★★★★ |

| Resources Connection (NasdaqGS:RGP) | 5.27% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.11% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.15% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.06% | ★★★★★★ |

| Huntington Bancshares (NasdaqGS:HBAN) | 5.01% | ★★★★★★ |

| Citizens Financial Group (NYSE:CFG) | 4.93% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 5.09% | ★★★★★★ |

| Credicorp (NYSE:BAP) | 5.95% | ★★★★★☆ |

| CVB Financial (NasdaqGS:CVBF) | 4.98% | ★★★★★☆ |

Click here to see the full list of 211 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Northfield Bancorp (Staten Island NY) (NasdaqGS:NFBK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Northfield Bancorp, Inc., based in Staten Island, NY, serves as the holding company for Northfield Bank, offering a range of banking products and services to individual and corporate customers with a market cap of approximately $345.44 million.

Operations: Northfield Bancorp, Inc. generates its revenue primarily through its community banking segment, which accounted for $128.70 million.

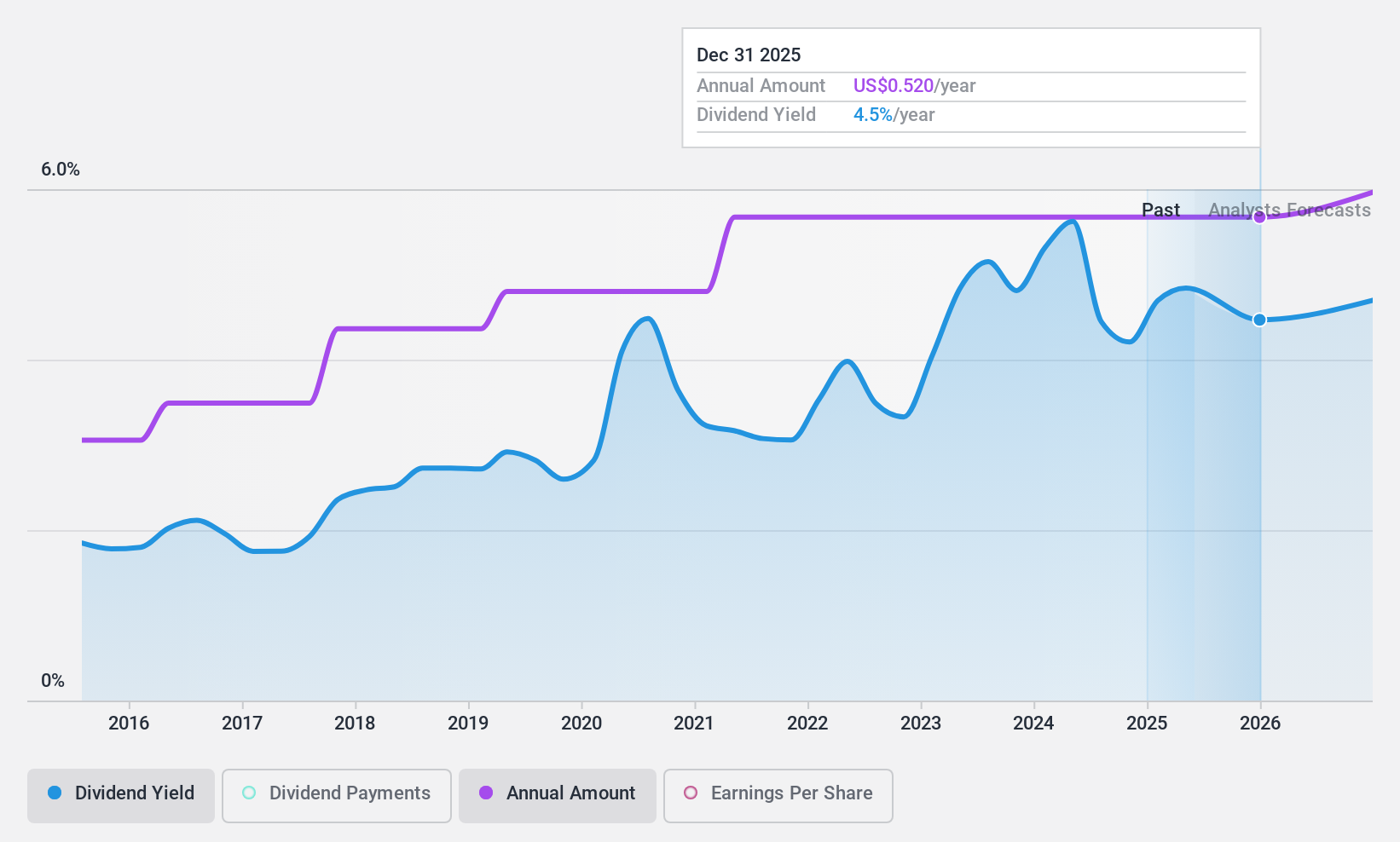

Dividend Yield: 6.7%

Northfield Bancorp has consistently grown its dividend over the past decade, maintaining a stable and reliable payout with a 6.68% yield, well above the US market average. Despite a decrease in profit margins from 36.5% to 25%, earnings are expected to grow by 11.35% annually. Recent corporate actions include multiple share repurchase programs totaling up to US$15 million and regular dividend payments, signaling confidence in financial stability despite insufficient data on long-term dividend coverage.

- Click here and access our complete dividend analysis report to understand the dynamics of Northfield Bancorp (Staten Island NY).

- The analysis detailed in our Northfield Bancorp (Staten Island NY) valuation report hints at an deflated share price compared to its estimated value.

Peoples Financial Services (NasdaqGS:PFIS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Peoples Financial Services Corp., with a market cap of approximately $280.38 million, serves as the bank holding company for Peoples Security Bank and Trust Company, offering a range of commercial and retail banking services.

Operations: Peoples Financial Services Corp. generates its revenue primarily through banking services, which amounted to $96.88 million.

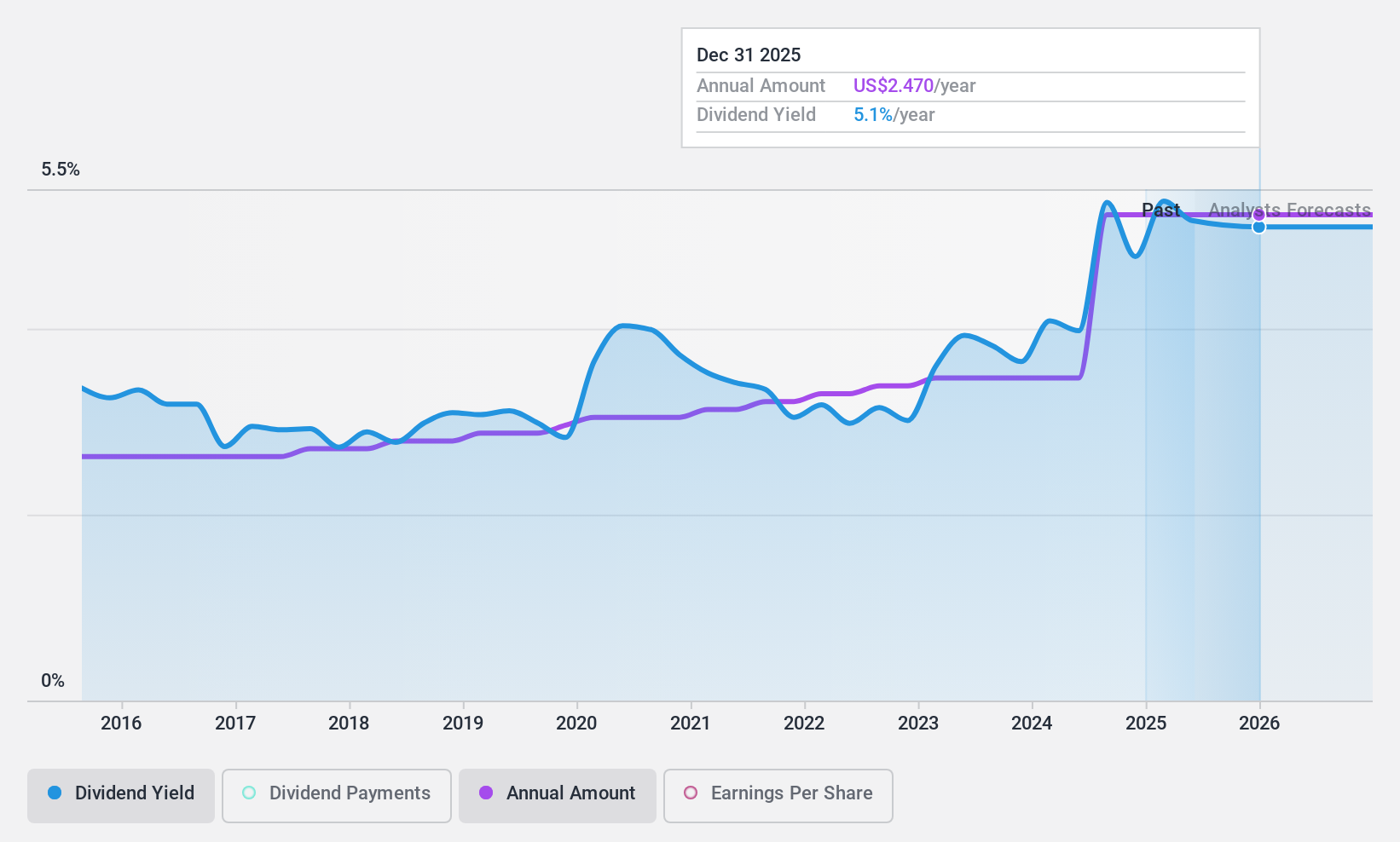

Dividend Yield: 4.1%

Peoples Financial Services has maintained its quarterly dividend at US$0.41 per share, consistent over the past year, despite a drop in net interest income from US$23.04 million to US$19.32 million and a decline in net income from US$7.58 million to US$3.47 million in Q1 2024. The company's dividends are supported by a moderate payout ratio of 49.9%, indicating sound coverage by earnings, though its dividend yield of 4.13% trails the top quartile of U.S market payers at 4.8%.

- Click to explore a detailed breakdown of our findings in Peoples Financial Services' dividend report.

- Our comprehensive valuation report raises the possibility that Peoples Financial Services is priced lower than what may be justified by its financials.

Robert Half (NYSE:RHI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Robert Half Inc. operates as a provider of talent solutions and business consulting services across North America, South America, Europe, Asia, and Australia, with a market capitalization of approximately $6.69 billion.

Operations: Robert Half Inc.'s revenue is derived from Contract Talent Solutions at $4.16 billion, Permanent Placement Talent Solutions at $0.54 billion, and Protiviti at $1.90 billion.

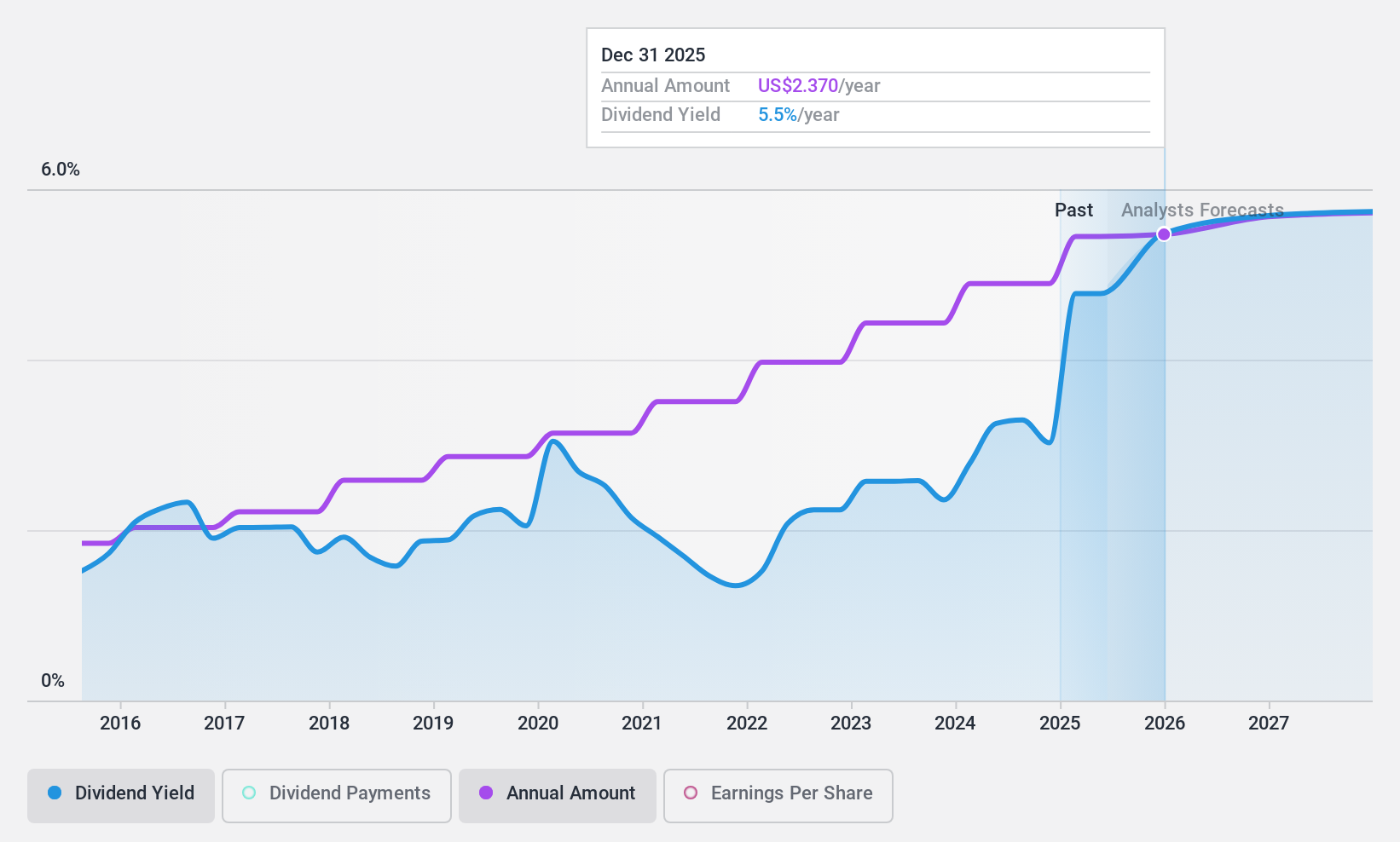

Dividend Yield: 3.3%

Robert Half has demonstrated a decade of growing and stable dividend payments, currently at US$0.53 per share with a yield of 3.27%. Despite lower profit margins year-over-year—5.7% versus 8.6%—and a recent earnings dip in Q1 2024 to US$63.7 million from US$122.01 million, dividends remain well-covered by earnings and cash flows, with payout ratios at 58.6% and 43.1%, respectively. The stock is trading at a significant discount, marked as 51.7% below its estimated fair value, suggesting potential undervaluation relative to its financial health and market position.

- Get an in-depth perspective on Robert Half's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Robert Half is trading behind its estimated value.

Key Takeaways

- Get an in-depth perspective on all 211 Top Dividend Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Peoples Financial Services is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PFIS

Peoples Financial Services

Operates as the bank holding company for Peoples Security Bank and Trust Company that provides various commercial and retail banking services.

Flawless balance sheet with high growth potential and pays a dividend.