- United States

- /

- Commercial Services

- /

- NYSE:RBA

RB Global (NYSE:RBA) Valuation in Focus Following Latin America Expansion Partnership News

Reviewed by Kshitija Bhandaru

RB Global (NYSE:RBA) announced a new alliance between IAA and Auto Traders of America in Guatemala. This move is designed to boost IAA’s reach in Latin America by offering buyers more support, improved access, and streamlined auction services.

See our latest analysis for RB Global.

After an impressive rally earlier in the year, RB Global’s share price has pulled back recently, down 14.6% over the past month and 8.8% in the last quarter. Still, long-term investors have enjoyed a 26% one-year total shareholder return and a strong 72% gain over three years. This reflects ongoing confidence in the company’s growth strategy and expanding platform.

If you’re curious what else is gaining momentum across the market, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

But with the stock trading below analyst targets and long-term gains in focus, is this a prime buying opportunity for RB Global, or is the market already factoring in much of its future potential?

Most Popular Narrative: 18.2% Undervalued

RB Global's last trade at $100.34 trails the narrative's fair value estimate of $122.70, highlighting a potential gap driven by bold long-term projections. This setup raises the question: what core assumptions push the valuation so much higher?

Strategic global expansion and technology investments are enhancing operational efficiency, supporting higher transaction volumes, and driving long-term revenue and margin growth. Growing demand for sustainability and expanded value-added services are boosting service revenues and strengthening RB Global's positioning in the pre-owned asset marketplace.

What is behind the hefty fair value upside? There is a strategic global push, aggressive bets on digital, and bold forecasts built in. Curious to see what figures are moving the needle? Unpack the full narrative for a glimpse at the financial targets shaping this estimate.

Result: Fair Value of $122.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty and the risk from disruptive digital alternatives could put pressure on RB Global's growth trajectory in the coming quarters.

Find out about the key risks to this RB Global narrative.

Another View: What Do Peer Comparisons Say?

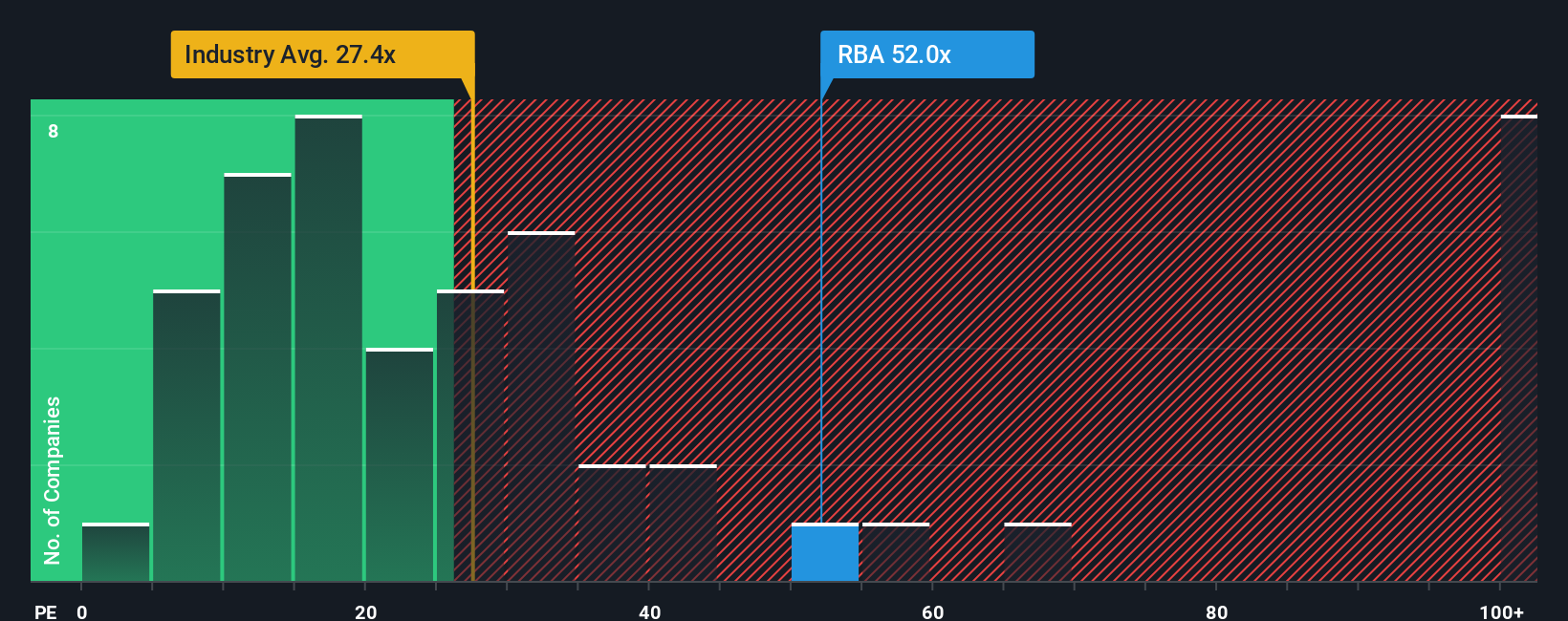

Looking at a common benchmark, RB Global's price-to-earnings ratio sits at 49.4x. This is much higher than both the US industry average of 27.2x and the peer average of 30.7x. Even compared to its fair ratio of 34.9x, the stock appears expensive by these measures. Does this premium price suggest investors expect exceptional growth, or does it raise a red flag for value seekers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RB Global Narrative

If you'd like a different perspective or want to dig into the details yourself, you can craft your own RB Global narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding RB Global.

Looking for more investment ideas?

Don't wait for the market to pass you by. Check out handpicked opportunities that could help shape your next big win with Simply Wall Street's unique tools.

- Boost your portfolio with steady income by tapping into these 20 dividend stocks with yields > 3% featuring attractive yields and reliable cash flows.

- Tap into fast-growing opportunities at the cutting edge of healthcare by checking these 33 healthcare AI stocks pushing innovation in AI-driven medical breakthroughs.

- Seize early-stage potential and dynamic price moves when you hunt for market standouts among these 3586 penny stocks with strong financials showing the strongest financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBA

RB Global

Operates a marketplace that provides insights, services, and transaction solutions for buyers and sellers of commercial assets and vehicles worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives