- United States

- /

- Professional Services

- /

- NYSE:PSN

Will Parsons' (PSN) Water Expansion Strategy Reshape Its Competitive Edge in US Infrastructure?

Reviewed by Sasha Jovanovic

- In recent days, MPA Delivery Partners, a joint venture including Parsons, secured a US$665 million, 4.5-year contract extension to continue managing the Hudson Tunnel Project, while Parsons also acquired Florida-based Applied Sciences Consulting to expand its water infrastructure capabilities.

- These developments highlight Parsons’ growing role in high-impact U.S. infrastructure projects and its efforts to broaden expertise through targeted acquisitions.

- To understand the implications of Parsons’ expanded water expertise, we’ll examine how these moves could shift its investment narrative outlook.

Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

Parsons Investment Narrative Recap

To be a shareholder in Parsons, you’d need to believe in the durability of U.S. infrastructure spending and the company's capacity to win and execute large-scale projects, while managing the risk that funding priorities or federal contract allocations could unexpectedly shift. The recent US$665 million Hudson Tunnel Project contract extension affirms Parsons' foothold in critical infrastructure, but since long-term public funding remains essential, this news does not materially alter the immediate catalysts or the largest funding-related risks facing the business today.

Of the recent updates, the acquisition of Applied Sciences Consulting stands out for deepening Parsons’ expertise in water infrastructure, a sector aligned with U.S. priorities in sustainable development and climate resilience. This could strengthen Parsons’ pipeline of public-sector contracts and broaden its margin profile, adding further backing to one of the main growth drivers.

Yet, against this momentum, there is a persistent risk that increased competition for design-build mega projects could pressure margins and bid success rates if federal budgets tighten or competitors accelerate investment in digital engineering capabilities...

Read the full narrative on Parsons (it's free!)

Parsons is projected to reach $7.4 billion in revenue and $350.2 million in earnings by 2028. This outlook assumes a 3.7% annual revenue growth rate and an earnings increase of $102.6 million from current earnings of $247.6 million.

Uncover how Parsons' forecasts yield a $86.67 fair value, in line with its current price.

Exploring Other Perspectives

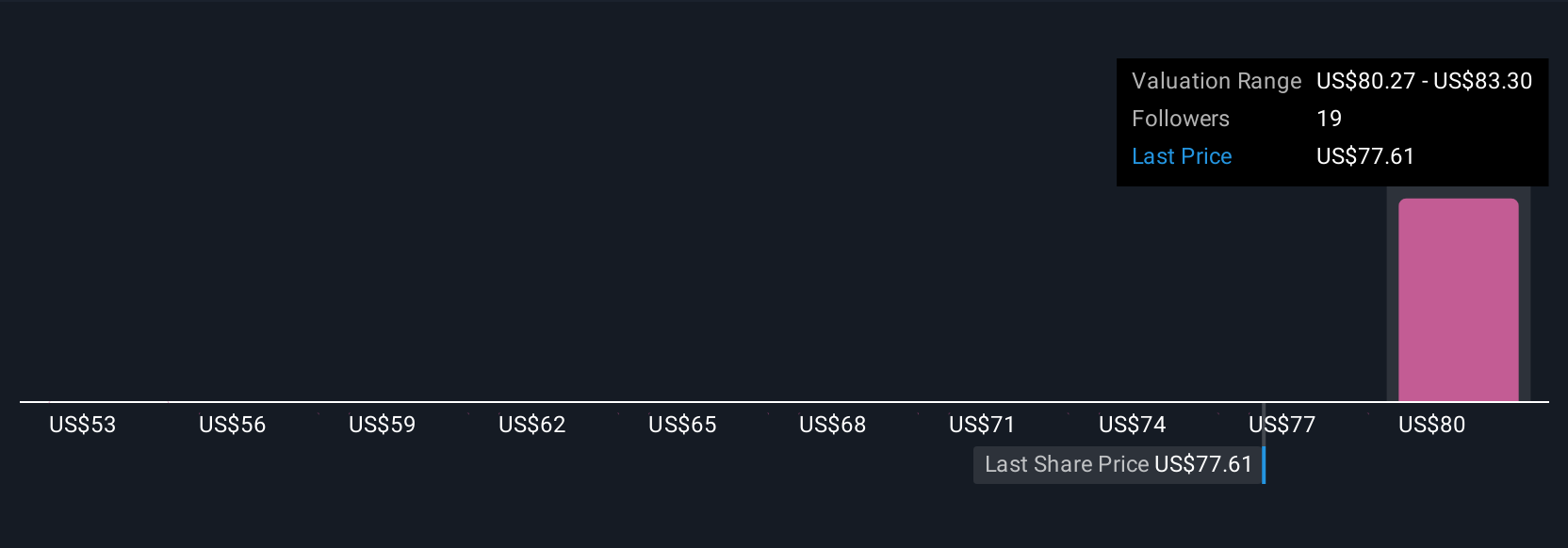

Four community members on Simply Wall St set Parsons' fair value between US$53 and US$94.41 per share. As investor opinions diverge widely, keep in mind that long-term federal funding support and contract wins may shape future performance in ways the market does not always anticipate.

Explore 4 other fair value estimates on Parsons - why the stock might be worth as much as 8% more than the current price!

Build Your Own Parsons Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Parsons research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Parsons research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Parsons' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSN

Parsons

Provides integrated solutions and services in the defense, intelligence, and critical infrastructure markets in North America, the Middle East, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives