- United States

- /

- Professional Services

- /

- NYSE:PSN

Parsons (PSN): Evaluating Valuation After Winning DTRA’s $3.5 Billion CTRIC IV Threat Reduction Contract

Reviewed by Simply Wall St

Parsons (PSN) just secured a spot on the Defense Threat Reduction Agency’s CTRIC IV contract, a recompete vehicle with a potential 10 year, $3.5 billion ceiling that could shape its long term revenue pipeline.

See our latest analysis for Parsons.

The CTRIC IV award lands as Parsons’ 90 day share price return of 11.65 percent and 30 day gain of 6.16 percent signal improving momentum, even though the year to date share price return is still negative and the five year total shareholder return of 128.58 percent shows the longer term story remains firmly intact.

If this defense contract has you thinking about where else security spending could flow next, it might be worth exploring aerospace and defense stocks for more potential ideas.

With shares still below analyst targets despite solid revenue and earnings growth, investors now face a key question: is Parsons trading at a discount to its long term prospects, or is the market already baking in future upside?

Most Popular Narrative: 11% Undervalued

With Parsons last closing at $84.46 versus a narrative fair value of $94.90, the most followed view sees meaningful upside from here.

Parsons' ongoing shift toward tech enabled, higher margin segments (cybersecurity, advanced digital engineering, software analytics) is accelerating through strategic, synergistic M&A (e.g., Chesapeake Technology International). This is positioning the company to continue expanding EBITDA and net margins over time.

Curious how steady revenue gains, rising margins, and a richer future earnings multiple all add up to this higher value? Want to see the exact roadmap behind that price?

Result: Fair Value of $94.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing dependence on U.S. federal budgets and potential hiccups integrating recent acquisitions could easily derail those upbeat margin and growth assumptions.

Find out about the key risks to this Parsons narrative.

Another Take: Multiples Paint a Pricier Picture

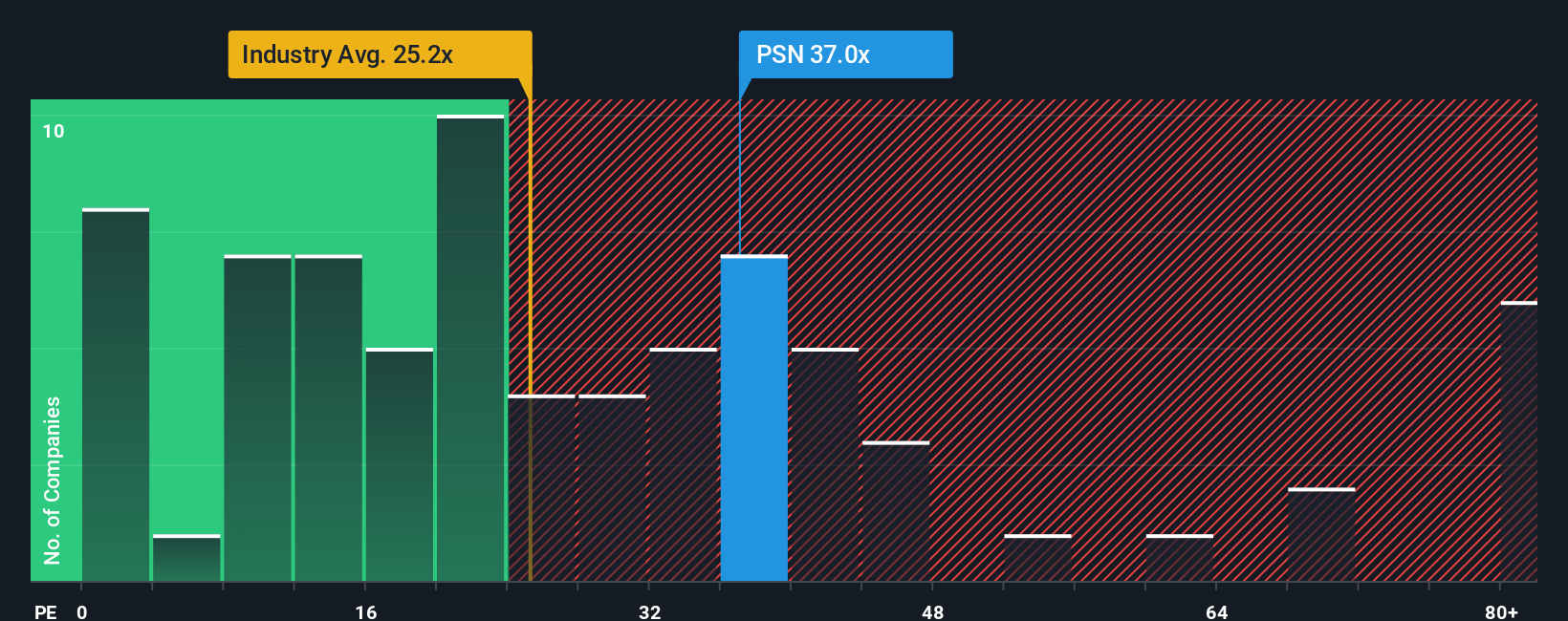

On earnings-based multiples, Parsons looks much less of a bargain. Its price to earnings ratio of 37.5 times sits well above the US Professional Services industry at 24.8 times and even its own fair ratio of 26.8 times, hinting more at valuation risk than hidden upside. Could the market be overpaying for growth that arrives more slowly than hoped?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Parsons Narrative

If you see the numbers differently or prefer to dig into the data yourself, you can build a personalized view in minutes by starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Parsons.

Ready for your next investing move?

Parsons might be compelling, but locking in your next edge means scanning the broader market now, before others act on the same opportunities.

- Capture potential mispricings by reviewing these 910 undervalued stocks based on cash flows that could offer stronger upside than widely followed names.

- Capitalize on structural shifts in medicine by researching these 30 healthcare AI stocks using artificial intelligence to reshape diagnostics, treatment, and patient outcomes.

- Boost your income strategy by targeting these 15 dividend stocks with yields > 3% that may help stabilize returns when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSN

Parsons

Provides integrated solutions and services in the defense, intelligence, and critical infrastructure markets in North America, the Middle East, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026