- United States

- /

- Professional Services

- /

- NYSE:PSN

Is Parsons Still a Good Opportunity After Recent 7.4% Weekly Surge?

Reviewed by Bailey Pemberton

Thinking about what to do with Parsons stock right now? You are not alone. Many investors are peering at the charts and valuations, weighing whether this is a short-term hop or the start of something longer lasting. Parsons shares have had quite a ride, surging 7.4% just in the past week and an impressive 15.6% over the past month. If you zoom out further, you will see some truly eye-opening gains of 110.7% over three years and 160.7% since five years ago. However, there has also been pressure, with a year-to-date dip of 3.3% and an 18.0% slide in the past year. Clearly, perceptions of risk and growth for this company are shifting alongside broader market developments.

But what about the stock’s valuation? On a scale where a higher score means stronger signs of undervaluation, Parsons scores 2 out of 6. That means the company is undervalued according to only two typical pricing checks, a modest result, but one that could be revealing based on what methods are used. Next, let’s break down exactly how these valuation approaches stack up and why understanding their limitations is crucial to making smarter buy, hold, or sell decisions. And stick around, because we will also touch on a different, smarter way to weigh value that investors too often overlook.

Parsons scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Parsons Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used method that estimates a company's value by projecting future cash flows and discounting them back to their value today. For Parsons, this approach relies on expectations of future growth in free cash flows, which is the cash Parsons can generate after investments to maintain or expand its assets, measured in millions of dollars.

According to recent data, Parsons' Last Twelve Months Free Cash Flow (FCF) is $524.5 million. Analyst estimates and extrapolations suggest that within the next five years, Parsons' FCF could reach $470 million, with Simply Wall St extending the outlook to about $555.7 million a decade from now. These forecasts account for a series of moderate annual growth rates, showing steady, incremental increases, though they slow after the initial analyst-covered period.

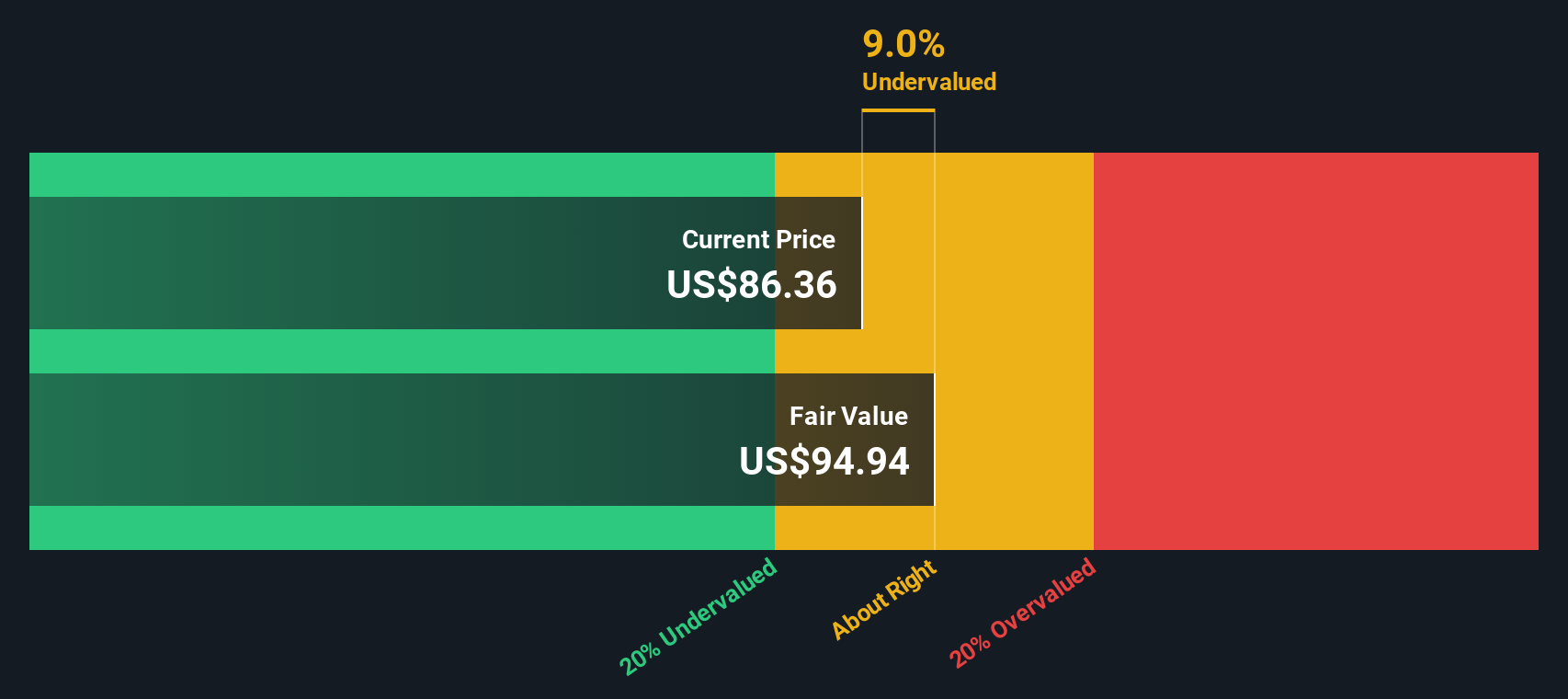

Using these projections, the DCF model calculates Parsons' fair value per share at $94.95. This is roughly 7.9% higher than its current trading price, implying the stock is only slightly undervalued by this method. Movements of less than 10% are generally considered within the margin of error for such models, so the difference here is relatively modest.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Parsons's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Parsons Price vs Earnings

The Price-to-Earnings (PE) ratio is generally the most reliable valuation metric for profitable companies like Parsons, as it puts current share price in context with the company's actual earnings power. A higher PE ratio can reflect expectations for faster growth or lower risk, while a lower PE may signal market skepticism, industry headwinds, or temporary business issues.

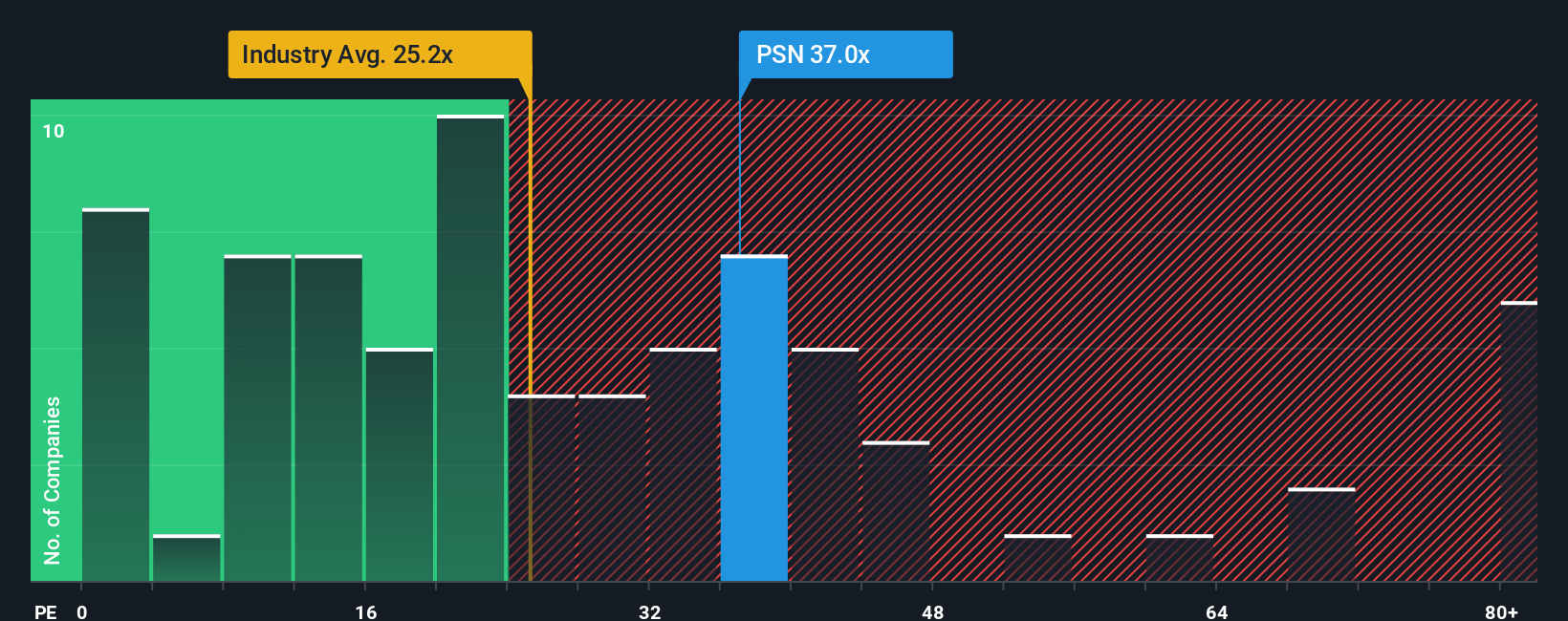

Right now, Parsons trades at a PE ratio of 37.7x. This stands noticeably above the professional services industry average of 26.8x and is below the peer group average of 50.4x. These benchmarks highlight a spread that often comes down to nuances in growth prospects, scale, and competitive positioning in the market.

To take the analysis a step further, Simply Wall St produces a "Fair Ratio" for Parsons, calculated at 27.2x. Unlike direct comparisons to sector peers or averages, the Fair Ratio combines more specific factors such as Parsons' expected earnings growth, industry dynamics, profit margins, company size, and relevant risks. This provides a more tailored benchmark for fair value based on Parsons’ unique position in the market.

When you compare the Fair Ratio (27.2x) with Parsons’ actual PE (37.7x), the stock appears somewhat overvalued against the company’s own earnings and growth outlook, even after factoring in industry and competitor context.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Parsons Narrative

Earlier we mentioned there is a better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story, connecting how you see a company's future with numbers like expected revenue, profit margins, and ultimately, your fair value estimate. Instead of just relying on standard metrics, Narratives let you personalize your investment view so it matches your knowledge, expectations, and what you believe is probable for Parsons.

With Narratives, you link Parsons’ business story directly to a financial forecast and a resulting fair value, making it easy to see how your perspective stacks up against actual market prices. Narratives are accessible to everyone within Simply Wall St's Community page, where millions of investors can create, update, or explore perspectives in a few clicks. Since Narratives update dynamically as new news or earnings emerge, your view always stays fresh and relevant.

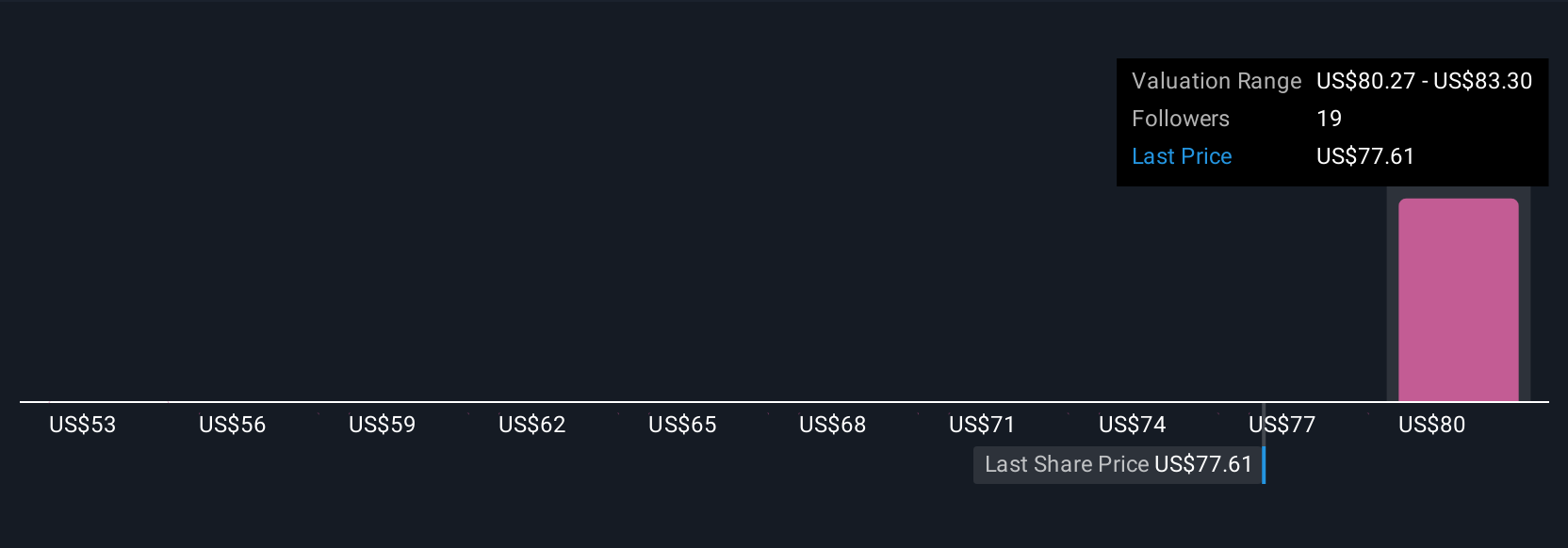

This approach empowers you to compare your own fair value directly to the latest price and decide if it's time to buy, hold, or sell. For example, right now, the most optimistic community Narratives see Parsons’ fair value as high as $100 per share, while the most cautious place it closer to $74, showing how investor stories can shape real investing decisions in practice.

Do you think there's more to the story for Parsons? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSN

Parsons

Provides integrated solutions and services in the defense, intelligence, and critical infrastructure markets in North America, the Middle East, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives