- United States

- /

- Professional Services

- /

- NYSE:PL

Planet Labs (PL) Deepens AI Bet With Pelican Launches – But How Defensible Is Its Data Moat?

Reviewed by Sasha Jovanovic

- Planet Labs PBC recently launched its AI-enabled, high-resolution Pelican-5 and Pelican-6 satellites, along with 36 SuperDoves of Flock 4H, on SpaceX’s Transporter-15 mission from Vandenberg Space Force Base, and has begun commissioning after establishing successful contact.

- By adding 40 cm-class, NVIDIA Jetson-equipped Pelican satellites to its Gen 1 fleet and expanding its SuperDove monitoring constellation, Planet is reinforcing its role as a provider of higher-value, AI-ready geospatial data and rapid insights for customers.

- We’ll now examine how the AI-enabled Pelican satellites’ edge-computing capabilities could reshape Planet Labs’ longer-term investment narrative and growth focus.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Planet Labs PBC Investment Narrative Recap

To own Planet Labs, you need to believe that higher value, AI-ready geospatial “solutions” can scale fast enough to justify heavy investment and ongoing losses. The Pelican-5 and Pelican-6 launch strengthens that story technologically, but it does not materially change the near term tension between high capital spending and the path to free cash flow or the risk that AI initiatives take longer than hoped to meaningfully add revenue.

The recent Tanager-1 general availability announcement ties directly into this theme, as it broadens Planet’s data products into methane and CO₂ monitoring while complementing Pelican and SuperDove imagery. Together, these newer constellations are central to the push toward larger, solution-focused contracts that could improve revenue quality and support the company’s ambition to move closer to financial self sufficiency.

Yet, in contrast to the technological progress, investors still need to be aware of how Planet’s significant capital expenditures and new satellite fleets could...

Read the full narrative on Planet Labs PBC (it's free!)

Planet Labs PBC’s narrative projects $409.3 million revenue and $29.2 million earnings by 2028. This requires 17.8% yearly revenue growth and about a $135.7 million earnings increase from -$106.5 million today.

Uncover how Planet Labs PBC's forecasts yield a $14.55 fair value, a 14% upside to its current price.

Exploring Other Perspectives

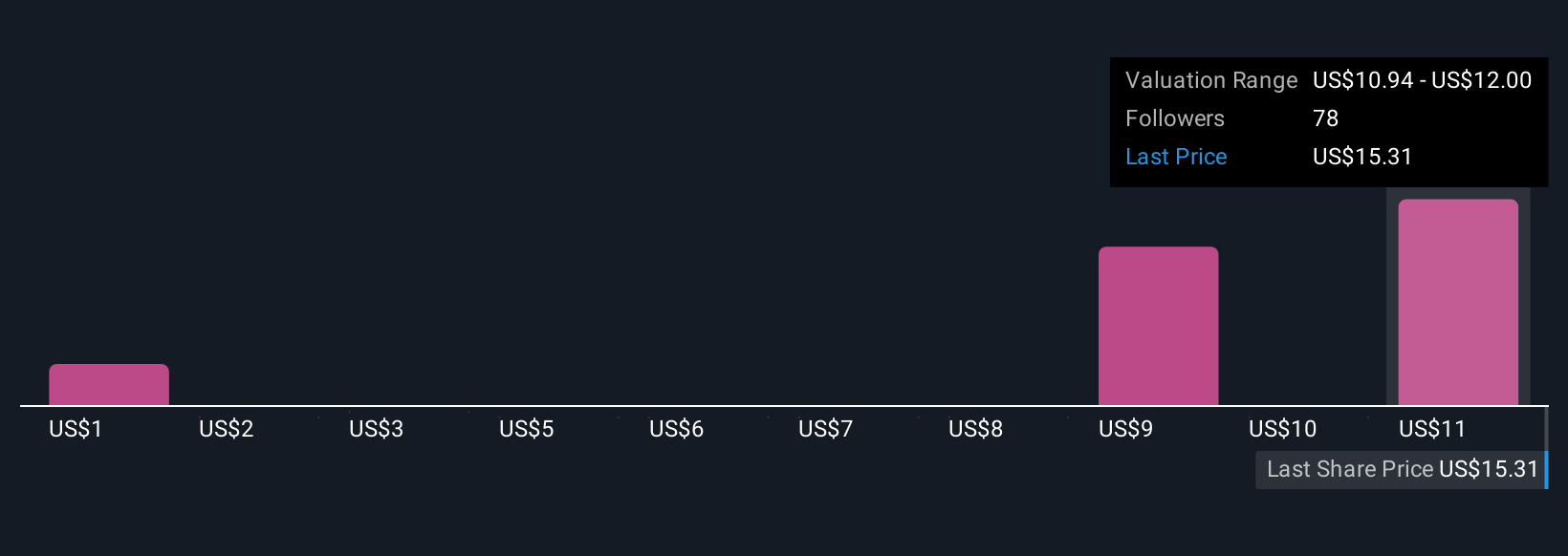

Eleven fair value estimates from the Simply Wall St Community span roughly US$0.23 to US$14.55 per share, highlighting sharply different views on Planet Labs’ potential. You can weigh those opinions against the company’s heavy satellite investment program, which may support long term growth but also keeps profitability and cash flow risks firmly in focus.

Explore 11 other fair value estimates on Planet Labs PBC - why the stock might be worth less than half the current price!

Build Your Own Planet Labs PBC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Planet Labs PBC research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Planet Labs PBC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Planet Labs PBC's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PL

Planet Labs PBC

Engages in the design, construction, and launch constellations of satellites with the intent of providing high cadence geospatial data delivered to customers through an online platform the United States and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026