- United States

- /

- Professional Services

- /

- NYSE:PL

Planet Labs PBC (NYSE:PL) Soars 22% After Securing National Geospatial-Intelligence Agency Contract

Reviewed by Simply Wall St

Planet Labs PBC (NYSE:PL) has recently strengthened its strategic partnerships, notably with Bayer and a major Asia-Pacific partner, contributing to a price increase of 22% in the last quarter. These collaborations improved market perception of Planet's ability to leverage its satellite technology for commercial gains. Expanded agreements with these clients ensure broader application of the company's imagery and analytics, particularly in agriculture and security. Additionally, being selected by the National Geospatial-Intelligence Agency and launching new satellites further underscored Planet's growth potential. While the tech-heavy Nasdaq experienced a 3.6% decline during the same period, Planet's partnerships and product advancements helped it outperform broader market trends, reflecting investor optimism. The company's performance contrasts with the weaker tech index, highlighting how its focus on diversifying its client base and advancing satellite capabilities might align with evolving market opportunities despite broader economic uncertainties.

Dig deeper into the specifics of Planet Labs PBC here with our thorough analysis report.

Over the past year, Planet Labs PBC achieved a total shareholder return of 119.25%, significantly outperforming the US market's return of 16.7% and the US Professional Services industry which returned 7.7%. Several key events contributed to this impressive performance. In February 2025, Planet secured a substantial multi-year partnership worth US$230 million with a major Asia-Pacific partner, enhancing its commercial footprint. Earlier in January, the company was awarded a US$200 million contract by the National Geospatial-Intelligence Agency, further strengthening its revenue pipeline.

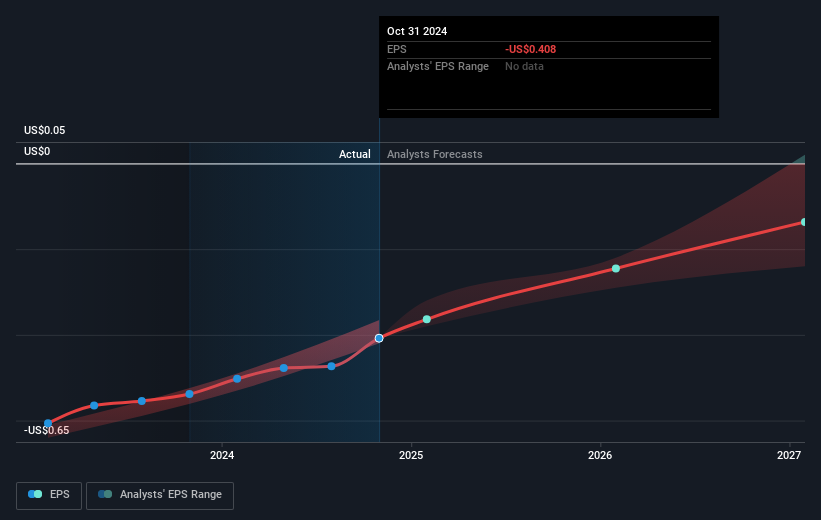

Strategically, Planet expanded its collaboration with Bayer and introduced transformative products like the Analysis-Ready PlanetScope in October 2024, boosting its capabilities in agriculture and environmental monitoring. Additionally, the launch of innovative products like the Tanager-1 hyperspectral satellite has played a critical role in enhancing its market position. These developments underscore Planet's ability to adapt and innovate, fostering investor confidence despite its continued focus on revenue growth over profitability.

- See how Planet Labs PBC measures up with our analysis of its intrinsic value versus market price.

- Uncover the uncertainties that could impact Planet Labs PBC's future growth—read our risk evaluation here.

- Already own Planet Labs PBC? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PL

Planet Labs PBC

Engages in the design, construction, and launch constellations of satellites with the intent of providing high cadence geospatial data delivered to customers through an online platform the United States and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives