- United States

- /

- Professional Services

- /

- NYSE:PL

Is Planet Labs (PL) Doubling European Output a Strategic Shift in Its Global Growth Ambitions?

Reviewed by Sasha Jovanovic

- Planet Labs PBC recently announced the arrival of its Pelican-5 and Pelican-6 satellites, along with 36 SuperDoves, at Vandenberg Space Force Base for a launch aboard SpaceX's Transporter-15 mission; the company also revealed plans for a new manufacturing facility in Berlin to double Pelican satellite production in response to major European contracts with the German government and NATO.

- These developments reflect Planet’s efforts to strengthen its position as a provider of high-resolution, on-demand earth observation services, aiming to meet escalating demand from government and commercial customers worldwide.

- We'll examine how doubling satellite production capacity in Europe could accelerate Planet Labs' efforts to serve expanding government and commercial contracts.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

Planet Labs PBC Investment Narrative Recap

To be a shareholder in Planet Labs PBC, you need to believe in the continued expansion of high-value, high-frequency Earth observation services and the company’s ability to convert technological advances, like the Pelican constellation, into sustainable, large-scale contracts. The Berlin facility launch and major satellite deployments directly address Planet's short-term catalyst: rapidly scaling up to meet surging European demand, though the substantial capital outlay also heightens near-term pressure on cash flow, a key ongoing risk for the business.

Of recent announcements, the shipment of the Pelican-5 and Pelican-6 satellites, plus 36 SuperDoves, to Vandenberg for the SpaceX Transporter-15 launch is most relevant. These satellites will increase imaging capacity and reduce delivery time for actionable data, addressing the accelerating need from government and commercial customers as Planet works to fill its European contracts.

Yet, despite record contract wins and production expansion, investors should also weigh the impact of sizable capital expenditures on short-term cash flow…

Read the full narrative on Planet Labs PBC (it's free!)

Planet Labs PBC's narrative projects $409.3 million revenue and $29.2 million earnings by 2028. This requires 17.8% yearly revenue growth and a $135.7 million increase in earnings from -$106.5 million.

Uncover how Planet Labs PBC's forecasts yield a $9.23 fair value, a 38% downside to its current price.

Exploring Other Perspectives

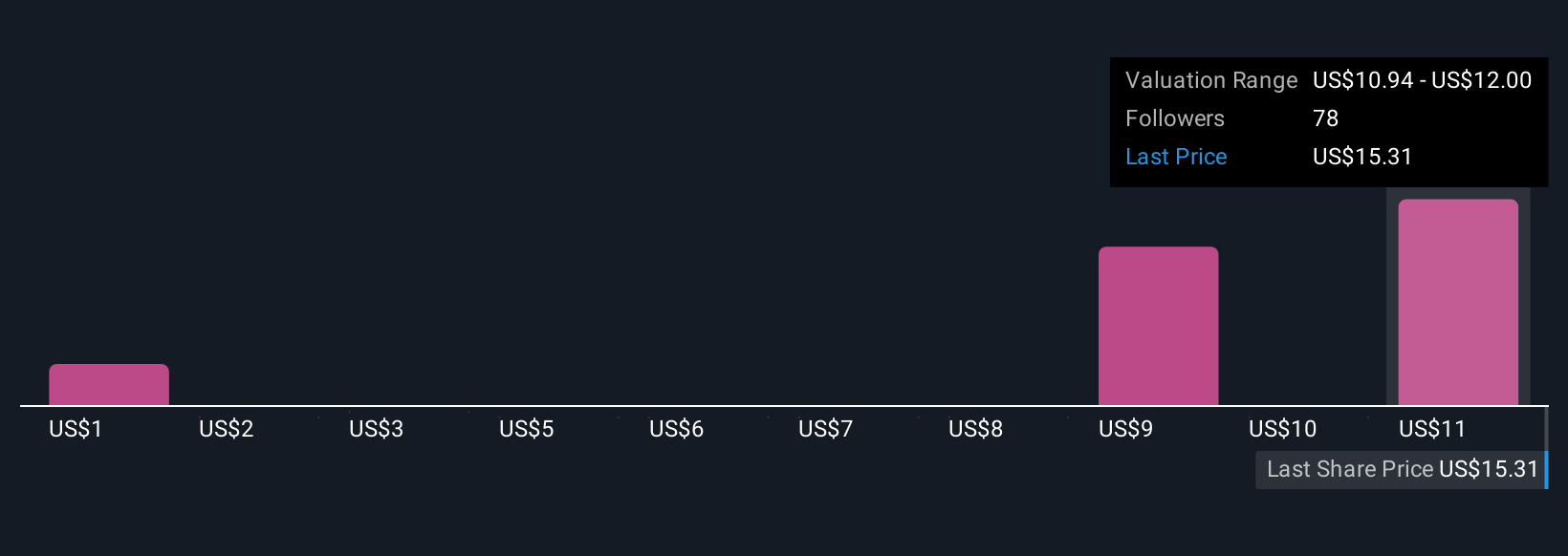

Eleven fair value estimates from the Simply Wall St Community range widely from US$1.35 to US$12 per share. While many see substantial potential in Planet Labs’ ramp-up to deliver on major European wins, opinions on valuation and risk differ, explore multiple viewpoints to inform your own outlook.

Explore 11 other fair value estimates on Planet Labs PBC - why the stock might be worth as much as $12.00!

Build Your Own Planet Labs PBC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Planet Labs PBC research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Planet Labs PBC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Planet Labs PBC's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PL

Planet Labs PBC

Engages in the design, construction, and launch constellations of satellites with the intent of providing high cadence geospatial data delivered to customers through an online platform the United States and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives