- United States

- /

- Commercial Services

- /

- NYSE:PBI

Know This Before Buying Pitney Bowes Inc. (NYSE:PBI) For Its Dividend

Dividend paying stocks like Pitney Bowes Inc. (NYSE:PBI) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

With Pitney Bowes yielding 4.7% and having paid a dividend for over 10 years, many investors likely find the company quite interesting. We'd guess that plenty of investors have purchased it for the income. The company also bought back stock during the year, equivalent to approximately 14% of the company's market capitalisation at the time. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Pitney Bowes!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, Pitney Bowes paid out 61% of its profit as dividends. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Pitney Bowes's cash payout ratio in the last year was 46%, which suggests dividends were well covered by cash generated by the business. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Is Pitney Bowes's Balance Sheet Risky?

As Pitney Bowes has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A rough way to check this is with these two simple ratios: a) net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and b) net interest cover. Net debt to EBITDA is a measure of a company's total debt. Net interest cover measures the ability to meet interest payments. Essentially we check that a) the company does not have too much debt, and b) that it can afford to pay the interest. With net debt of 5.03 times its EBITDA, Pitney Bowes could be described as a highly leveraged company. While some companies can handle this level of leverage, we'd be concerned about the dividend sustainability if there was any risk of an earnings downturn.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. Interest cover of 2.56 times its interest expense is starting to become a concern for Pitney Bowes, and be aware that lenders may place additional restrictions on the company as well. Low interest cover and high debt can create problems right when the investor least needs them, and we're reluctant to rely on the dividend of companies with these traits.

We update our data on Pitney Bowes every 24 hours, so you can always get our latest analysis of its financial health, here.

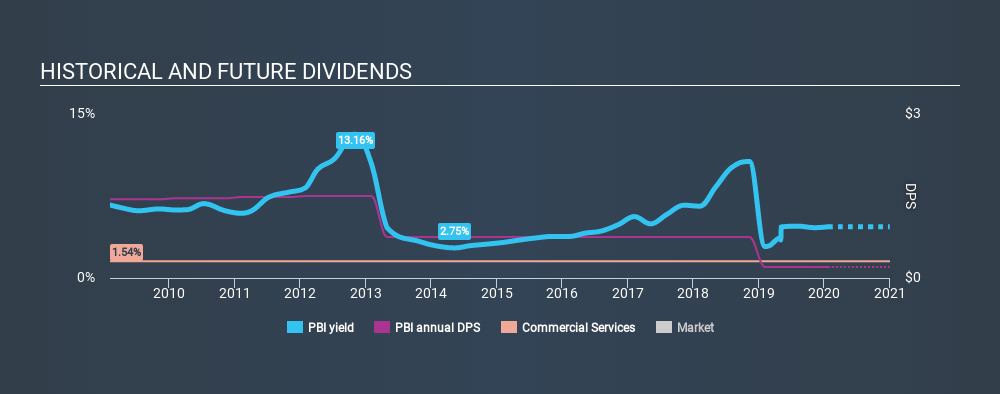

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Pitney Bowes has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. This dividend has been unstable, which we define as having been cut one or more times over this time. During the past ten-year period, the first annual payment was US$1.44 in 2010, compared to US$0.20 last year. Dividend payments have fallen sharply, down 86% over that time.

When a company's per-share dividend falls we question if this reflects poorly on either external business conditions, or the company's capital allocation decisions. Either way, we find it hard to get excited about a company with a declining dividend.

Dividend Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Pitney Bowes's EPS have fallen by approximately 17% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

To summarise, shareholders should always check that Pitney Bowes's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. First, we think Pitney Bowes has an acceptable payout ratio and its dividend is well covered by cashflow. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. In sum, we find it hard to get excited about Pitney Bowes from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Without at least some growth in earnings per share over time, the dividend will eventually come under pressure either from costs or inflation. Very few businesses see earnings consistently shrink year after year in perpetuity though, and so it might be worth seeing what the 5 analysts we track are forecasting for the future.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:PBI

Pitney Bowes

Operates as a technology-driven company that provides SaaS shipping solutions, mailing innovation, and financial services to small businesses, large enterprises, and government entities around the world.

Good value slight.

Similar Companies

Market Insights

Community Narratives