- United States

- /

- Commercial Services

- /

- NYSE:NVRI

Even after rising 9.9% this past week, Enviri (NYSE:NVRI) shareholders are still down 59% over the past five years

Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. For example the Enviri Corporation (NYSE:NVRI) share price dropped 59% over five years. That's not a lot of fun for true believers. The falls have accelerated recently, with the share price down 18% in the last three months.

While the stock has risen 9.9% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Enviri

Enviri wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, Enviri grew its revenue at 8.8% per year. That's a pretty good rate for a long time period. The share price return isn't so respectable with an annual loss of 10% over the period. That suggests the market is disappointed with the current growth rate. That could lead to an opportunity if the company is going to become profitable sooner rather than later.

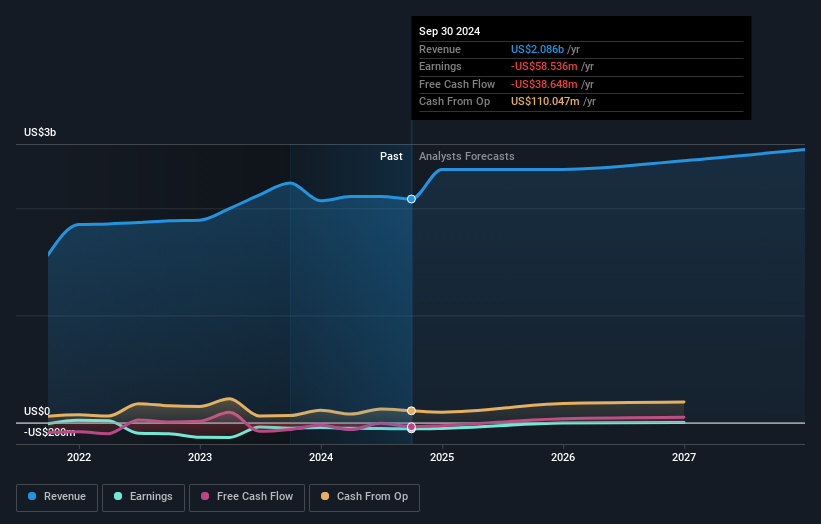

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. If you are thinking of buying or selling Enviri stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Investors in Enviri had a tough year, with a total loss of 1.9%, against a market gain of about 28%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 10% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Enviri .

Enviri is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Enviri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NVRI

Enviri

Provides environmental solutions for industrial and specialty waste streams in the United States and internationally.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives