- United States

- /

- Commercial Services

- /

- NYSE:NVRI

Enviri Corporation (NYSE:NVRI) Held Back By Insufficient Growth Even After Shares Climb 45%

Enviri Corporation (NYSE:NVRI) shares have had a really impressive month, gaining 45% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 46%.

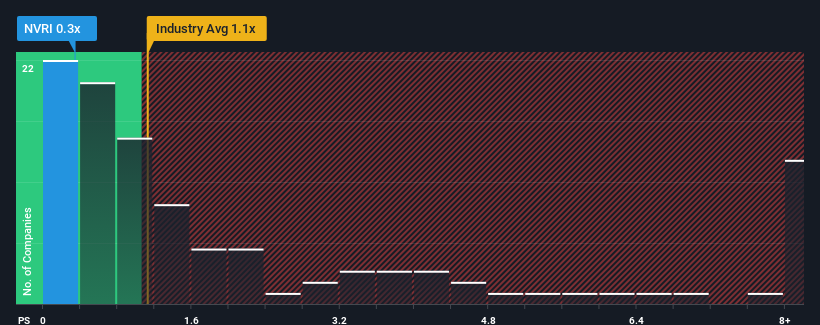

In spite of the firm bounce in price, considering around half the companies operating in the United States' Commercial Services industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider Enviri as an solid investment opportunity with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Enviri

What Does Enviri's Recent Performance Look Like?

Recent times haven't been great for Enviri as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Enviri's future stacks up against the industry? In that case, our free report is a great place to start.How Is Enviri's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Enviri's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 6.7%. Revenue has also lifted 14% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 4.7% per annum during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 27% per annum, which is noticeably more attractive.

With this information, we can see why Enviri is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Enviri's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Enviri maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Enviri with six simple checks.

If these risks are making you reconsider your opinion on Enviri, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Enviri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NVRI

Enviri

Provides environmental solutions for industrial and specialty waste streams in the United States and internationally.

Good value with imperfect balance sheet.