- United States

- /

- Professional Services

- /

- NYSE:NSP

How Investors May Respond To Insperity (NSP) Earnings Outlook Cut Ahead of Q3 2025 Report

Reviewed by Sasha Jovanovic

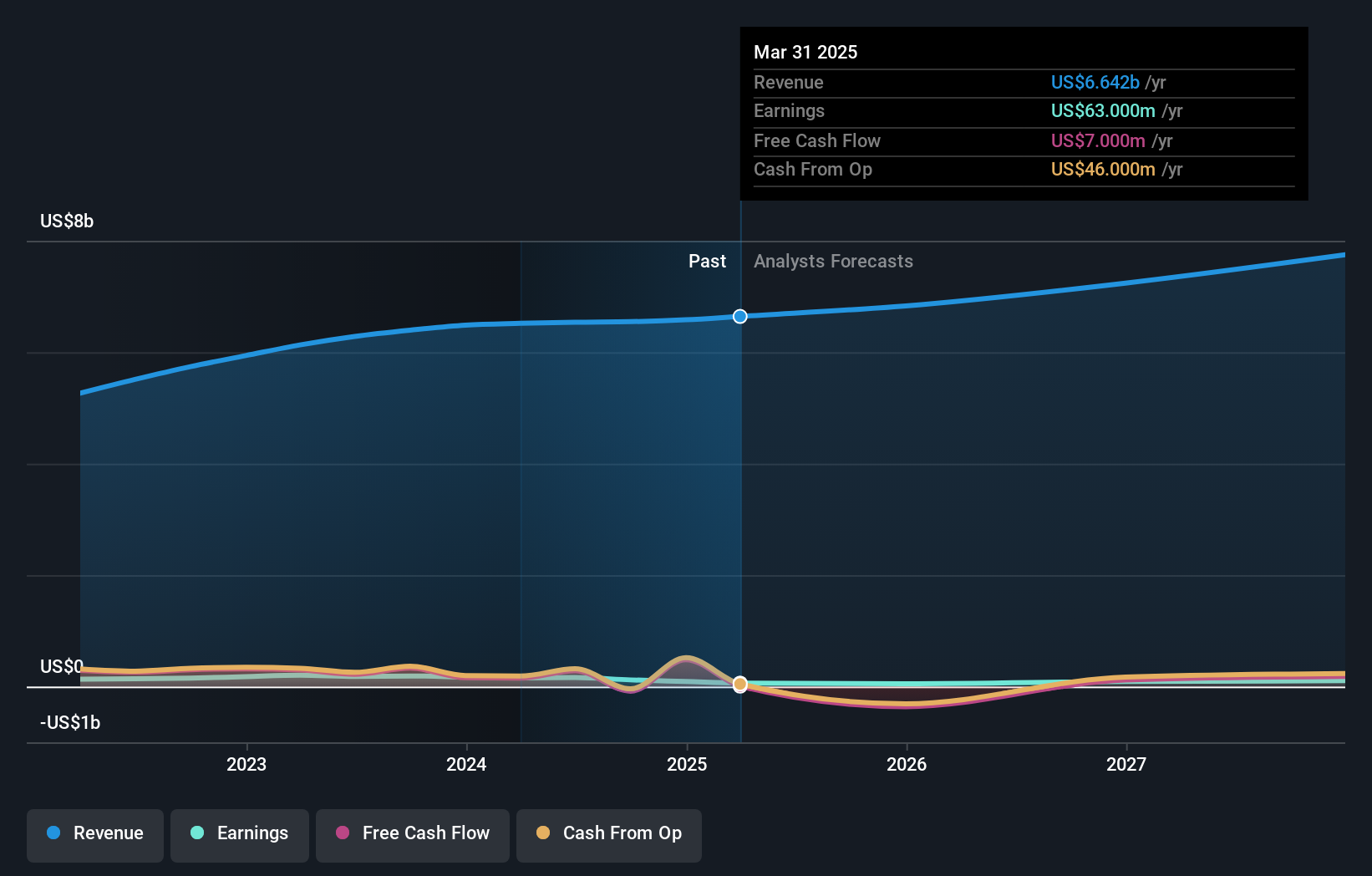

- Insperity is preparing to release its Q3 2025 earnings on November 3, 2025, following a prior quarter where it missed analyst expectations and earnings estimates for 2025 were recently revised downward to US$1.01 per share with revenues around US$6.85 billion.

- Market focus has intensified on the upcoming report, largely due to the significant downward adjustment in earnings forecasts after the company’s previous results fell short of expectations.

- Next, we’ll consider how these lowered earnings projections might influence Insperity's longer-term investment outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Insperity Investment Narrative Recap

To be a shareholder in Insperity, it often comes down to a belief in the long-term demand for outsourced HR and compliance solutions, especially among small and midsized businesses, and confidence that Insperity can defend its margins and return to more stable earnings growth. The recent downward revision in 2025 earnings estimates has amplified near-term uncertainty, with the upcoming quarterly results now a key catalyst. Currently, the most immediate risk lies in cost escalation for healthcare and benefits, which may continue to pressure profit margins if left unchecked.

Among recent company actions, Insperity launched its updated HR solutions portfolio, headlined by Insperity HRScale developed with Workday, which specifically aims to attract larger mid-market clients. This could influence the revenue mix and margin prospects if adoption is strong, but short-term market attention remains squarely on the impact of compressed earnings and how soon profitability can recover. The strength and sustainability of Insperity’s pricing and plan adjustments may determine how quickly the business can regain its footing.

By contrast, persistent healthcare cost increases may challenge even the most robust pricing strategies, there’s a reason investors should keep an eye on...

Read the full narrative on Insperity (it's free!)

Insperity's outlook anticipates $7.7 billion in revenue and $109.6 million in earnings by 2028. This is based on a 5.0% annual revenue growth rate and a $69.6 million increase in earnings from the current $40.0 million.

Uncover how Insperity's forecasts yield a $57.75 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for Insperity span a wide range, from US$57.75 to US$252.90. With profit margins coming under pressure from higher healthcare costs, the range reflects how sharply opinions can diverge, see what other investors are considering.

Explore 2 other fair value estimates on Insperity - why the stock might be worth just $57.75!

Build Your Own Insperity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Insperity research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Insperity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Insperity's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSP

Insperity

Engages in the provision of human resources (HR) and business solutions to improve business performance for small and medium-sized businesses primarily in the United States.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives