- United States

- /

- Professional Services

- /

- NYSE:NOTE

FiscalNote Holdings, Inc. (NYSE:NOTE) Stocks Shoot Up 45% But Its P/S Still Looks Reasonable

Despite an already strong run, FiscalNote Holdings, Inc. (NYSE:NOTE) shares have been powering on, with a gain of 45% in the last thirty days. Looking further back, the 24% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

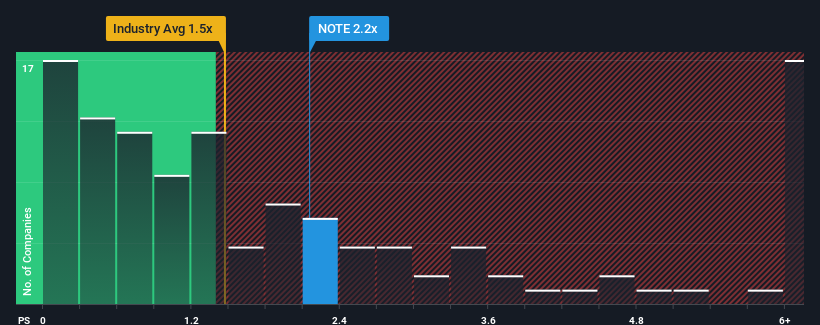

Since its price has surged higher, you could be forgiven for thinking FiscalNote Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.2x, considering almost half the companies in the United States' Professional Services industry have P/S ratios below 1.5x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for FiscalNote Holdings

How FiscalNote Holdings Has Been Performing

Recent times have been advantageous for FiscalNote Holdings as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think FiscalNote Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For FiscalNote Holdings?

FiscalNote Holdings' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The strong recent performance means it was also able to grow revenue by 99% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 9.6% as estimated by the six analysts watching the company. With the industry only predicted to deliver 6.4%, the company is positioned for a stronger revenue result.

With this information, we can see why FiscalNote Holdings is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does FiscalNote Holdings' P/S Mean For Investors?

FiscalNote Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of FiscalNote Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 2 warning signs for FiscalNote Holdings that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NOTE

FiscalNote Holdings

Operates as a technology provider for global policy and market intelligence in North America, Europe, Australia, and Asia.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives