- United States

- /

- Commercial Services

- /

- NYSE:MSA

Should MSA Safety’s (MSA) Pacific-Asia Gateway Launch Prompt a Fresh Look at Its Digital Expansion?

Reviewed by Sasha Jovanovic

- In early October 2025, MSA Safety launched its FieldServer ProtoNode Gateway in the Pacific-Asia region, introducing advanced industrial connectivity with secure remote monitoring via cloud communications for a broad range of fixed detection systems.

- This move extends MSA Safety's reach in international markets and emphasizes its focus on digital innovation for enhanced site safety and compliance.

- We'll explore how MSA Safety's new gateway launch may influence its investment narrative, especially regarding global digital safety expansion.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

MSA Safety Investment Narrative Recap

Belief in MSA Safety as a shareholder centers on the company’s ability to translate growing global demand for digital safety solutions into steady revenue, while successfully managing margin pressures from inflation and foreign exchange. The FieldServer ProtoNode Gateway launch in Pacific-Asia underscores MSA’s digital expansion, though its near-term impact may not be significant enough to offset the softness seen in core Fire Service and Industrial PPE lines or fully address ongoing gross margin challenges.

Of recent announcements, the launch of the ALTAIRio 6 Multigas Detector in September 2025 feels most relevant. Both products reflect MSA’s focus on digitized, cloud-connected worker technologies designed to meet more stringent safety requirements, supporting its core catalyst of premium product growth, especially as customers increasingly seek data-driven compliance and remote asset management.

Yet, with international expansion comes fresh exposure to foreign exchange risks and shifting tariff landscapes, reminders that investors should watch for creeping costs when...

Read the full narrative on MSA Safety (it's free!)

MSA Safety's outlook expects $2.1 billion in revenue and $377.8 million in earnings by 2028. This is based on a 5.2% annual revenue growth rate and a $100.9 million increase in earnings from the current $276.9 million level.

Uncover how MSA Safety's forecasts yield a $191.80 fair value, a 10% upside to its current price.

Exploring Other Perspectives

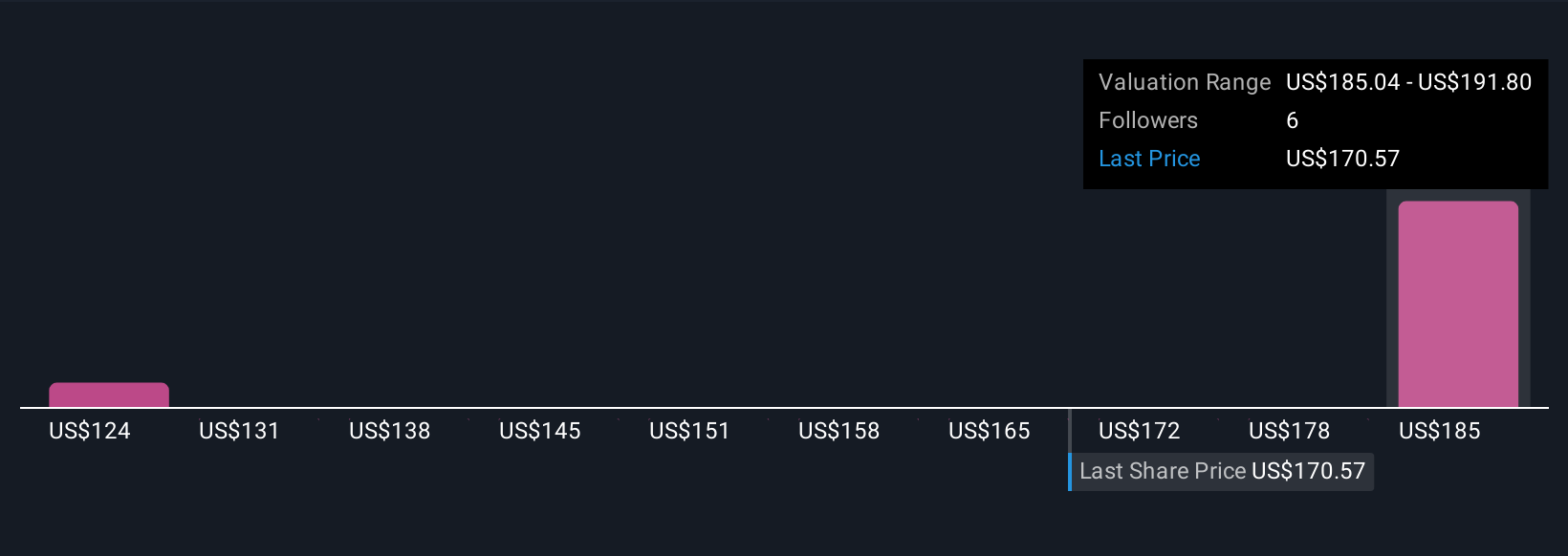

Simply Wall St Community fair value estimates for MSA Safety range from US$124.23 to US$191.80, across three independent analyses. With margin pressures persisting, you can see how investor opinions differ widely and why it’s important to consider several perspectives on MSA’s outlook.

Explore 3 other fair value estimates on MSA Safety - why the stock might be worth 28% less than the current price!

Build Your Own MSA Safety Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MSA Safety research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MSA Safety research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MSA Safety's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSA

MSA Safety

Develops, manufactures, and supplies safety products and technology solutions that protect people and facility infrastructures worldwide.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives