- United States

- /

- Professional Services

- /

- NYSE:MMS

Does Skyral Partnership and Digital Twin Integration Shift the Long-Term Outlook for Maximus (MMS)?

Reviewed by Simply Wall St

- On September 18, 2025, Skyral and Maximus announced a strategic partnership to transform government and healthcare service delivery in the US, Canada, and UK using advanced modelling, simulation, and data analytics technology.

- This collaboration uniquely positions both companies to address operational challenges in the public sector by integrating digital twin and AI-driven solutions for optimized workforce management and service delivery.

- We'll explore how the integration of digital twin technology into Maximus' services may influence its long-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Maximus Investment Narrative Recap

Being a Maximus shareholder often means believing in the ongoing digital transformation of public sector services, with particular confidence in the company's ability to adapt amid regulatory complexity and rising tech demands. While the new Skyral partnership strengthens Maximus’ digital capabilities and supports its long-term transition to tech-enabled services, it does not materially change the company’s current exposure to contract timing risks from government budget delays, still the key near-term hurdle for earnings visibility.

The boost to Maximus’ US$400 million share buyback program on September 8, 2025, is especially relevant, it reinforces the company’s commitment to shareholder returns and comes at a time when additional investments in digital partnerships could enhance long-term value. As the company continues to balance incremental technology investment with capital returns, investors remain focused on how future contract wins and budget cycles might impact near-term results.

However, against these strengths, investors should not overlook the ongoing risk of contract volume normalization, especially if...

Read the full narrative on Maximus (it's free!)

Maximus' narrative projects $6.1 billion revenue and $486.5 million earnings by 2028. This requires 3.9% yearly revenue growth and a $170.3 million earnings increase from $316.2 million.

Uncover how Maximus' forecasts yield a $105.00 fair value, a 18% upside to its current price.

Exploring Other Perspectives

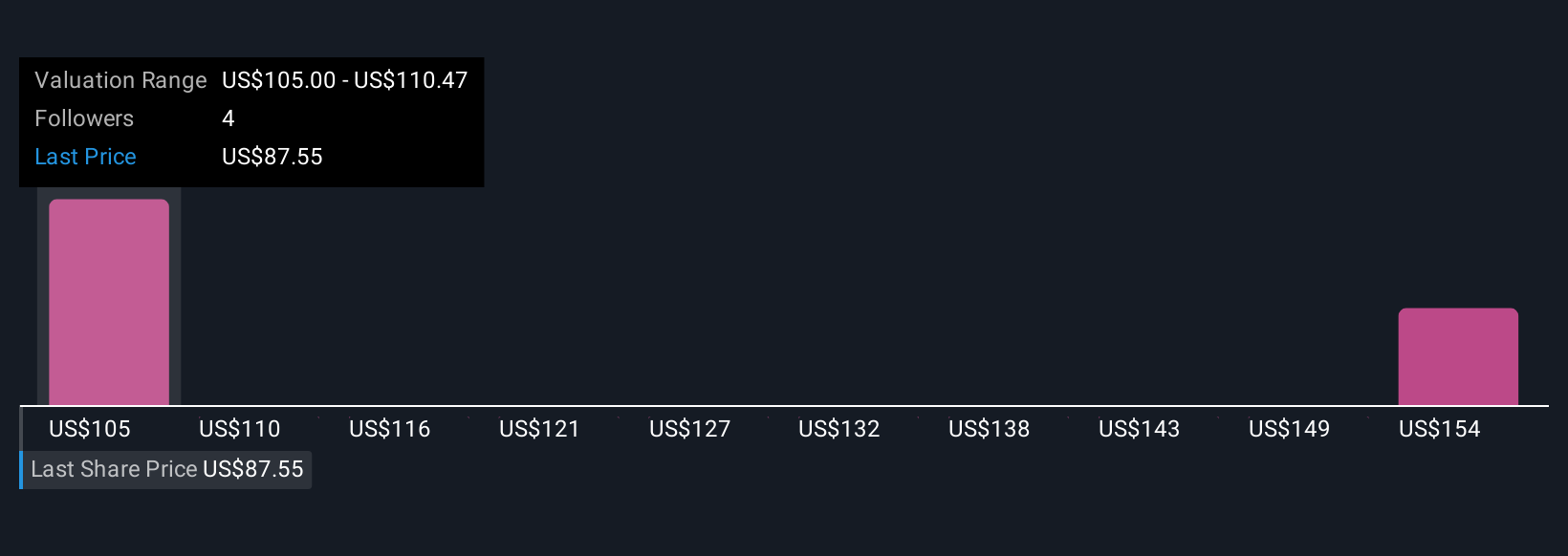

Simply Wall St Community members have set fair value estimates from US$105 to US$159.73 across two views, highlighting a wide range. As agencies demand more technology-driven solutions, the biggest risk still comes from delayed or uncertain government contract cycles, be sure to weigh every side of the potential outcomes.

Explore 2 other fair value estimates on Maximus - why the stock might be worth just $105.00!

Build Your Own Maximus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Maximus research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Maximus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Maximus' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMS

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives