- United States

- /

- Professional Services

- /

- NYSE:LDOS

Leidos Holdings Shares Surge 31% in 2025 Amid Cybersecurity Contract Wins

Reviewed by Bailey Pemberton

If you're weighing what to do with your Leidos Holdings shares, you're not alone. With the stock closing recently at $187.81, it's natural to wonder if now is the right time to buy, hold, or even step away. The numbers certainly catch the eye: while the past week has seen a slight retreat of -2.8%, Leidos is up 1.6% over the last month, and an impressive 31.1% year to date. The longer-term picture pops even more, with a whopping 128.1% return over five years. That kind of growth attracts attention, but it also invites questions about what's driving these moves.

Recent developments in government cybersecurity contracts and greater defense spending have supported bullish sentiment, reflecting the company's core strengths in technology-driven solutions. While market jitters can deliver a few bumps along the way, these industry trends contribute to a sense of durability and growth potential. This is one reason investors are taking a closer look right now.

The real question is whether Leidos is fairly priced today or if there is further upside to capture. Using six different valuation checks, Leidos scores a 5 out of 6 for being undervalued, which is remarkable and suggests there is more here than meets the eye. But before you make any big moves, let's dig into each valuation method in turn and stay tuned for an even more practical perspective at the end of this article.

Approach 1: Leidos Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those amounts back to today's dollars. This method looks beyond recent earnings and focuses on the core cash-generating power of the business over time.

For Leidos Holdings, the current free cash flow stands at $1.27 billion. Looking ahead, analysts provide forecasts for the next several years, and projections extend up to a decade. By 2028, annual free cash flow is expected to reach $1.74 billion. Estimates go further, with Simply Wall St extrapolating values approaching $2.28 billion by 2035.

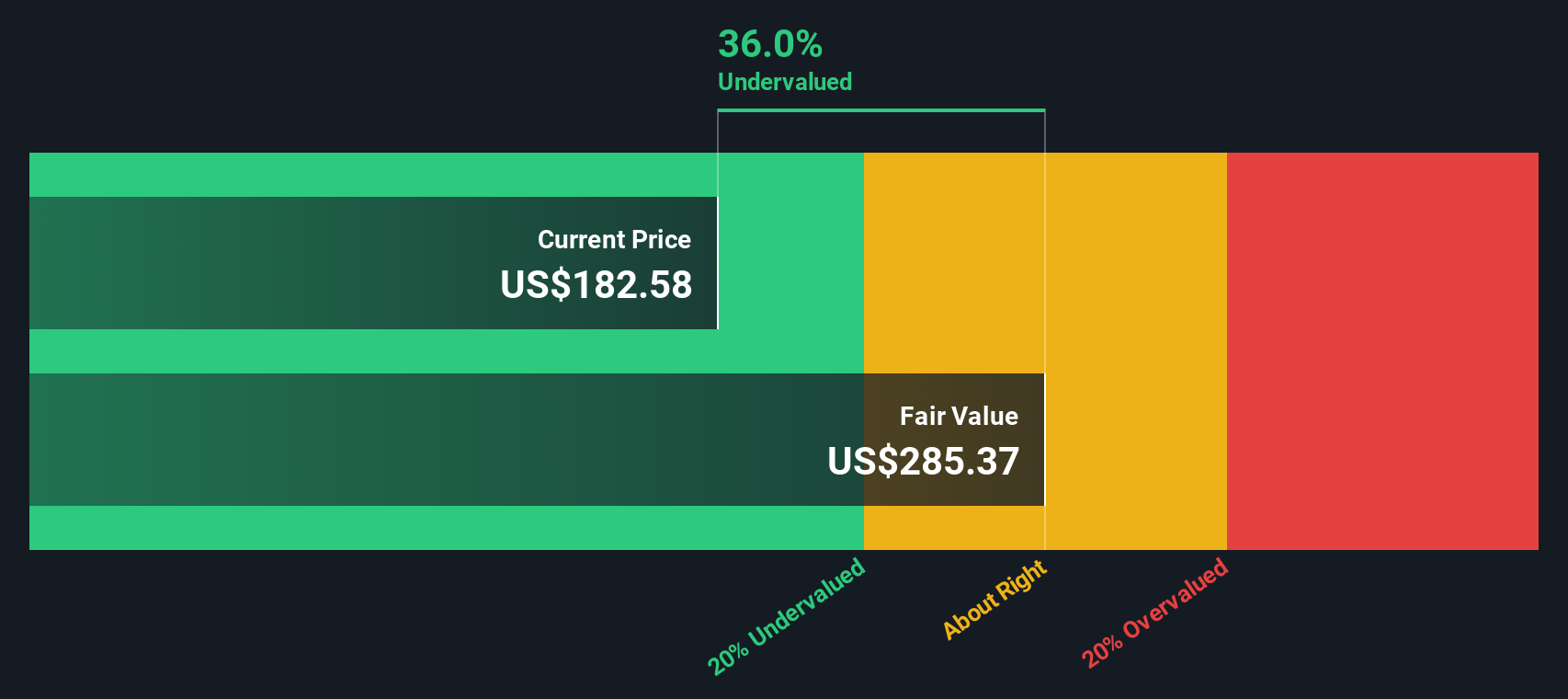

After aggregating these forecasts and discounting them to present value, the DCF model calculates an intrinsic value of $308.50 per share. That figure is notably higher than the recent trading price of $187.81, which implies the stock is trading at a 39.1% discount to its estimated fair value. In summary, the DCF analysis suggests Leidos Holdings is undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Leidos Holdings is undervalued by 39.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Leidos Holdings Price vs Earnings

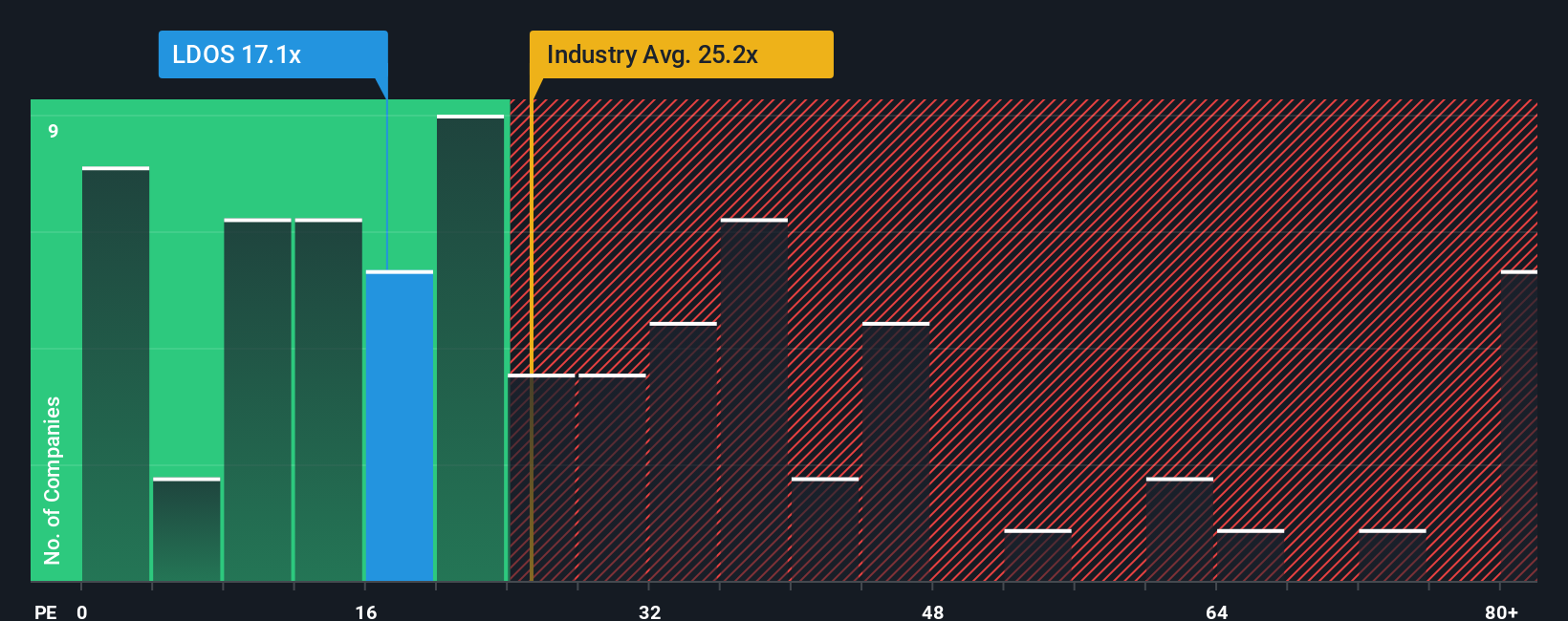

The price-to-earnings (PE) ratio is a widely used valuation tool for profitable companies like Leidos Holdings, as it relates the company’s current share price to its earnings per share. This metric is favored because it allows investors to assess how much they are paying for a company’s profits compared to competitors and the broader industry.

What is considered a “normal” or “fair” PE ratio depends on how quickly a company is expected to grow and how risky its earnings are. Fast-growing companies with resilient earnings often command higher PE ratios, while those with lower growth or higher risk typically trade at a discount.

Leidos Holdings is currently trading at a PE of 17.2x. This is noticeably lower than the industry average PE of 27.2x and also below the average for its listed peers, which sits at 41.4x. Rather than just comparing with peers or industry averages, Simply Wall St’s proprietary Fair Ratio takes into account key factors such as Leidos’ profit growth, overall risk, margins, and even its market cap to arrive at a more tailored benchmark. For Leidos, the Fair Ratio is estimated at 26.0x.

Comparing Leidos’ current PE of 17.2x with its Fair Ratio of 26.0x suggests the stock is trading well below its fair value and may present a compelling opportunity for investors focused on valuation.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Leidos Holdings Narrative

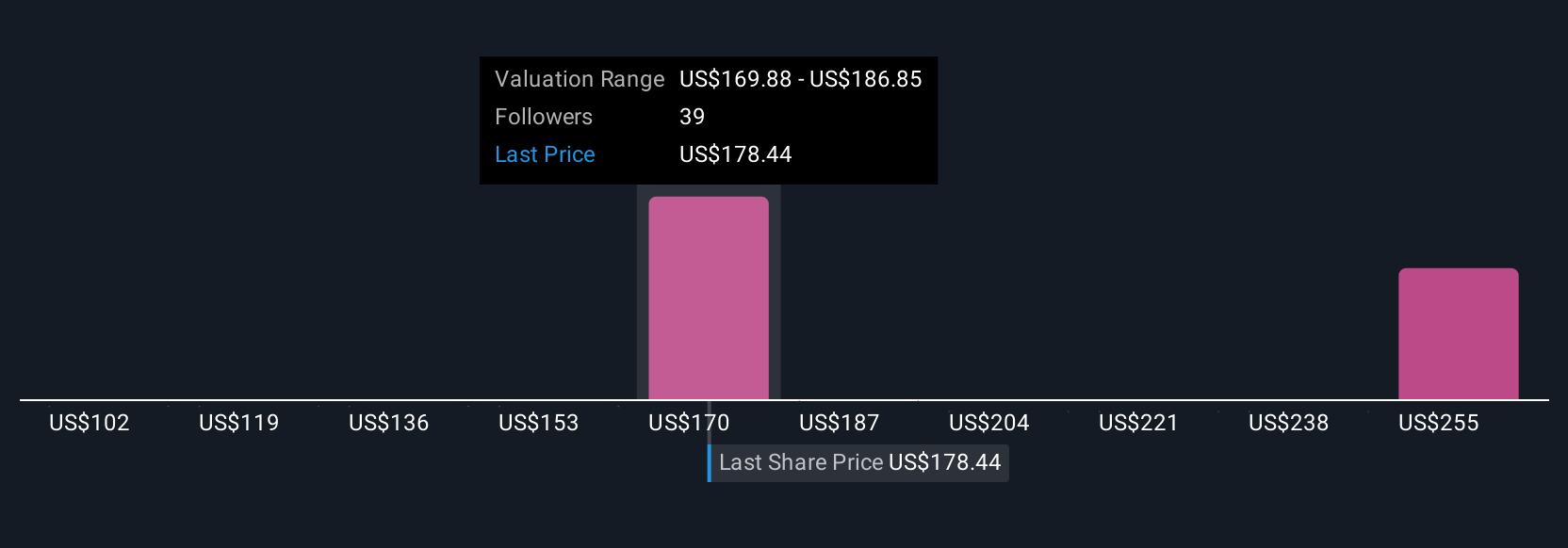

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, approachable way to put your own story behind the numbers. You lay out what you believe about a company, such as future revenue, margins, or risks, and connect those assumptions to a financial forecast and, ultimately, your own fair value estimate. Narratives let you link the underlying business case, like government funding, digital transformation, or acquisition synergies, directly to the numbers driving your investment decisions.

On Simply Wall St’s Community page, used by millions of investors, Narratives make it easy and accessible to build your perspective and instantly see how your outlook compares against the current share price. They are updated dynamically whenever key news or earnings data comes in, helping you stay ahead of the curve and adapt as new information emerges. For example, one investor might see Leidos as a growth leader and set a Narrative fair value of $210 by forecasting strong project wins and margin expansion. Another investor, focusing on integration hurdles or budget volatility, may set a much more cautious value at $164. Narratives help you cut through the noise and act, buy or sell, based on your own logic and conviction.

Do you think there's more to the story for Leidos Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LDOS

Leidos Holdings

Provides services and solutions for government and commercial customers in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives