- United States

- /

- Professional Services

- /

- NYSE:LDOS

Does Leidos’ (LDOS) Airport Security Tech Partnership Mark a Turning Point for Its Aviation Segment?

Reviewed by Sasha Jovanovic

- Leidos and Quadridox recently announced the integration of their computed tomography and X-ray diffraction imaging systems to create a new advanced baggage screening technology for airports, designed to enhance security and operational efficiency.

- This collaboration combines Leidos' Examiner 3DX CT with Quadridox’s DELPHI XRDI, signaling an important step toward more effective and adaptable airport security screening systems, with successful internal tests and a planned airport trial in 2026.

- To understand the impact of this partnership, particularly the potential to advance Leidos' high-tech offerings in aviation security, we'll examine how it may influence the company's investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Leidos Holdings Investment Narrative Recap

Leidos shareholders need to believe in the company’s ability to consistently win and execute valuable government contracts, especially in national security and digital modernization, while navigating cost pressures and reliance on U.S. federal funding. The new airport security technology partnership with Quadridox marks a positive step in broadening Leidos’ advanced aviation solutions, but its near-term impact on the primary catalyst, continued government spending, appears modest; meanwhile, the biggest risk remains exposure to shifting federal budgets.

Among recent announcements, the multi-year contract to modernize Kazakhstan’s air traffic control systems stands out. This project, much like the new airport screening initiative, aligns with Leidos’ core objective to drive growth through advanced infrastructure solutions, supporting the key catalyst of sustained demand for digital modernization in critical environments.

In contrast, investors should be mindful of how any reduction in U.S. government funding or shifts in political priorities could...

Read the full narrative on Leidos Holdings (it's free!)

Leidos Holdings is projected to achieve $18.6 billion in revenue and $1.5 billion in earnings by 2028. This outlook is based on a 3.0% annual revenue growth rate and an increase in earnings of $0.1 billion from the current $1.4 billion.

Uncover how Leidos Holdings' forecasts yield a $218.08 fair value, a 15% upside to its current price.

Exploring Other Perspectives

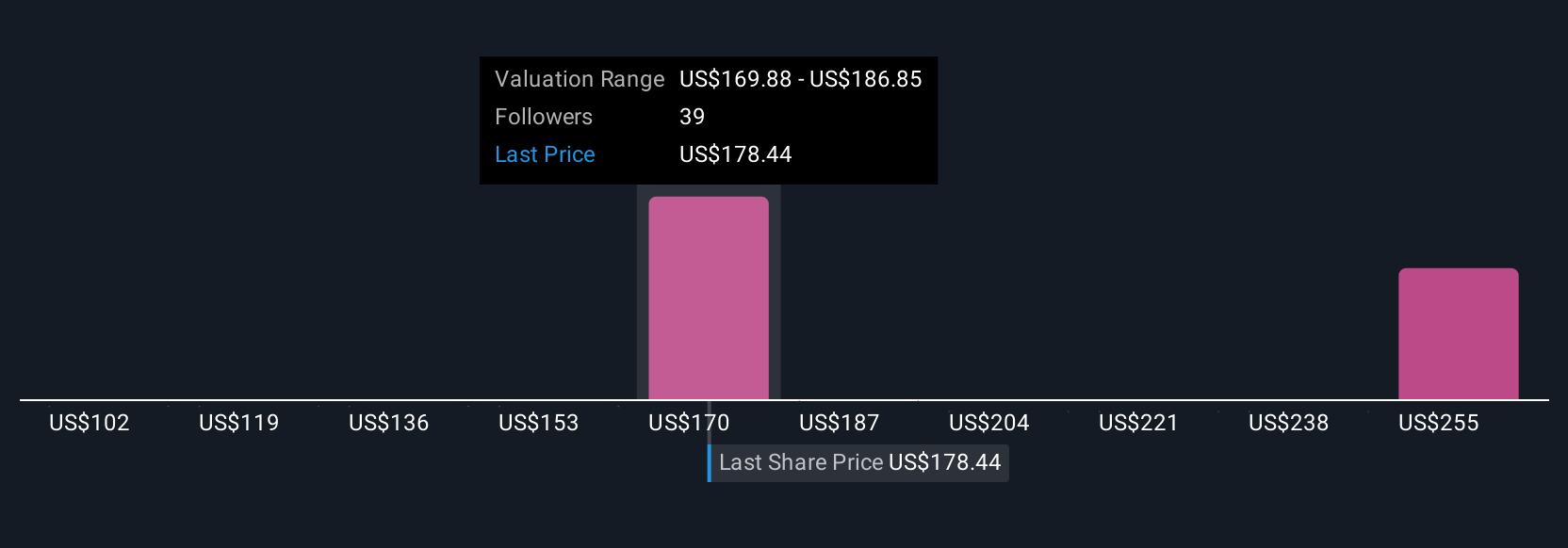

Six fair value estimates from the Simply Wall St Community placed Leidos between US$152.74 and US$298.38 per share. While many see recurring digital modernization contracts as a vital growth driver, outcomes remain highly sensitive to government budget decisions, be sure to compare different viewpoints before making up your mind.

Explore 6 other fair value estimates on Leidos Holdings - why the stock might be worth 20% less than the current price!

Build Your Own Leidos Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leidos Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Leidos Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leidos Holdings' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LDOS

Leidos Holdings

Provides services and solutions for government and commercial customers in the United States and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success