- United States

- /

- Professional Services

- /

- NYSE:LDOS

Does Kazakhstan’s SkyLine-X Deal Strengthen Leidos Holdings’ (LDOS) Global Growth and Recurring Revenue Profile?

Reviewed by Sasha Jovanovic

- Earlier this month, Kazaeronavigatsia announced it had signed a 19-year contract with Leidos Holdings to modernize Kazakhstan's national air traffic control system, upgrading four control centers and 21 towers with the advanced SkyLine-X Air Traffic Management platform.

- This long-term agreement highlights Leidos' international expansion and secures recurring revenue opportunities tied to Kazakhstan's rapidly growing aviation sector.

- We’ll explore how this landmark contract with Kazakhstan could reshape Leidos’ growth prospects by strengthening its global and recurring revenue profile.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Leidos Holdings Investment Narrative Recap

To invest in Leidos Holdings, you need to believe the company can successfully balance its reliance on US federal funding with growth in international and service-based markets. While the 19-year Kazakhstan contract showcases progress on global diversification and provides recurring revenue, it does not meaningfully change the fact that near-term catalysts are still driven by US government spending. The greatest risk remains a potential shift or reduction in federal budgets, which could impact revenue more immediately than international wins.

Among recent announcements, Leidos' $128 million FBI contract to enhance the Next Generation Identification (NGI) system ties directly to its core strength in large, mission-critical federal projects. These domestic wins, especially in defense and law enforcement modernization, underpin the company’s short-term performance, reinforcing why federal funding trends remain central to the investment story, even as international contracts like Kazakhstan’s point toward a more diversified future.

However, even with expanding global contracts, investors should not overlook the potential vulnerabilities created by heavy exposure to changing government priorities…

Read the full narrative on Leidos Holdings (it's free!)

Leidos Holdings' outlook anticipates $18.6 billion in revenue and $1.5 billion in earnings by 2028. This is based on a 3.0% annual revenue growth rate and a $0.1 billion increase in earnings from the current $1.4 billion.

Uncover how Leidos Holdings' forecasts yield a $194.71 fair value, a 4% upside to its current price.

Exploring Other Perspectives

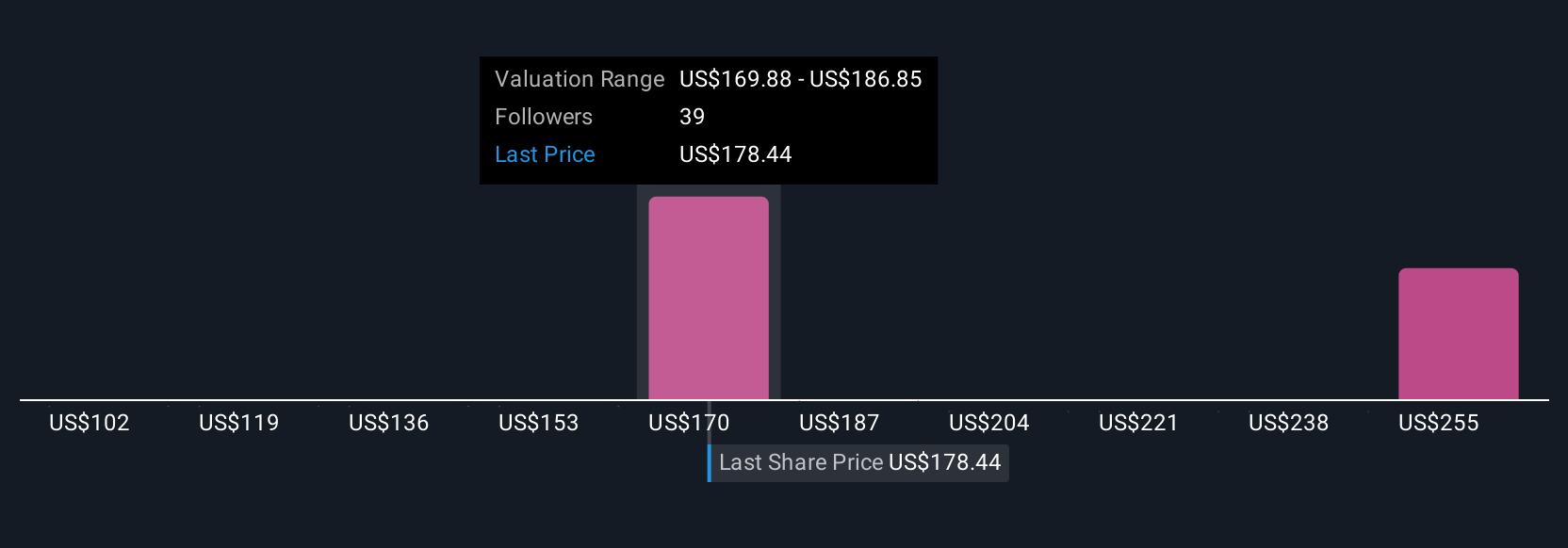

Simply Wall St Community members estimate Leidos’ fair value between US$102 and US$307, with eight unique viewpoints. While this wide spread shows how opinions differ, most still point to federal spending as an essential driver of company performance.

Explore 8 other fair value estimates on Leidos Holdings - why the stock might be worth 46% less than the current price!

Build Your Own Leidos Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leidos Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Leidos Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leidos Holdings' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LDOS

Leidos Holdings

Provides services and solutions for government and commercial customers in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives