- United States

- /

- Commercial Services

- /

- NYSE:KAR

OPENLANE (KAR): Revisiting Valuation After Improved Q3 Results and Lowered Full-Year Outlook

Reviewed by Simply Wall St

OPENLANE (KAR) just posted higher revenue and net income for the third quarter, but also lowered its earnings guidance for the year. The company now expects a diluted loss instead of income. This combination gives investors plenty to consider.

See our latest analysis for OPENLANE.

OPENLANE’s share price has rebounded strongly this year, with a 27.25% year-to-date gain, while the 1-year total shareholder return is 29.31%. Short-term momentum has been more volatile, however, with some cooling over the past three months as investors reassess risk after the company’s earnings outlook was cut despite business growth.

If you're curious how other fast-moving companies are navigating shifting outlooks, now is a great chance to discover fast growing stocks with high insider ownership.

With OPENLANE’s strong results contrasted by downgraded guidance, the big question is whether the market has already priced in future uncertainty or if these moves have created a new window to buy at a discount.

Most Popular Narrative: 19% Undervalued

OPENLANE’s fair value, according to the most widely followed narrative, sits notably above the last close. With the share price still trailing this target, investors have reason to dig deeper into what’s driving sentiment.

Ongoing investment in AI-driven products, process automation, and user experience enhancements (e.g., Absolute Sale and advanced inspection technology) is driving higher transaction values and operational efficiencies. These efforts are already resulting in significant margin expansion and are likely to further improve net margins over time.

Want to know how forward-looking technology bets are hardwired into this valuation? The forecast hinges on bold profit leaps and improving long-term margins. The exact financial milestones might surprise you. See what powers this compelling price target.

Result: Fair Value of $31.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from both established auction houses and new digital-first entrants, as well as potential regulatory shifts, could limit OPENLANE’s expected margin growth.

Find out about the key risks to this OPENLANE narrative.

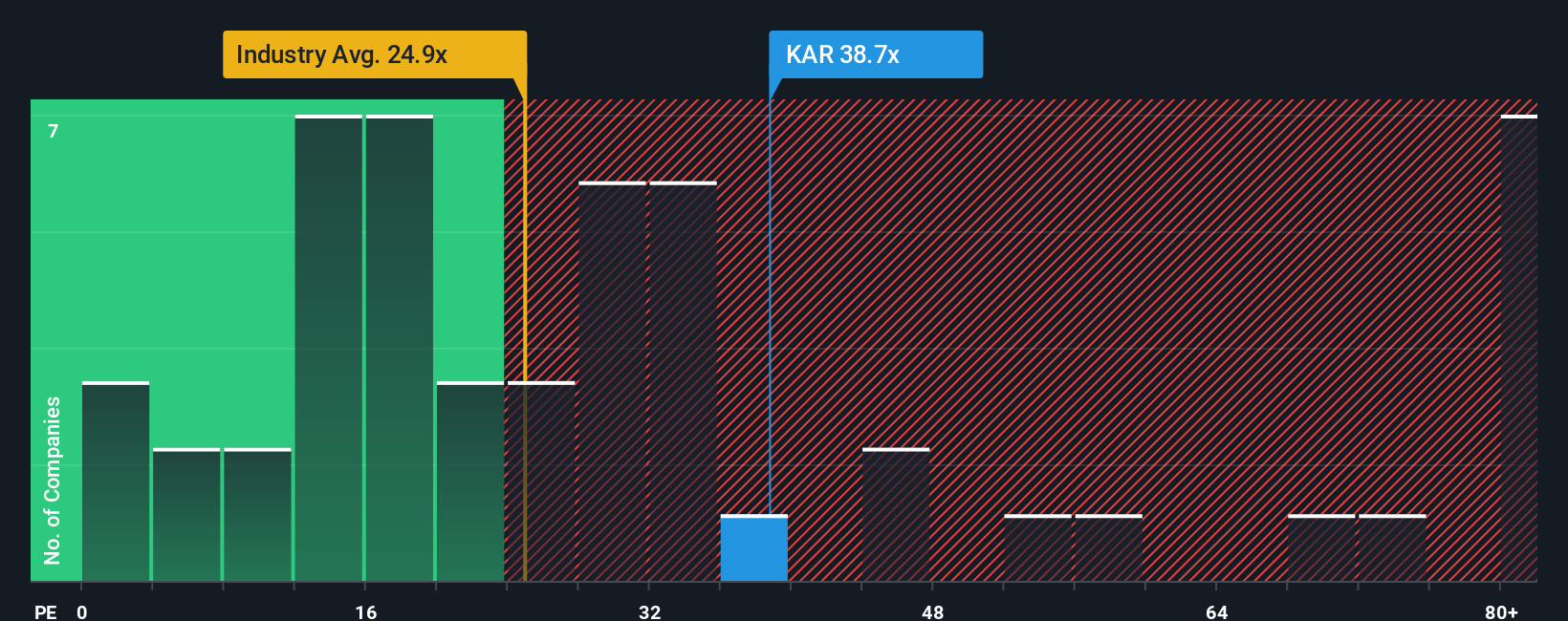

Another View: Multiples Tell a Cautious Story

While the most popular view points to OPENLANE being undervalued, our comparison against the sector and its peers using price-to-earnings multiples is less optimistic. The company trades at 28.8 times earnings, higher than the US Commercial Services industry average of 25.6x, but slightly below the peer group at 31.5x. The fair ratio, which the market could eventually revert to, is 28.6x. This is almost exactly where OPENLANE sits today. Does this suggest the upside is already priced in, or could momentum still surprise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OPENLANE Narrative

If you see things differently or prefer making your own call, you can easily craft your personalized view in just a few minutes: Do it your way.

A great starting point for your OPENLANE research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Take decisive steps to strengthen your portfolio. The market rewards those who act quickly, so don’t let these standout sectors and trends pass you by.

- Uncover high-yield opportunities and boost your income by checking out these 16 dividend stocks with yields > 3% with strong yields above 3%.

- Ride the wave of technological breakthroughs and track progress with these 25 AI penny stocks that are reshaping industries with artificial intelligence.

- Position yourself for exceptional value growth. See these 897 undervalued stocks based on cash flows tapping into stocks currently priced lower than their cash flow suggests.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KAR

OPENLANE

Operates as a digital marketplace for used vehicles, which connects sellers and buyers in the United States, Canada, Continental Europe and the United Kingdom.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives