- United States

- /

- Commercial Services

- /

- NYSE:KAR

OPENLANE (KAR): Evaluating Valuation After Strong Q3 Results and Upgraded 2025 Guidance

Reviewed by Simply Wall St

OPENLANE (KAR) caught investor attention after reporting higher-than-expected results for Q3 2025. This was driven by double-digit growth in dealer-to-dealer volumes and market share gains across North America. Management also raised guidance for the full year.

See our latest analysis for OPENLANE.

OPENLANE’s strong Q3 results and management’s upward revision to guidance have put a spotlight on the company’s long-term transformation. After a robust year-to-date share price return of 24.4% and an impressive 1-year total shareholder return of 29.1%, recent momentum has cooled a bit, with the stock slipping around 11% over the last three months even as profit metrics improve. Still, with its ongoing digital innovation and market share gains, OPENLANE’s performance story has clear upside signals that investors are watching closely.

If you’re curious about what other high potential opportunities are out there, now's a smart time to broaden your horizon and discover fast growing stocks with high insider ownership

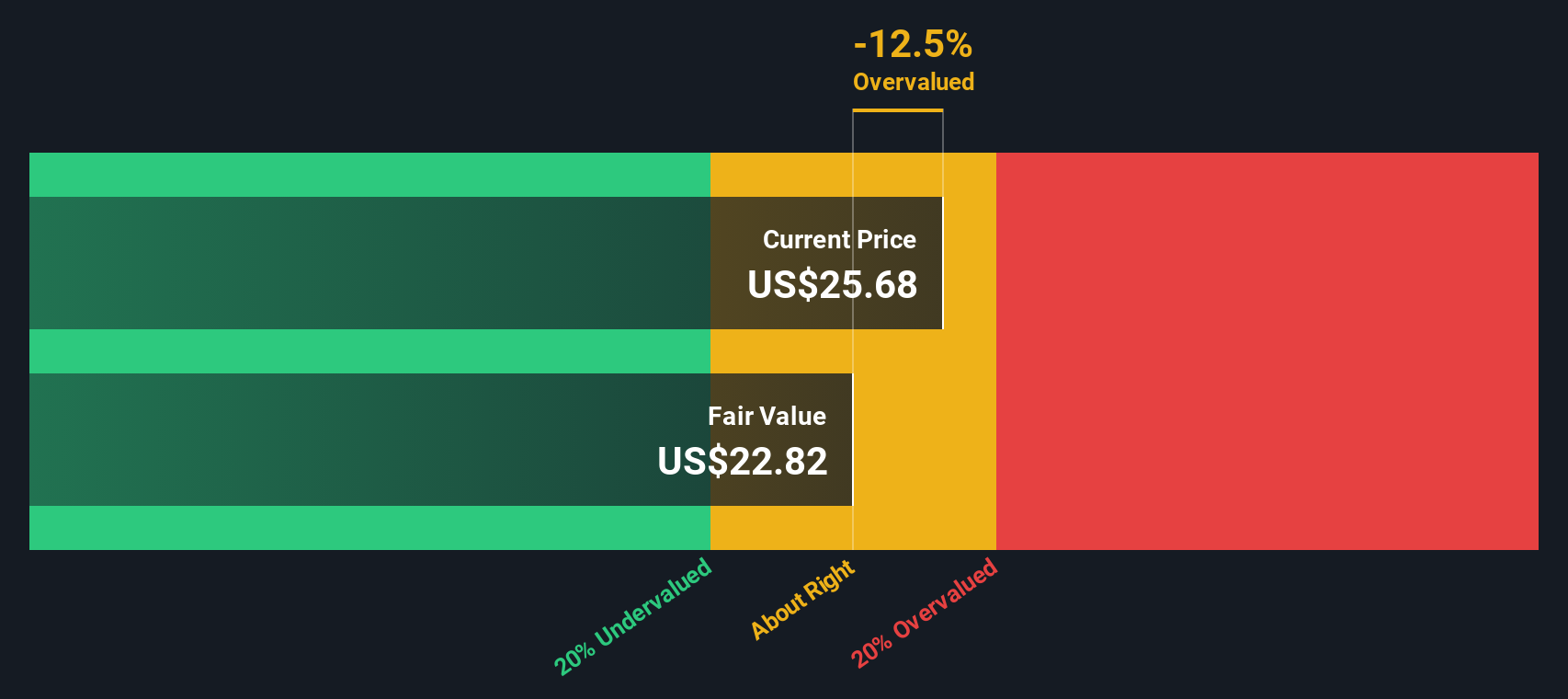

Given OPENLANE’s impressive financial momentum and guidance upgrades, the key question now is whether these strengths are fully reflected in the current share price or if a genuine buying opportunity remains for investors seeking future upside.

Most Popular Narrative: 20% Undervalued

OPENLANE’s most widely followed narrative sets the fair value at $31.36, notably higher than the last close of $25.10. This puts the spotlight squarely on the company’s future prospects and the drivers behind this premium valuation.

The accelerating shift from physical to digital platforms in the wholesale vehicle auction industry, evidenced by OPENLANE's double-digit growth in dealer-to-dealer digital volumes and sustained market share gains, points to continued secular tailwinds for revenue growth as digital adoption remains in its early stages within a large total addressable market. Ongoing investment in AI-driven products, process automation, and user experience enhancements is driving higher transaction values and operational efficiencies. These improvements are already resulting in significant margin expansion and are likely to further improve net margins over time.

Want to know why analysts are bullish on OPENLANE’s upside? The full narrative reveals bold growth and margin forecasts fueling its premium price target. See what stands behind the math before making your move.

Result: Fair Value of $31.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying digital competition or unexpected integration challenges could pressure OPENLANE’s margins and earnings outlook. This may impact the bullish narrative analysts currently support.

Find out about the key risks to this OPENLANE narrative.

Another View: What Do the Numbers Say?

While analysts see OPENLANE as undervalued, our SWS DCF model offers a different perspective. It values the company even higher than the consensus, which suggests shares are trading at a significant discount. However, the DCF approach relies on bold assumptions about future growth and margins. Is this optimism warranted, or could projections prove too aggressive?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own OPENLANE Narrative

If you think the story deserves a different angle or want to see the numbers for yourself, it only takes a few minutes to craft your own view. Do it your way

A great starting point for your OPENLANE research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their watchlist fresh with tomorrow’s winners. Don’t miss out on these handpicked stock ideas with real potential for upside and growth from the Simply Wall Street Screener.

- Pocket opportunities others overlook by checking out these 3589 penny stocks with strong financials, which are showing strong fundamentals and rapid growth potential.

- Secure cash flow for your portfolio and boost your passive income with these 16 dividend stocks with yields > 3%, offering attractive yields above 3%.

- Ride the AI wave early and see which businesses are leading innovation by reviewing these 25 AI penny stocks right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KAR

OPENLANE

Operates as a digital marketplace for used vehicles, which connects sellers and buyers in the United States, Canada, Continental Europe and the United Kingdom.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives