What Jacobs Solutions (J)'s Landmark Mukaab Contract Win Reveals About Its Middle East Growth Ambitions

Reviewed by Sasha Jovanovic

- On November 5, 2025, the New Murabba Development Company appointed Jacobs, in partnership with AECOM, to provide multidisciplinary design services for The Mukaab, a 247-acre flagship project in Riyadh's new urban district linked to Saudi Arabia's Vision 2030 initiative.

- This high-profile win highlights Jacobs' expanding role in transformative Middle Eastern infrastructure projects and signals its expertise in delivering innovative, sustainable urban environments.

- We'll assess how Jacobs' involvement in The Mukaab, a core component of Vision 2030, could shape the company's investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Jacobs Solutions Investment Narrative Recap

Owning Jacobs Solutions shares means believing in the company’s ability to leverage global infrastructure and technology shifts to drive long-term growth across diverse markets. The latest New Murabba contract in Riyadh adds a significant, high-profile project to Jacobs’ backlog, supporting its regional diversification and reinforcing its role in large-scale sustainable urban development. That said, the immediate impact on the company’s core short-term catalyst, record backlog and margin improvement, appears incremental rather than transformational, while exposure to project execution risks over multi-year developments remains.

Among the recent contract wins, Jacobs’ expanded nine-year commitment in Jackson, Mississippi's wastewater infrastructure is especially relevant. This complements the company’s broader push into critical water and resilience projects, tying directly to anticipated spending in infrastructure modernization, a key underpinning of projected revenue visibility and margin growth over the next several years.

But in contrast, investors should not overlook the long-tail risks around cost overruns and regulatory changes on complex, multi-year infrastructure projects that could...

Read the full narrative on Jacobs Solutions (it's free!)

Jacobs Solutions' outlook anticipates $14.4 billion in revenue and $971.8 million in earnings by 2028. This scenario implies a 6.7% annual revenue growth rate and a $486.8 million increase in earnings from the current $485.0 million.

Uncover how Jacobs Solutions' forecasts yield a $159.66 fair value, a 4% upside to its current price.

Exploring Other Perspectives

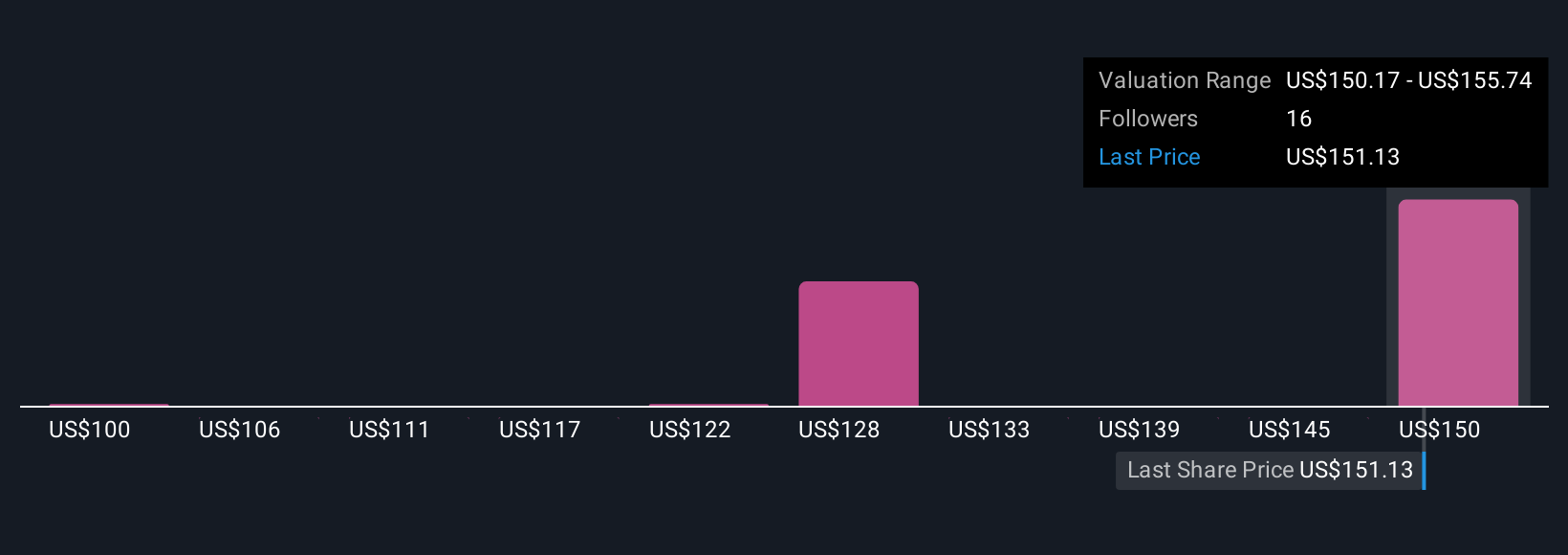

Simply Wall St Community members assigned fair values for Jacobs Solutions ranging from US$100 to US$202, covering 5 separate analyses. While some see upside driven by a record-high backlog, others caution that multi-year project risks can limit earnings visibility, so it’s worth comparing multiple outlooks.

Explore 5 other fair value estimates on Jacobs Solutions - why the stock might be worth as much as 32% more than the current price!

Build Your Own Jacobs Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jacobs Solutions research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Jacobs Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jacobs Solutions' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:J

Jacobs Solutions

Engages in the infrastructure and advanced facilities, and consulting businesses in the United States, Europe, Canada, India, Asia, Australia, New Zealand, the Middle East, and Africa.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives