Last Update 18 Nov 25

Fair value Increased 0.015%J: Recent Wins And Adjusted Outlook Will Shape Balanced Performance Ahead

Analysts have modestly increased their price target for Jacobs Solutions from $159.66 to $159.69, citing adjusted expectations for revenue growth and profit margins.

What's in the News

- Jacobs has been named as a supplier on the United Kingdom's Crown Commercial Service’s Management Consultancy Framework Four. The company will provide advisory services for infrastructure projects to public sector clients for the next two years (Client Announcements).

- The company was awarded a nine-year contract by JXN Water to operate and maintain Jackson, Mississippi's wastewater infrastructure. This expands Jacobs' role in supporting the city's essential water systems (Client Announcements).

- Jacobs, in a joint venture with AECOM, has been appointed to provide design services for The Mukaab, which is the central feature of Riyadh's New Murabba development and part of Saudi Arabia’s Vision 2030 initiative (Client Announcements).

- Selected by EirGrid, Jacobs will participate in a five-year framework to help deliver Ireland’s renewable electricity transmission goals and support grid resilience (Client Announcements).

- Jacobs received a five-year contract extension to continue as Program Management Consultant for the Port of Alaska’s modernization. This project is critical for the state’s infrastructure and economic security (Client Announcements).

Valuation Changes

- Fair Value: Increased slightly from $159.66 to $159.69 per share.

- Discount Rate: Increased modestly from 7.25% to 7.44%.

- Revenue Growth: Decreased from 6.75% to 5.98% annually.

- Net Profit Margin: Decreased slightly from 6.75% to 6.37%.

- Future P/E: Increased from 21.69x to 24.26x.

Key Takeaways

- Strong momentum in digital transformation and infrastructure modernization drives sustainable revenue and margin growth across high-priority markets.

- Strategic focus on consulting, technology, and disciplined capital returns bolsters higher-quality earnings and increasing shareholder value.

- Reliance on public sector spending, capital-intensive growth initiatives, and project execution risks expose Jacobs to revenue volatility, margin pressure, and potential earnings underperformance.

Catalysts

About Jacobs Solutions- Engages in the infrastructure and advanced facilities, and consulting businesses in the United States, Europe, Canada, India, Asia, Australia, New Zealand, the Middle East, and Africa.

- Record-high backlog growth (up 14% year-over-year) in Water, Advanced Facilities, and Critical Infrastructure-driven by global infrastructure modernization, water scarcity, and data center expansion-provides strong visibility into multi-year revenue growth and supports confidence in accelerating top-line results into FY '26 and beyond.

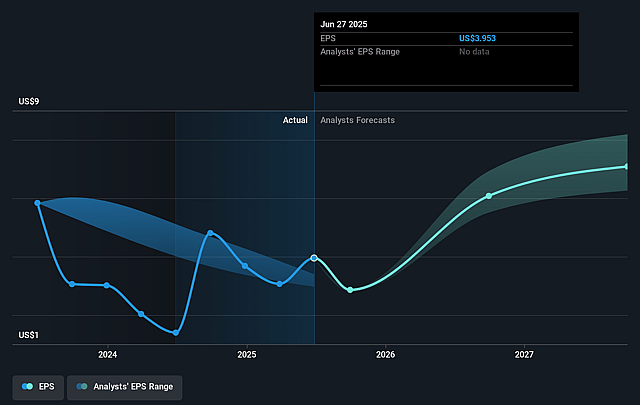

- Rapid adoption of digital transformation-exemplified by growing Digital Twin engagements, the transformational NVIDIA Omniverse partnership, and expanding AI/data center projects-positions Jacobs to capture high-margin, recurring digital services revenue, further supporting sustainable net margin and EPS growth.

- Rising public and private sector investments in climate adaptation, water modernization, and decarbonization projects (Marinus Link, advanced wastewater reuse, resilient transportation) are fueling durable demand for Jacobs' integrated solutions, expected to drive strong revenue growth across high-priority markets.

- Continued strategic shift toward consulting and technology-driven solutions (notably PA Consulting's double-digit growth and operating margins above 20%) is improving business mix, expanding operating margins, and supporting higher future earnings quality and EPS growth.

- Enhanced capital return strategy, robust cash flows, and margin self-help initiatives (including disciplined cost management and margin improvements) are enabling material share repurchases and dividend growth, directly supporting EPS accretion and overall shareholder value.

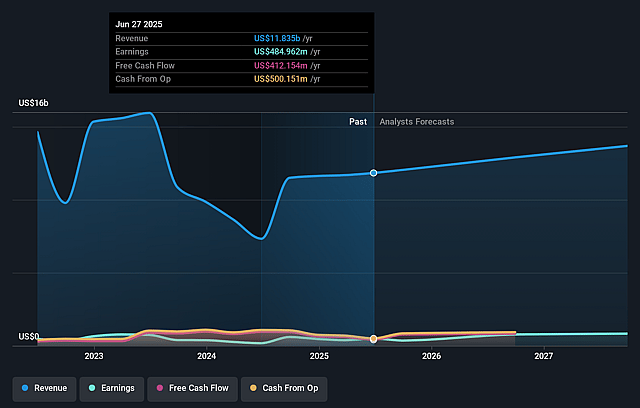

Jacobs Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Jacobs Solutions's revenue will grow by 6.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.1% today to 6.8% in 3 years time.

- Analysts expect earnings to reach $971.8 million (and earnings per share of $8.78) by about September 2028, up from $485.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.2x on those 2028 earnings, down from 35.4x today. This future PE is lower than the current PE for the US Professional Services industry at 26.3x.

- Analysts expect the number of shares outstanding to decline by 3.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.31%, as per the Simply Wall St company report.

Jacobs Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Jacobs' ongoing success is partially reliant on robust government and public sector spending, especially in Water, Transportation, and Defense; any shifts in fiscal policy, budget cuts, or political instability (as seen in U.K. infrastructure delays and uncertainty about U.S. federal funding allocations) could introduce revenue volatility and jeopardize long-term backlog and top-line growth.

- Although the company is diversifying and investing in high-growth markets like Data Centers and Life Sciences, these areas can experience rapid technological change and shifting client expectations, potentially requiring large, continual investments in digital solutions and AI capabilities; such capital intensity and the risk of misallocation could compress net margins and strain cash flows if growth slows or competition intensifies.

- Jacobs is benefitting from secular tailwinds like infrastructure modernization and climate adaptation; however, macroeconomic risks such as rising interest rates and tighter credit markets could dampen global infrastructure and capital spending, leading to delayed or canceled projects and adversely impacting both revenue and earnings.

- The company's backlog growth is weighted toward longer-tail Water and Infrastructure projects, which, while providing revenue visibility, may expose Jacobs to project execution risks, cost overruns, and potential regulatory changes over multi-year timeframes-negatively affecting margins or resulting in earnings revisions if not managed effectively.

- Integration and performance risk remain around acquisitions (e.g., PA Consulting) and business separations; any difficulty in extracting anticipated synergies or achieving organizational efficiencies-especially as Jacobs shifts toward higher-value consulting-could result in elevated operating expenses, underperformance in intended margin improvement, and downward pressure on overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $155.741 for Jacobs Solutions based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $175.0, and the most bearish reporting a price target of just $132.63.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $14.4 billion, earnings will come to $971.8 million, and it would be trading on a PE ratio of 21.2x, assuming you use a discount rate of 7.3%.

- Given the current share price of $143.71, the analyst price target of $155.74 is 7.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Jacobs Solutions?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.