Jacobs Solutions (J): Exploring Valuation After Earnings Beats and Upgraded Analyst Outlook

Reviewed by Kshitija Bhandaru

See our latest analysis for Jacobs Solutions.

Jacobs Solutions recently reached a new 52-week high and has continued to build momentum following several quarters of earnings beats. The company’s robust fundamentals and consistent upward move have contributed to a 12.6% total shareholder return over the past year, outperforming many peers and reflecting renewed confidence in its longer-term prospects.

If you're looking for your next stand-out idea beyond Jacobs, this is the perfect opportunity to discover fast growing stocks with high insider ownership.

With the stock trading near record highs and valuation metrics still signaling potential value, the key question for investors is whether Jacobs Solutions is still an overlooked opportunity or if the market has already priced in all its growth.

Most Popular Narrative: Fairly Valued

With Jacobs Solutions closing at $154.60 and the most popular narrative suggesting a fair value of $155.74, the share price sits right in line with analyst expectations. Investors are watching closely as ambitious growth strategies unfold, setting the scene for a pivotal period ahead.

Record-high backlog growth (up 14% year-over-year) in Water, Advanced Facilities, and Critical Infrastructure, driven by global infrastructure modernization, water scarcity, and data center expansion, provides strong visibility into multi-year revenue growth and supports confidence in accelerating top-line results into FY '26 and beyond. Rapid adoption of digital transformation, exemplified by growing Digital Twin engagements, the transformational NVIDIA Omniverse partnership, and expanding AI/data center projects, positions Jacobs to capture high-margin, recurring digital services revenue, further supporting sustainable net margin and EPS growth.

Curious about what bold projections lie beneath this price target? The real story involves significant margin improvement, digital acceleration, and a future profit multiple that might surprise you. See the full narrative for the quantifiable assumptions driving such a confident valuation.

Result: Fair Value of $155.74 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in government spending priorities or unexpected project execution challenges could quickly change the growth outlook for Jacobs Solutions.

Find out about the key risks to this Jacobs Solutions narrative.

Another View: Market Multiples Tell a Different Story

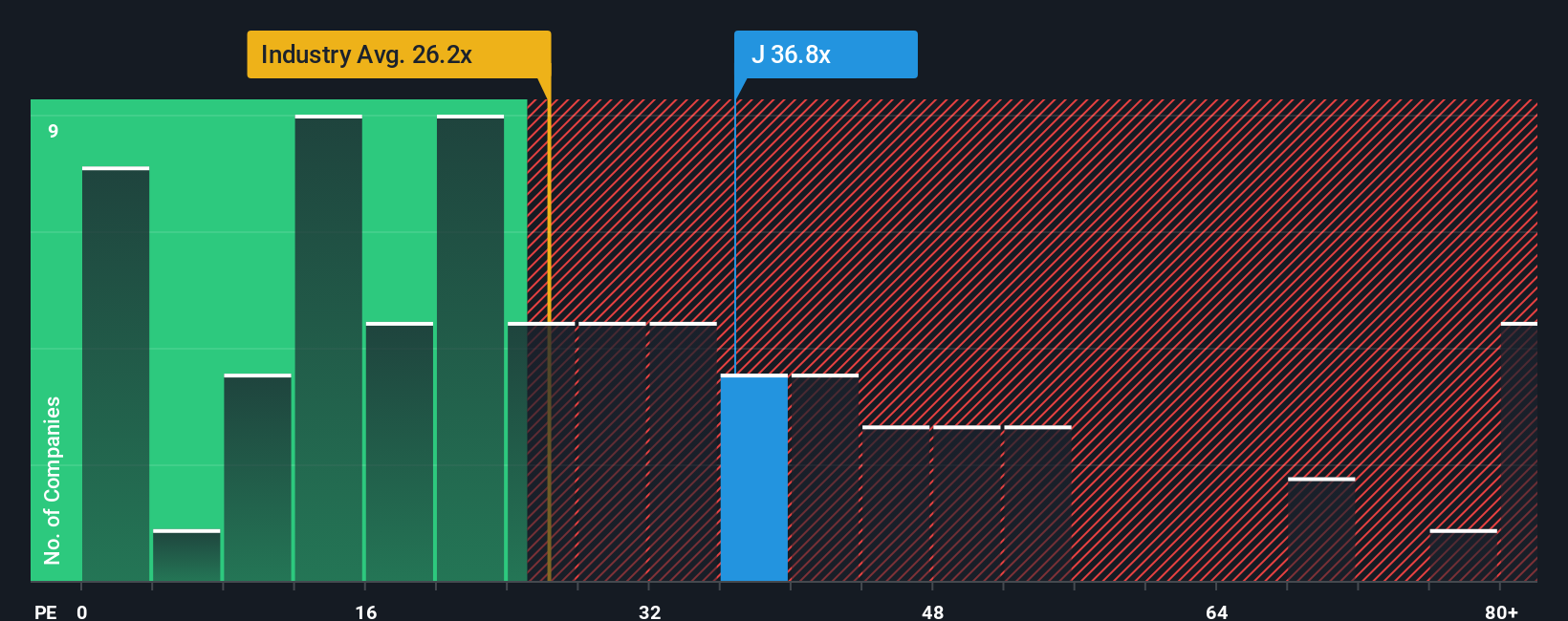

From a market multiples perspective, Jacobs Solutions trades at a price-to-earnings ratio of 38.1x, which is noticeably higher than both the industry average of 26.8x and its peers at 36.6x. Even compared to its fair ratio of 34.7x, the stock appears pricey. This raises questions about valuation risk if earnings growth slows. Could the current optimism be overextended, or is there justification for the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jacobs Solutions Narrative

If you see the story differently or want to follow your own analysis, you can quickly craft your own view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Jacobs Solutions.

Looking for more great investment moves?

Don’t settle for just one opportunity. Fuel your portfolio by checking out other promising stocks highlighted by our expert screeners. There is always a chance to get ahead.

- Maximize your search for yield with these 19 dividend stocks with yields > 3% that continue to deliver payouts above 3%, perfect for growth and income alike.

- Jump ahead of the curve as you review these 24 AI penny stocks, identifying companies on the frontier of artificial intelligence and automation breakthroughs.

- Secure your spot among savvy investors assessing these 894 undervalued stocks based on cash flows where market pricing has not caught up to the company’s true potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:J

Jacobs Solutions

Engages in the infrastructure and advanced facilities, and consulting businesses in the United States, Europe, Canada, India, Asia, Australia, New Zealand, the Middle East, and Africa.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives