Jacobs Solutions: Evaluating Valuation After Major DFW Airport Digital Transformation Win and Global Flood Platform Launch

Reviewed by Simply Wall St

Jacobs Solutions has been chosen to spearhead a major digital transformation project with Dallas Fort Worth Airport, leveraging its expertise in artificial intelligence and advanced analytics. This engagement, combined with the global rollout of its Flood Platform service, is drawing fresh attention from investors.

See our latest analysis for Jacobs Solutions.

Following these headline-grabbing moves in digital transformation and infrastructure software, Jacobs Solutions has seen momentum build, with a nearly 24% year-to-date share price return and a one-year total shareholder return of 18%. That is on top of its impressive medium- and long-term growth, as three- and five-year total shareholder returns sit at 81% and 116% respectively. These recent wins appear to have reinforced investor confidence in Jacobs’ strategy for future growth.

If the surge in digital infrastructure has you exploring similar trends, now’s a great moment to discover fast growing stocks with high insider ownership

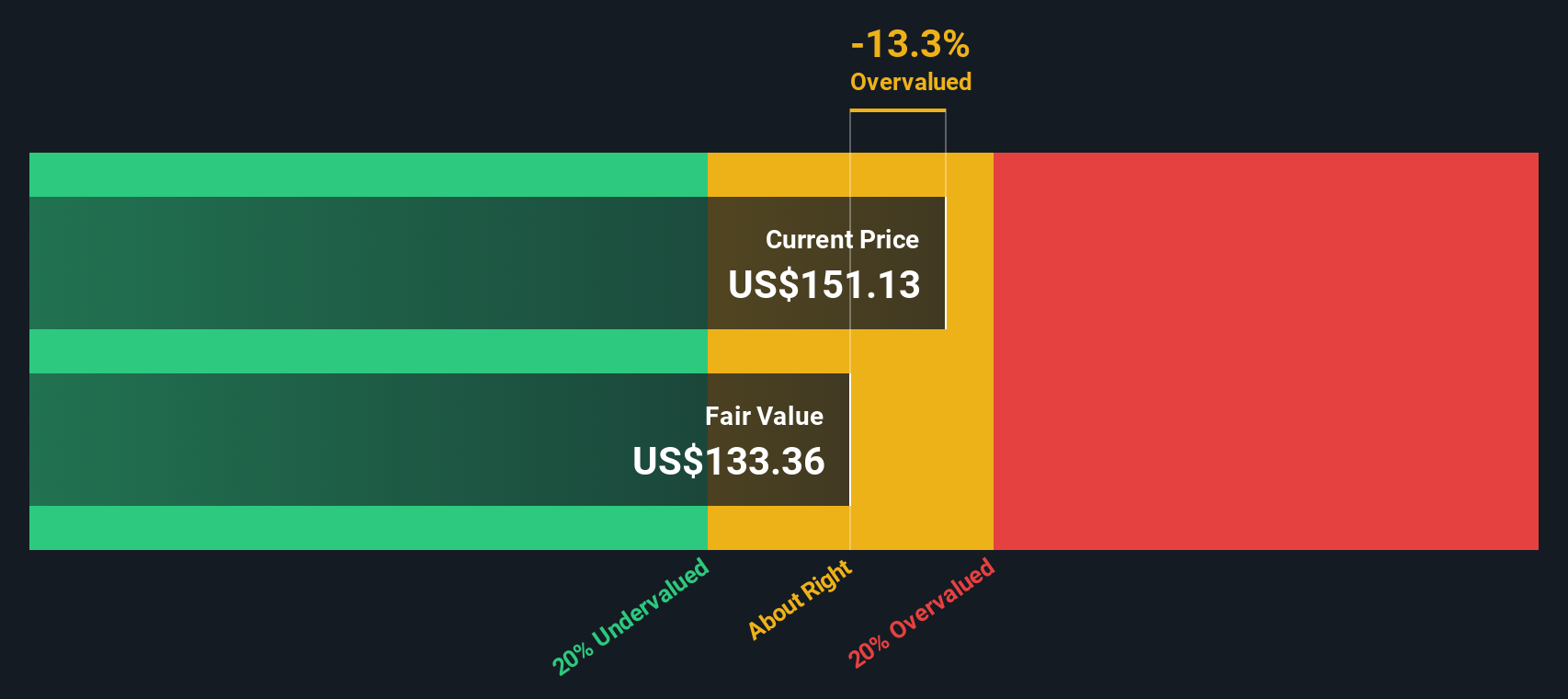

But with such strong gains already realized and ambitious digital bets coming to fruition, is Jacobs Solutions’ stock still trading at an attractive valuation? Or is all the upside already reflected in the current price?

Most Popular Narrative: 4.3% Overvalued

Despite Jacobs Solutions' strong run and ambitious outlook, the most-followed narrative suggests investors might be pricing in more than current fundamentals warrant, with the fair value sitting just below the latest market close.

Rapid adoption of digital transformation, exemplified by growing Digital Twin engagements, the transformational NVIDIA Omniverse partnership, and expanding AI/data center projects, positions Jacobs to capture high-margin, recurring digital services revenue. This may also support sustainable net margin and EPS growth.

What is the engine behind that bold valuation? Much of it depends on breakthrough growth from digital initiatives and a profit margin expansion that could change the outlook. Can Jacobs achieve the increase in profitability implied by these forecasts? The full narrative unpacks the ambitious numbers everyone is talking about.

Result: Fair Value of $157.66 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in government spending priorities or setbacks in large-scale project execution could destabilize Jacobs’ current momentum and could impact future earnings growth.

Find out about the key risks to this Jacobs Solutions narrative.

Another View: Discounted Cash Flow Sends a Different Signal

From another perspective, our DCF model suggests Jacobs Solutions may actually be undervalued, estimating a fair value of $204.25 per share compared to the current market price. This contrasts with the narrative view, which sees the stock as modestly overvalued. Which method better captures the company’s true potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jacobs Solutions for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jacobs Solutions Narrative

If you want to dig deeper or trust your own analysis, you can easily explore the data and craft a custom narrative yourself in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Jacobs Solutions.

Looking for More Investment Ideas?

Don’t let a great opportunity slip through your fingers. Use these tailored ideas to focus on tomorrow’s potential winners before everyone else finds them.

- Capture impressive income potential and stability by checking out these 17 dividend stocks with yields > 3% with attractive yields backed by resilient business models.

- Tap into healthcare’s AI transformation and see which companies are at the forefront of medical innovation through these 33 healthcare AI stocks.

- Ride technology’s next wave and identify promising leaders shaking up industries by taking a close look at these 24 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:J

Jacobs Solutions

Engages in the infrastructure and advanced facilities, and consulting businesses in the United States, Europe, Canada, India, Asia, Australia, New Zealand, the Middle East, and Africa.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives