- United States

- /

- Commercial Services

- /

- NYSE:GEO

Investors more bullish on GEO Group (NYSE:GEO) this week as stock rallies 3.7%, despite earnings trending downwards over past three years

One simple way to benefit from the stock market is to buy an index fund. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, The GEO Group, Inc. (NYSE:GEO) shareholders have seen the share price rise 93% over three years, well in excess of the market return (13%, not including dividends).

Since the stock has added US$64m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for GEO Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years of share price growth, GEO Group actually saw its earnings per share (EPS) drop 18% per year.

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Given this situation, it makes sense to look at other metrics too.

Do you think that shareholders are buying for the 2.6% per annum revenue growth trend? We don't. While we don't have an obvious theory to explain the share price rise, a closer look at the data might be enlightening.

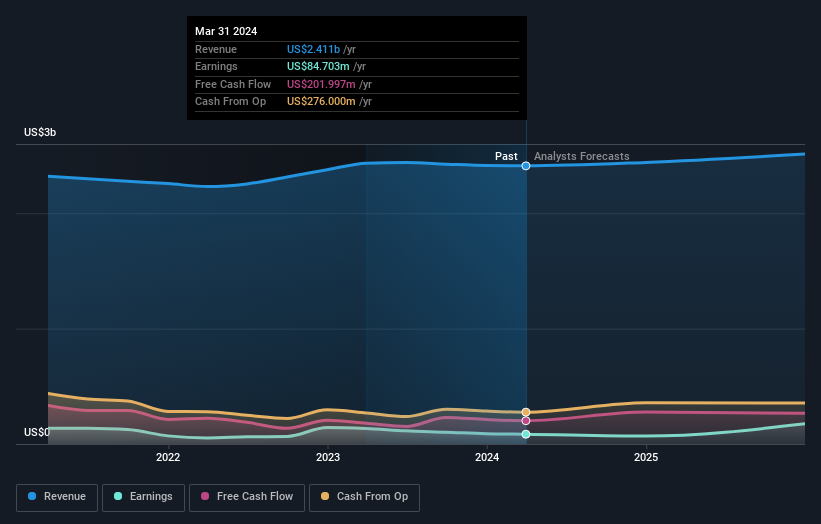

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on GEO Group

A Different Perspective

It's good to see that GEO Group has rewarded shareholders with a total shareholder return of 85% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 4% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand GEO Group better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with GEO Group (including 1 which is a bit concerning) .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEO

GEO Group

The GEO Group, Inc. (NYSE: GEO) engages in ownership, leasing, and management of secure facilities, processing centers, and community-based reentry facilities in the United States, Australia, the United Kingdom, and South Africa.

Good value slight.