- United States

- /

- Professional Services

- /

- NYSE:FVRR

Fiverr (FVRR) Is Down 8.3% After Posting Strong Q3 Earnings and Upgraded Revenue Guidance – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Fiverr International Ltd. recently announced its third quarter 2025 earnings, reporting revenue of US$107.9 million and net income of US$5.54 million, both higher than the previous year, alongside updated revenue guidance for the fourth quarter and full year.

- The company’s rising profitability and increased earnings per share reflect a shift toward higher-margin services and strengthened growth in core marketplace activities, drawing attention from market participants.

- We'll explore how Fiverr's improved earnings and full-year revenue guidance may influence its investment narrative and future growth prospects.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Fiverr International Investment Narrative Recap

To be a shareholder in Fiverr today often means believing in the platform’s ability to expand into higher-value, AI-powered freelance services while sustaining solid profitability gains. The latest quarterly results, showing increased revenue and earnings, support this long-term growth narrative but did not materially alter the most pressing short-term catalyst: accelerating adoption of complex services, nor the largest risk, which remains the potential dampening of overall growth from marketplace maturation as simpler categories get displaced by automation.

Fiverr’s newly raised full-year revenue guidance to US$428 million–US$436 million is especially timely, offering investors clearer visibility into the company’s expected operating momentum. This more confident guidance, coupled with strengthening margins, underscores why many now see the platform’s shift to recurring and premium services as a significant avenue for driving better earnings stability, yet, it remains important to consider how quickly these higher-value offerings can offset any slowdown in simpler gigs.

However, investors should also be aware that even with robust financial performance, competition and platform saturation could inhibit Fiverr’s ability to expand its active buyer base as...

Read the full narrative on Fiverr International (it's free!)

Fiverr International's outlook anticipates $533.3 million in revenue and $60.0 million in earnings by 2028. Achieving this milestone would require an 8.4% annual revenue growth rate and a $41.8 million earnings increase from the current $18.2 million.

Uncover how Fiverr International's forecasts yield a $32.56 fair value, a 51% upside to its current price.

Exploring Other Perspectives

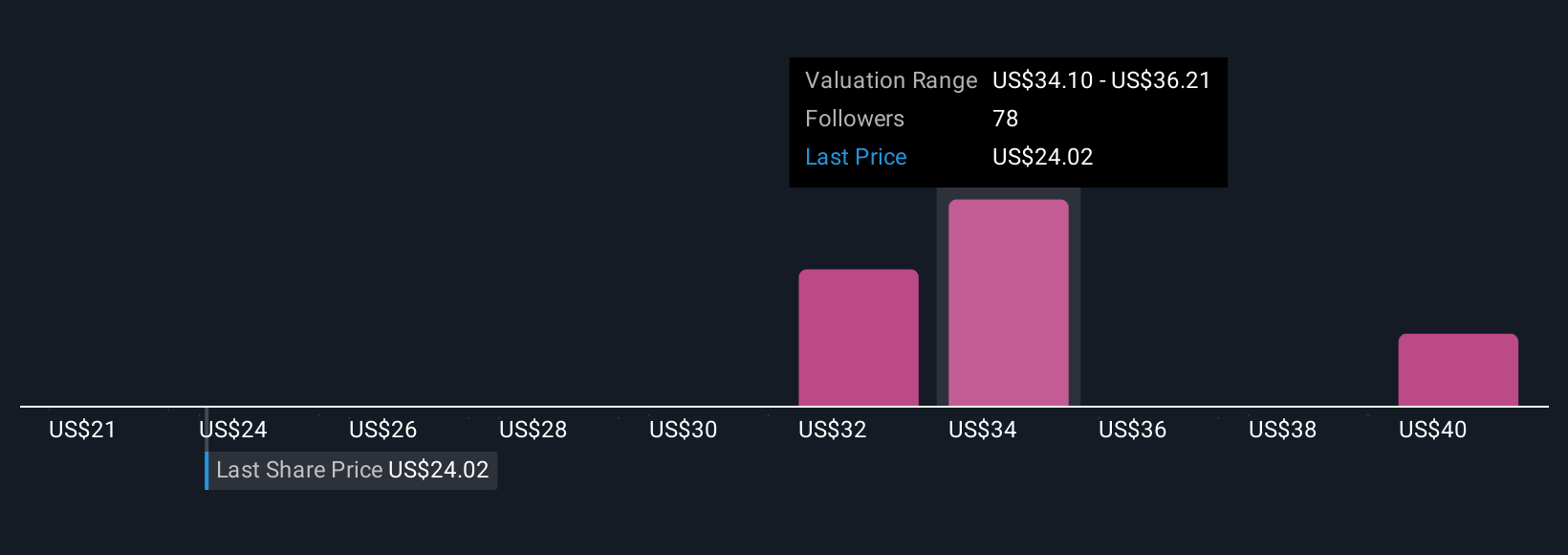

Six members of the Simply Wall St Community valued Fiverr between US$32.56 and US$42.25 per share before the most recent results. Many point to risks around marketplace maturation and growth sustainability, reflecting wide differences in confidence about the company’s future path.

Explore 6 other fair value estimates on Fiverr International - why the stock might be worth as much as 95% more than the current price!

Build Your Own Fiverr International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fiverr International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fiverr International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fiverr International's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FVRR

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives