- United States

- /

- Professional Services

- /

- NYSE:FCN

Will New EMEA Hires Strengthen FTI Consulting’s Competitive Edge in Tax Advisory Services (FCN)?

Reviewed by Sasha Jovanovic

- Earlier this week, FTI Consulting announced it has strengthened its EMEA Tax Advisory team by hiring Marcus Rea as Senior Managing Director in London and Thomas Lassey as Managing Director in Dubai.

- This move expands the firm’s tax and restructuring advisory capabilities across Europe and the Middle East, supporting its ongoing growth in high-demand, specialized consulting services for complex financial matters.

- We’ll explore how the addition of experienced leaders in EMEA tax and restructuring may further support FTI Consulting’s competitive positioning.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

FTI Consulting Investment Narrative Recap

FTI Consulting’s appeal for shareholders often centers on demand for specialized financial advisory amid increased regulatory complexity and economic uncertainty. The recent senior hires in EMEA tax and restructuring reflect ongoing efforts to build leadership bench strength, but the appointments are unlikely to immediately influence the most pressing near-term catalysts or offset key risks such as competitive fee pressure or the impact of automation on high-touch consulting revenue.

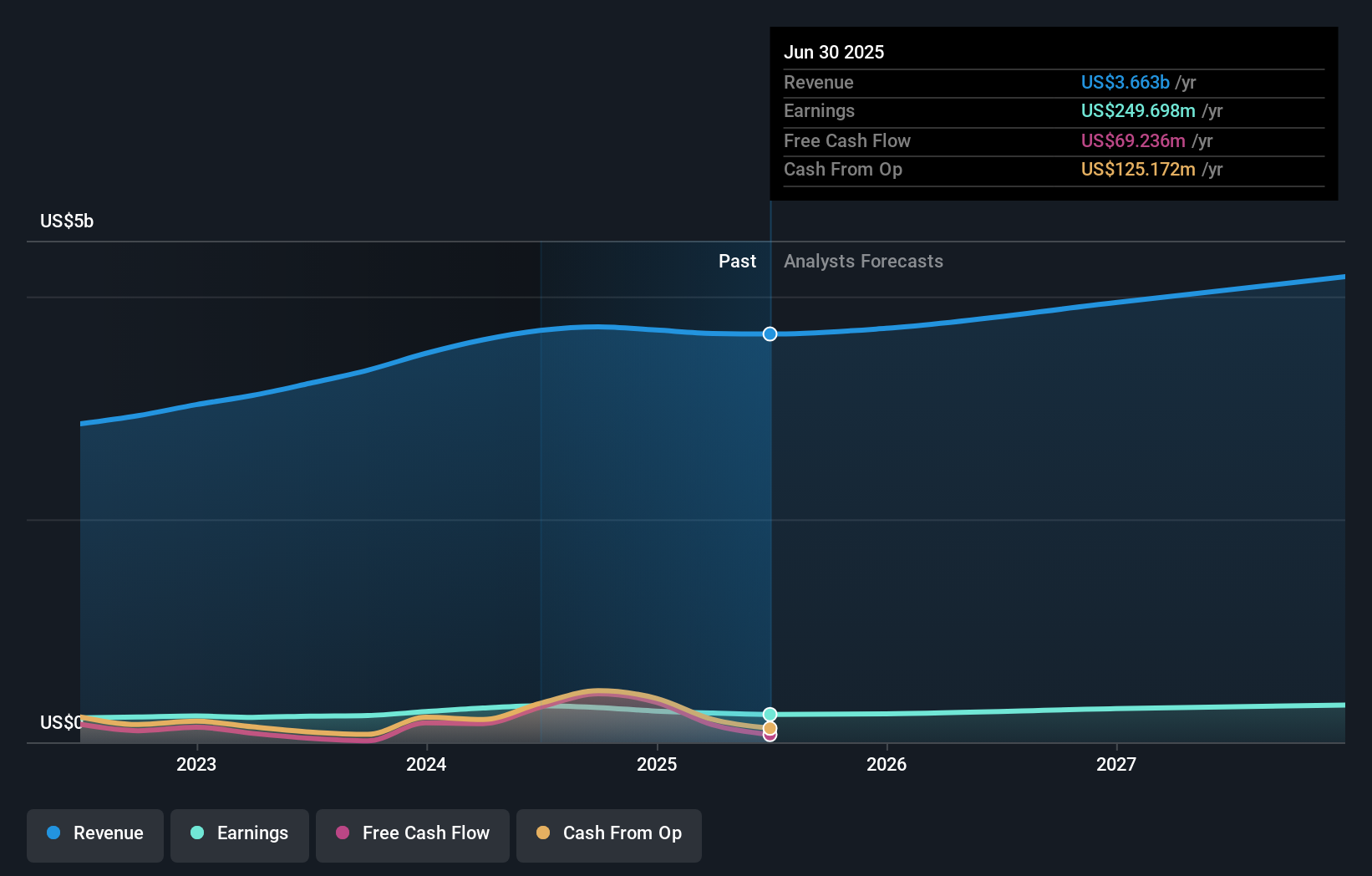

One recent announcement that stands out is the company’s upgraded full-year earnings guidance, with revenue now expected between US$3,685,000,000 and US$3,735,000,000. While this signals management’s confidence in ongoing business momentum, it does not diminish the importance of integrating newly hired senior experts and delivering sustained profit growth amid industry headwinds.

On the other hand, investors should be aware of increasing margin pressure if integration costs from talent acquisition…

Read the full narrative on FTI Consulting (it's free!)

FTI Consulting's outlook anticipates $4.3 billion in revenue and $358.3 million in earnings by 2028. This is based on a 5.3% annual revenue growth rate and a $108.6 million increase in earnings from the current $249.7 million level.

Uncover how FTI Consulting's forecasts yield a $166.00 fair value, in line with its current price.

Exploring Other Perspectives

The Simply Wall St Community provided one fair value estimate for FTI Consulting at US$166, showing little diversity among private investor opinions. While community perspectives can differ, keeping an eye on how fee competition could shape future earnings remains crucial for those following this stock.

Explore another fair value estimate on FTI Consulting - why the stock might be worth just $166.00!

Build Your Own FTI Consulting Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FTI Consulting research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free FTI Consulting research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FTI Consulting's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCN

FTI Consulting

Provides business advisory services to manage change, mitigate risk, and resolve disputes worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives