- United States

- /

- Professional Services

- /

- NYSE:FCN

FTI Consulting (FCN): Net Profit Margin Decline Challenges Valuation Narrative

Reviewed by Simply Wall St

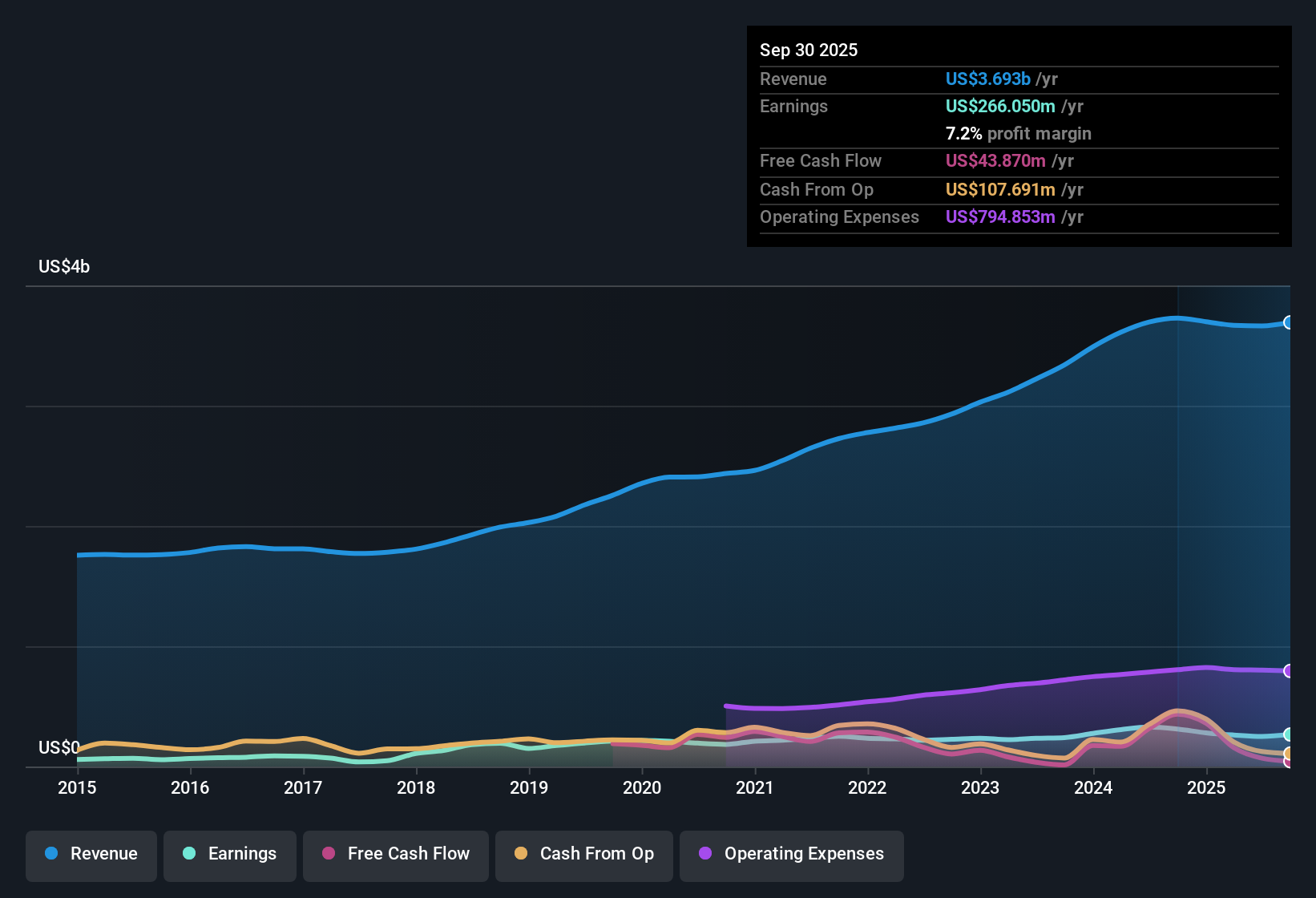

FTI Consulting (FCN) posted forecasted earnings growth of 14.04% per year, trailing the broader US market’s anticipated 15.5% pace. Net profit margin came in at 6.8%, down from last year’s 8.9%, with revenue expected to rise 6.5% per year, lower than the US market average of 10%. Against this backdrop, investors are weighing the company’s consistent earnings track record and favorable value metrics, particularly as high earnings quality and growing profits remain in focus, while no significant risks have been flagged in the data.

See our full analysis for FTI Consulting.Next, we will see how the latest numbers measure up to the narratives that shape market expectations, highlighting where consensus holds and where the story might be evolving.

See what the community is saying about FTI Consulting

Profit Margin Recovery Expected by 2026

- Analyst forecasts project net profit margins will climb from 6.8% now to 8.4% in three years, a turnaround after the decline from last year's 8.9%.

- Analysts' consensus view points to FTI's growing focus on talent and proprietary technology as the main driver for this rebound. Strategic investments are expected to allow the company to win more premium, repeat business.

- Higher-value mandates, powered by digital tools and experienced hires, are seen as enabling margin expansion despite industry cost pressures.

- Expanding international presence is expected to cushion global volatility and help stabilize profits across cycles. This aligns with analysts’ thesis for continued improvement.

Valuation Remains Attractive Versus Peers

- FTI trades at a Price-To-Earnings Ratio of 19.5x, notably below the Professional Services industry average of 25.9x and peer average of 42x.

- Analysts' consensus view argues that even as revenue growth moderates, FTI’s strong track record of earnings quality and efficient integration of talent reflects a value proposition the market is currently missing.

- The market’s lower multiple may underestimate the high proportion of recurring and higher-margin work FTI is building via strategic investments.

- The company’s ability to weather global regulatory challenges and ramp up new talent is highlighted as a foundation for durable, above-average returns within the sector.

Share Count Set for Meaningful Reduction

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next three years, pointing to rapid share buybacks ahead.

- According to the analysts’ consensus narrative, these repurchases not only enhance per-share value but are a signal management sees long-term upside, even as overall revenue and profit growth slow compared to industry benchmarks.

- Consensus notes buybacks could amplify EPS growth, helping earnings per share rise toward the projected $11.05 by September 2028.

- This approach signals confidence in cash generation and capital management, supporting the broader investment thesis for FTI within its industry context.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for FTI Consulting on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Uncover your perspective and shape your own narrative in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding FTI Consulting.

See What Else Is Out There

FTI’s projected profit margins and revenue growth both lag the broader market. Share buybacks mask the impact of slower operational expansion.

If you want steadier growth, use stable growth stocks screener (2089 results) to find companies delivering reliable earnings and sales results, no matter what the cycle brings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCN

FTI Consulting

Provides business advisory services to manage change, mitigate risk, and resolve disputes worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion