- United States

- /

- Professional Services

- /

- NYSE:FCN

FTI Consulting (FCN): Evaluating Valuation After Strong Earnings, Raised Guidance, and Expanded Buyback

Reviewed by Simply Wall St

FTI Consulting (FCN) announced third-quarter results showing higher sales and net income compared to last year, while also raising its full-year 2025 earnings guidance. Along with an expanded share buyback, these updates are sparking new interest from investors.

See our latest analysis for FTI Consulting.

The surge in FTI Consulting’s share price, with a 1-day gain of 5.54% and a 9.12% jump over the past week, reflects investors responding enthusiastically to the company’s upbeat earnings, higher guidance, and expanded buyback. While the 1-year total shareholder return sits at -15.99%, longer-term holders have still seen a 67.42% total return over five years. This highlights the stock’s enduring appeal even through recent volatility and renewed momentum following this quarter’s solid performance and strategic moves.

If these shifts in confidence have you thinking bigger, it might be the perfect time to discover fast growing stocks with high insider ownership.

With shares rallying on upbeat results, rising earnings guidance, and a larger buyback, investors now face a key question: is there still value to be found, or are future gains already reflected in the price?

Most Popular Narrative: 4.5% Undervalued

With FTI Consulting’s last close price at $166.58 and the narrative placing fair value at $174.50, the latest consensus suggests shares have room to move higher. The stage is set by bullish expectations around premium consulting demand and global expansion.

Continued strategic investment in proprietary digital tools, analytics, and talent—especially experienced academics and senior professionals—positions FTI to capture higher-value, tech-enabled mandates and command premium billing rates. This approach could drive both higher top-line and improved net margins over time.

What’s fueling the optimism? This narrative hints at a powerful mix: a strong push into digital innovation, evolving margin dynamics, and ambitious analyst targets shaping the boldest projections yet. Curious how those assumptions stack up? The most surprising input is just a click away.

Result: Fair Value of $174.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent industry competition and the rapid advance of automation could limit FTI Consulting’s growth potential sooner than analysts anticipate.

Find out about the key risks to this FTI Consulting narrative.

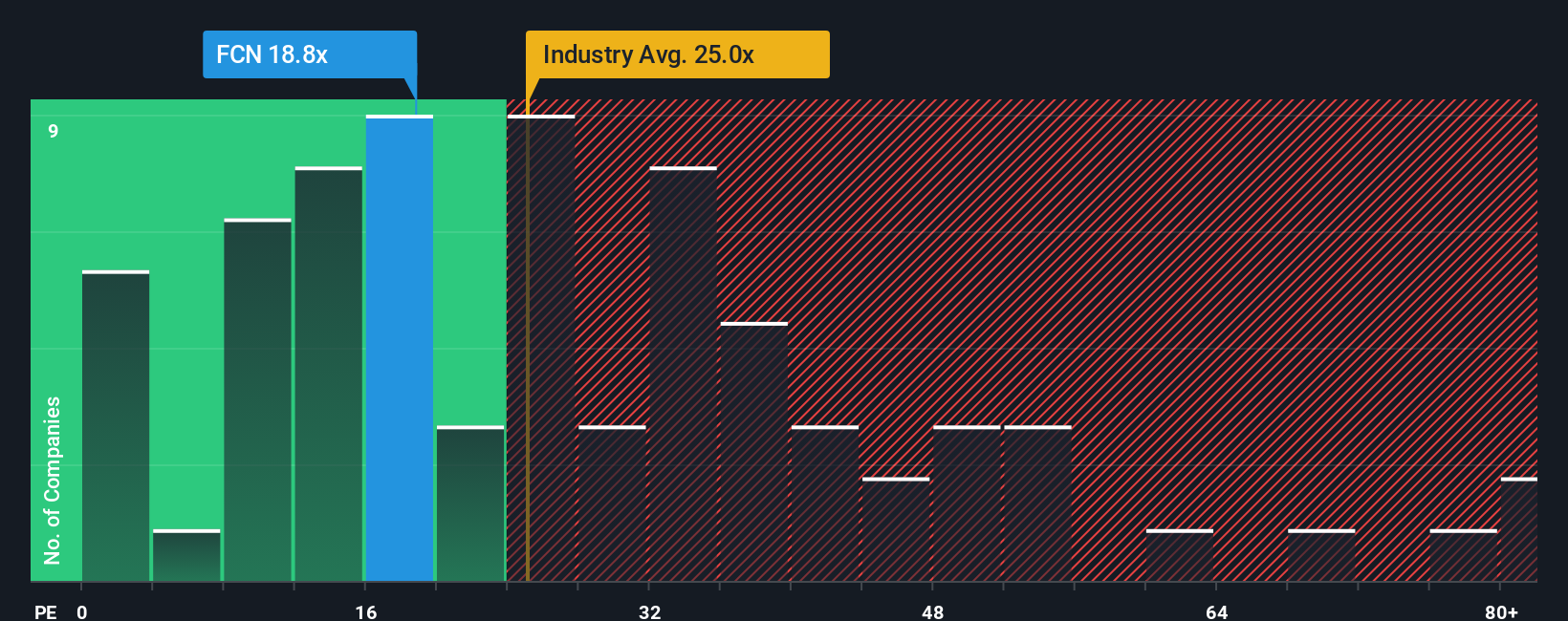

Another View: Multiples Tell a Different Story

Looking at valuation through the lens of the price-to-earnings ratio offers a more cautious perspective. FTI Consulting trades at 18.9x earnings, lower than both its peers (40.8x) and the industry average (27x). The market's fair ratio is estimated at 24.7x, which suggests there could be more room to rerate. Alternatively, is the market factoring in some hidden risk?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FTI Consulting for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FTI Consulting Narrative

If you see things differently or want to run the numbers on your own terms, it’s fast and easy to draft your own perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding FTI Consulting.

Looking for more investment ideas?

Never settle for just one opportunity. Amplify your investing with proven strategies and fresh possibilities, so you don't let profit potential slip away.

- Unearth tomorrow’s tech giants by checking out these 27 AI penny stocks that are pioneering breakthroughs in artificial intelligence and smart automation.

- Boost your income stream with these 19 dividend stocks with yields > 3% offering attractive yields over 3 percent and steady fundamentals.

- Tap into the future of computing by reviewing these 28 quantum computing stocks reshaping industries with revolutionary speed and problem-solving power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCN

FTI Consulting

Provides business advisory services to manage change, mitigate risk, and resolve disputes worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives