- United States

- /

- Professional Services

- /

- NYSE:FCN

Assessing FTI Consulting’s Valuation After Its Recent Share Price Rebound

Reviewed by Bailey Pemberton

- Wondering if FTI Consulting at around $176 a share is quietly turning into a value opportunity, or if the easy money has already been made? Here is a closer look at what the current price is really implying.

- The stock has bounced recently, up 3.4% over the last week and 7.6% over the past month, even though it is still down 7.0% year to date and 9.6% over the last year, after gains of 12.5% over three years and 59.0% over five years.

- That mixed performance comes against a backdrop of FTI continuing to win high profile restructuring and dispute advisory mandates, as companies and governments lean on its expertise in volatile markets. At the same time, ongoing demand for complex regulatory and transformation work has kept FTI in the conversation whenever investors discuss durable consulting franchises.

- On our screen, FTI Consulting posts a valuation score of 3/6. This means it looks undervalued on half of our six core checks. Next we break down what that means across different valuation methods, before finishing with a more holistic way to think about what the stock might be worth.

Find out why FTI Consulting's -9.6% return over the last year is lagging behind its peers.

Approach 1: FTI Consulting Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to the present.

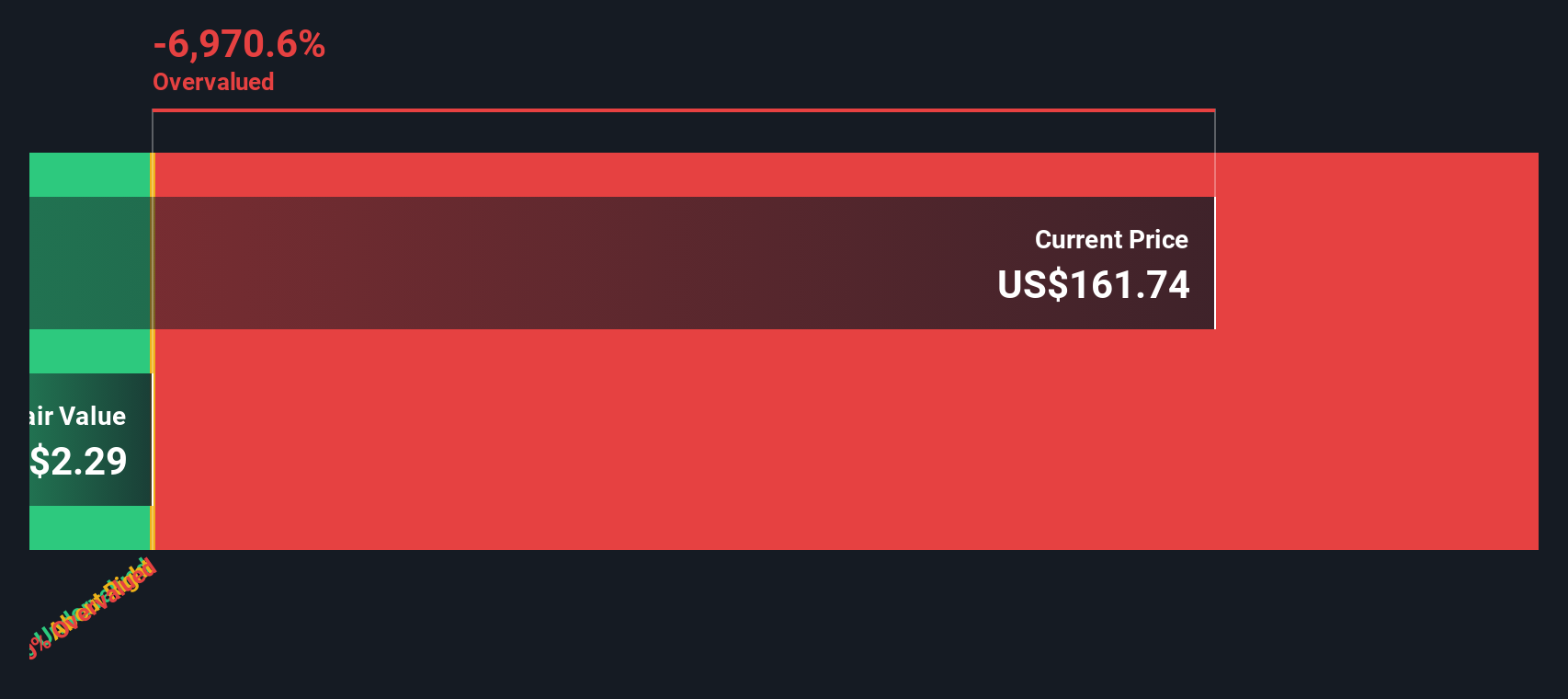

For FTI Consulting, the model starts with last twelve months Free Cash Flow of about $56.4 million and then applies a 2 Stage Free Cash Flow to Equity approach. Near term cash flows are projected to fall sharply, before gradually stabilising over the following years, with forecast Free Cash Flow in 2035 of roughly $0.13 million based on Simply Wall St extrapolations beyond the limited analyst forecast horizon.

When all these projected cash flows are discounted back to today, the model arrives at an intrinsic value of about $0.16 per share. Compared with the current share price around $176, this implies the stock is roughly 112837.0% above the DCF estimate, suggesting the cash flow assumptions in this model are extremely conservative or not well aligned with how the market views FTI’s earnings power.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests FTI Consulting may be overvalued by 112837.0%. Discover 913 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: FTI Consulting Price vs Earnings

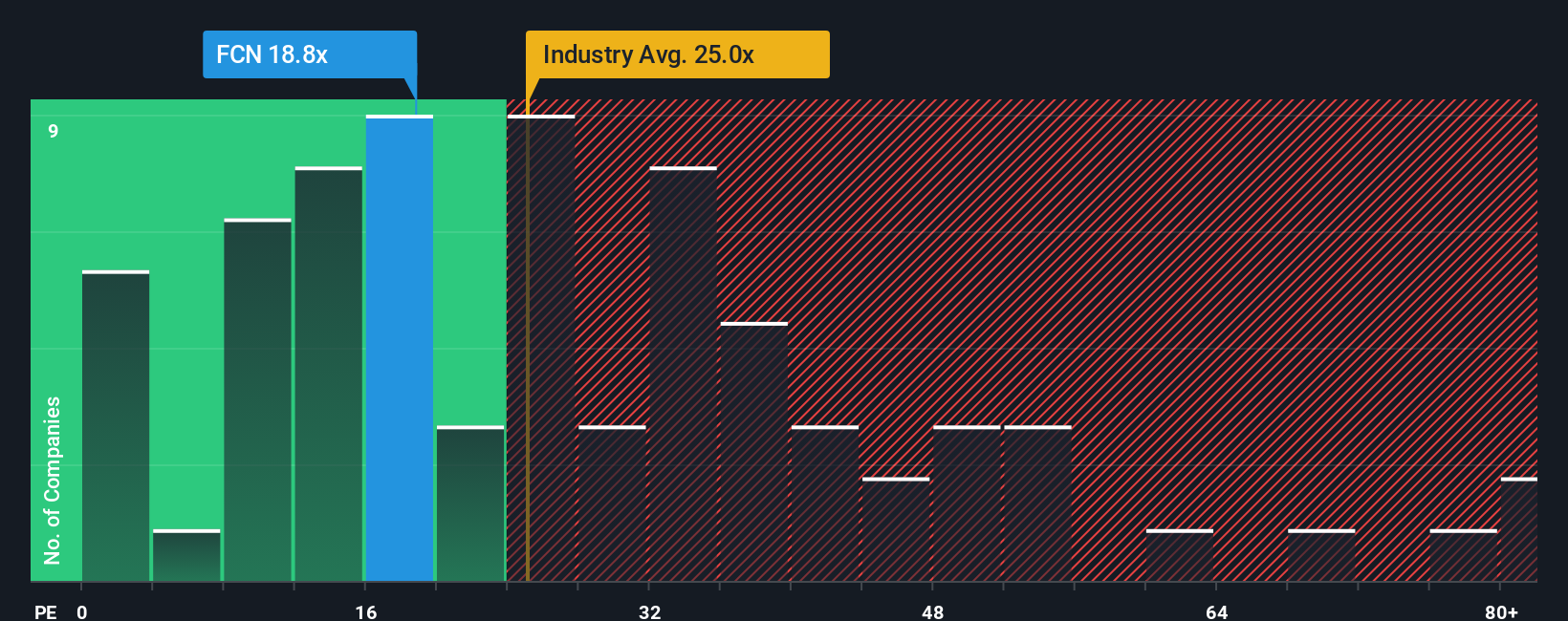

For profitable businesses like FTI Consulting, the price to earnings, or PE, ratio is a practical way to gauge value because it ties the share price directly to the profits the company is generating today. What counts as a normal or fair PE depends on how fast earnings are expected to grow and how risky those earnings are, with faster growing, more resilient businesses typically justifying higher multiples.

FTI Consulting currently trades on a PE of about 20.1x. That sits a little below both the broader Professional Services industry average of roughly 24.4x and the peer group average of around 21.6x, suggesting the market is applying a modest discount versus comparable consulting names. However, headline comparisons like these do not fully capture company specific strengths, growth and risk.

Simply Wall St’s Fair Ratio framework aims to solve that by estimating the PE multiple a stock should trade on given its earnings growth profile, margins, industry, market cap and risk factors. For FTI Consulting, the Fair Ratio is 24.0x, comfortably above the current 20.1x. On this basis, the shares appear somewhat undervalued relative to what its fundamentals might warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1464 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your FTI Consulting Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, a simple way to attach your own story about FTI Consulting to the numbers by setting your assumptions for future revenue, earnings, margins and a fair value estimate. You can then link that story to a dynamic forecast and a Fair Value that you can compare against the current share price to help decide whether to buy, hold or sell.

On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool that updates automatically when new information like earnings, guidance or news hits the market. This helps their fair value stay in sync with reality rather than relying on a one off spreadsheet.

For example, one investor might build an optimistic FTI Consulting Narrative that assumes revenue growing a little faster than the roughly 6 percent consensus, margins lifting above 8 percent and a future PE closer to 24x, producing a Fair Value well above the current price. A more cautious investor might instead plug in slower growth, flat margins and a PE nearer 13x, getting a Fair Value around 166 dollars and concluding that the stock is closer to fairly valued.

Do you think there's more to the story for FTI Consulting? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCN

FTI Consulting

Provides business advisory services to manage change, mitigate risk, and resolve disputes worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion