- United States

- /

- Professional Services

- /

- NYSE:FCN

A Fresh Cybersecurity Hire at FTI Consulting (FCN): What Does It Mean for the Company’s Valuation?

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 12.7% Undervalued

According to the most widely followed narrative, FTI Consulting is currently considered undervalued by 12.7% compared to its fair value estimate. This reflects analysts’ view that the market may be underappreciating the firm’s growth and operational improvements over the next few years.

Ongoing global regulatory complexity and heightened scrutiny in areas such as anti-money laundering, financial crime, and cybersecurity are driving sustained demand for FTI's Forensic & Litigation Consulting, Corporate Finance & Restructuring, and Strategic Communications practices. This trend is likely to expand the overall addressable market and support future revenue growth.

Ever wondered what is fueling that undervalued tag and rosy price outlook? Discover which bold growth metrics and industry shifts analysts are betting on to drive FTI’s next chapter. Do not miss the surprising assumptions behind this valuation story. Dig deeper to see just what sets FTI apart in today’s competitive market.

Result: Fair Value of $185.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including rising automation that could erode margins, and unpredictable regulatory changes, which may disrupt FTI's international expansion ambitions.

Find out about the key risks to this FTI Consulting narrative.Another View: Discounted Cash Flow Model Tells a Different Story

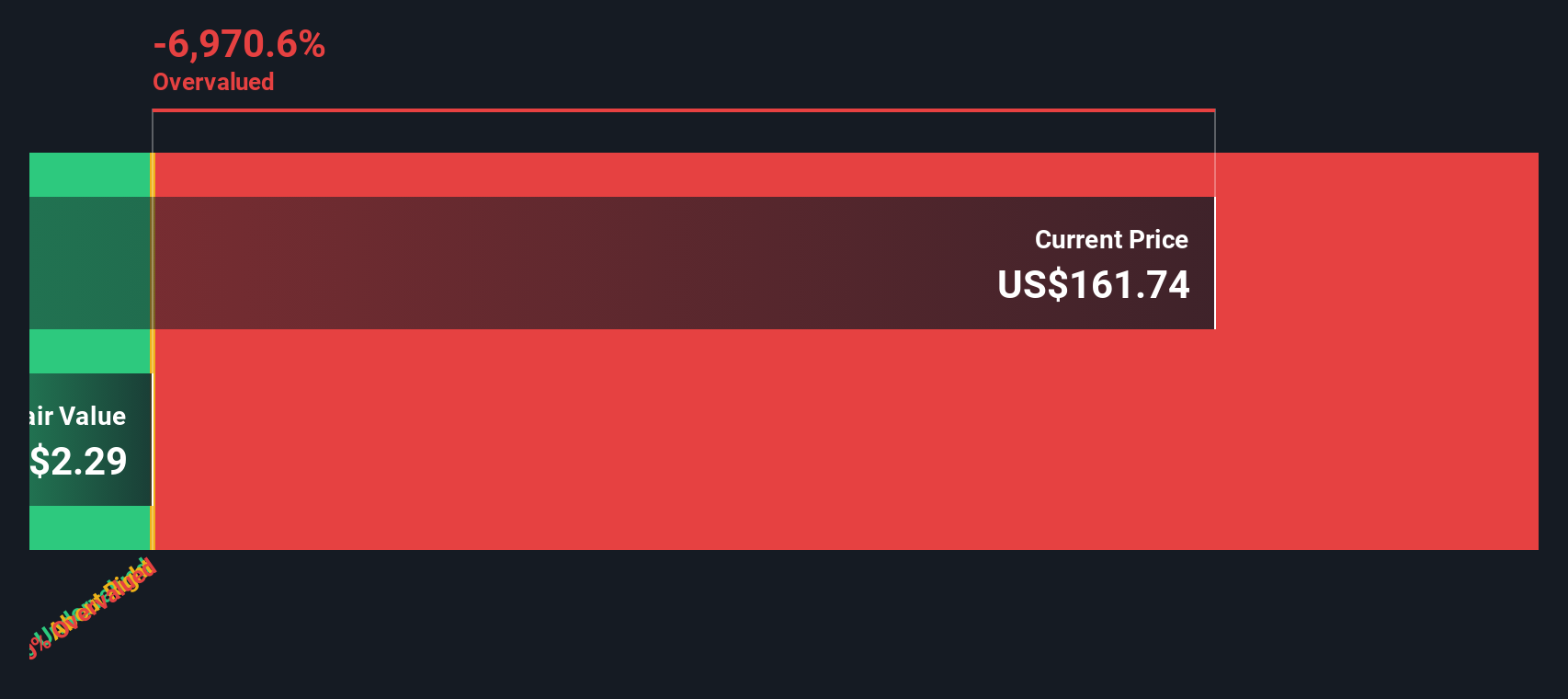

While analysts see FTI Consulting as undervalued based on expected growth and earnings, our DCF model offers a reality check and suggests the shares may actually be priced above their fair value. Which valuation truly captures the risks and opportunities ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own FTI Consulting Narrative

If you think the story unfolds differently or want to see the numbers for yourself, it only takes a few minutes to craft your own perspective. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding FTI Consulting.

Looking for More Smart Investment Opportunities?

Broaden your portfolio and catch trends before the crowd does by acting on these proven strategies. The next big winner could be closer than you think.

- Capitalize on fast-growing small-caps making waves. Find penny stocks with strong financials to spot tomorrow’s market leaders early in their rise with penny stocks with strong financials.

- Harness the surge in artificial intelligence. Uncover under-the-radar AI penny stocks set to transform industries and drive future profits with AI penny stocks.

- Secure reliable income streams. Identify companies offering dividend stocks with yields > 3% so your investments can work harder for you using dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCN

FTI Consulting

Provides business advisory services to manage change, mitigate risk, and resolve disputes worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion