- United States

- /

- Commercial Services

- /

- NYSE:DLX

It's Unlikely That Deluxe Corporation's (NYSE:DLX) CEO Will See A Huge Pay Rise This Year

Key Insights

- Deluxe will host its Annual General Meeting on 25th of April

- Salary of US$943.8k is part of CEO Barry McCarthy's total remuneration

- The overall pay is 69% above the industry average

- Deluxe's EPS grew by 69% over the past three years while total shareholder loss over the past three years was 49%

Shareholders of Deluxe Corporation (NYSE:DLX) will have been dismayed by the negative share price return over the last three years. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. These are some of the concerns that shareholders may want to bring up at the next AGM held on 25th of April. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

View our latest analysis for Deluxe

How Does Total Compensation For Barry McCarthy Compare With Other Companies In The Industry?

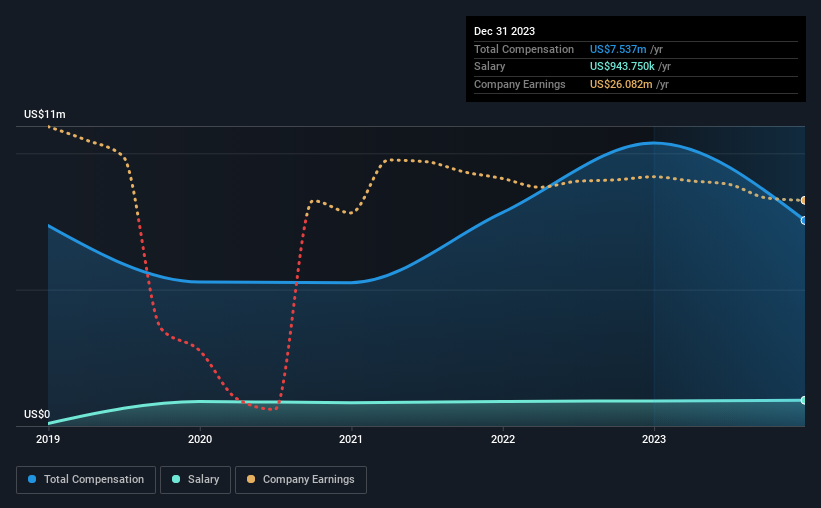

According to our data, Deluxe Corporation has a market capitalization of US$834m, and paid its CEO total annual compensation worth US$7.5m over the year to December 2023. We note that's a decrease of 27% compared to last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$944k.

On examining similar-sized companies in the American Commercial Services industry with market capitalizations between US$400m and US$1.6b, we discovered that the median CEO total compensation of that group was US$4.5m. This suggests that Barry McCarthy is paid more than the median for the industry. Moreover, Barry McCarthy also holds US$3.3m worth of Deluxe stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$944k | US$919k | 13% |

| Other | US$6.6m | US$9.5m | 87% |

| Total Compensation | US$7.5m | US$10m | 100% |

On an industry level, roughly 25% of total compensation represents salary and 75% is other remuneration. Deluxe pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Deluxe Corporation's Growth

Deluxe Corporation has seen its earnings per share (EPS) increase by 69% a year over the past three years. Its revenue is down 2.0% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Deluxe Corporation Been A Good Investment?

With a total shareholder return of -49% over three years, Deluxe Corporation shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 4 warning signs for Deluxe (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DLX

Deluxe

Provides technology-enabled solutions to small and medium-sized businesses, and financial institutions in the United States and Canada.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives