- United States

- /

- Professional Services

- /

- NYSE:DAY

Will Dayforce's Flex Work Expansion and Analyst Downgrade Shift the DAY Investment Narrative?

Reviewed by Simply Wall St

- Earlier this month, Dayforce Inc. announced a significant expansion of its Flex Work solution, introducing enhanced capabilities for managing contingent workforces, including vendor management, on-demand staffing, and expanded agency partnerships for a mobile-first experience.

- This move highlights Dayforce’s response to changing workforce expectations, as recent research shows strong employee demand for flexible scheduling and growing executive focus on streamlining temporary staffing.

- We'll explore how the analyst downgrade and evolving sentiment following this Flex Work expansion may influence Dayforce’s investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Dayforce Investment Narrative Recap

For a shareholder, the core thesis behind Dayforce hinges on sustained demand for unified Human Capital Management (HCM) platforms, driven by digital transformation and increasing workforce complexity. The recent expansion of Dayforce Flex Work, while a meaningful product update, does not appear to materially impact the most important short-term catalyst, the completion of the US$70 per share acquisition by Thoma Bravo and Abu Dhabi Investment Authority. The biggest current risk remains around execution and integration of new offerings amid rising competition.

Among recent announcements, the US$11.5 billion acquisition agreement is most relevant, as it sets a floor for the share price and effectively makes near-term operational catalysts or risks secondary. However, execution risks tied to complex enterprise implementations and longer sales cycles remain, especially as Dayforce scales new products like Flex Work and expands into contingent workforce management.

By contrast, investors should also be aware of the potential for execution mishaps or longer sales cycles if...

Read the full narrative on Dayforce (it's free!)

Dayforce's narrative projects $2.5 billion revenue and $301.9 million earnings by 2028. This requires 10.5% yearly revenue growth and a $252.9 million earnings increase from $49.0 million today.

Uncover how Dayforce's forecasts yield a $70.17 fair value, in line with its current price.

Exploring Other Perspectives

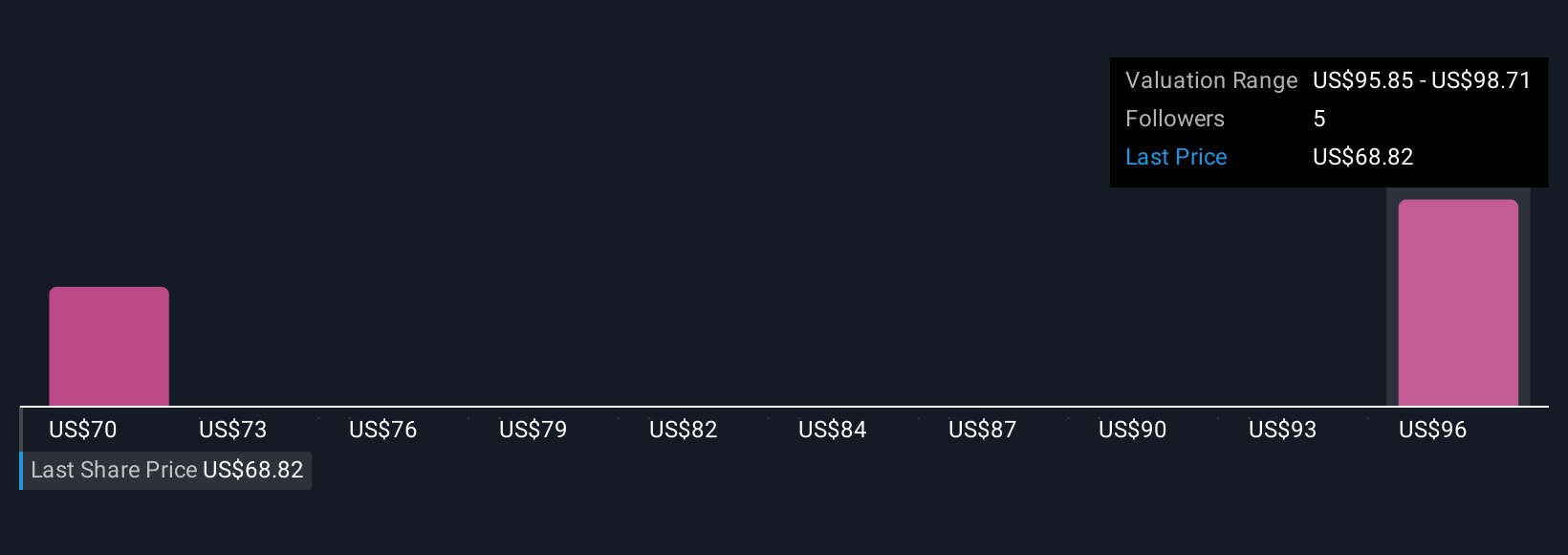

Three individual fair value estimates from the Simply Wall St Community for Dayforce range from US$70.17 to US$98.69 per share. While some see strong upside potential, many will weigh this optimism against the execution risks and competitive threats facing Dayforce in HCM software, reminding you to explore multiple viewpoints before making a decision.

Explore 3 other fair value estimates on Dayforce - why the stock might be worth just $70.17!

Build Your Own Dayforce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dayforce research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Dayforce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dayforce's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAY

Dayforce

Operates as a human capital management (HCM) software company in the United States, Canada, Australia, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives