- United States

- /

- Commercial Services

- /

- NYSE:CXW

CoreCivic (CXW) Is Up 5.5% After Winning Five-Year ICE Contract at Diamondback Facility – Has the Recurring Revenue Thesis Strengthened?

Reviewed by Sasha Jovanovic

- On October 1, the Oklahoma Department of Corrections announced that CoreCivic has been awarded a five-year contract to resume operations at the 2,160-bed Diamondback Correctional Facility under an Intergovernmental Services Agreement with US Immigration and Customs Enforcement.

- This contract enables CoreCivic to reactivate an idle facility, illustrating the company's ability to quickly capitalize on increased government demand for detention capacity.

- We'll explore how securing long-term government contracts for previously idle facilities could reinforce CoreCivic's recurring revenue and profit outlook.

Find companies with promising cash flow potential yet trading below their fair value.

CoreCivic Investment Narrative Recap

To own CoreCivic stock, you need to believe that federal detention and enforcement spending will remain robust, driving demand for large, secure facilities even as policy risks persist. The new five-year Diamondback Correctional Facility contract highlights CoreCivic’s agility in reactivating assets, directly supporting the most important near-term catalyst: increased government contracts fueling occupancy and revenue. However, the company remains highly reliant on a small number of federal agencies, so any change in contract renewals or priorities could quickly pressure results.

One of the most relevant announcements is the recent September 29 win: two major ICE contracts for facilities in California and Kansas, with a combined projected annual revenue of US$200 million. This continues the theme of rapid, recurring contract wins, reinforcing the potential for higher occupancy rates and improved profit margins as more idle beds are activated.

On the flip side, investors should watch for the concentration risk tied to just a handful of government customers, as even a single contract loss could...

Read the full narrative on CoreCivic (it's free!)

CoreCivic's narrative projects $2.8 billion in revenue and $252.2 million in earnings by 2028. This requires 11.7% yearly revenue growth and a $148.2 million increase in earnings from the current $104.0 million.

Uncover how CoreCivic's forecasts yield a $29.88 fair value, a 60% upside to its current price.

Exploring Other Perspectives

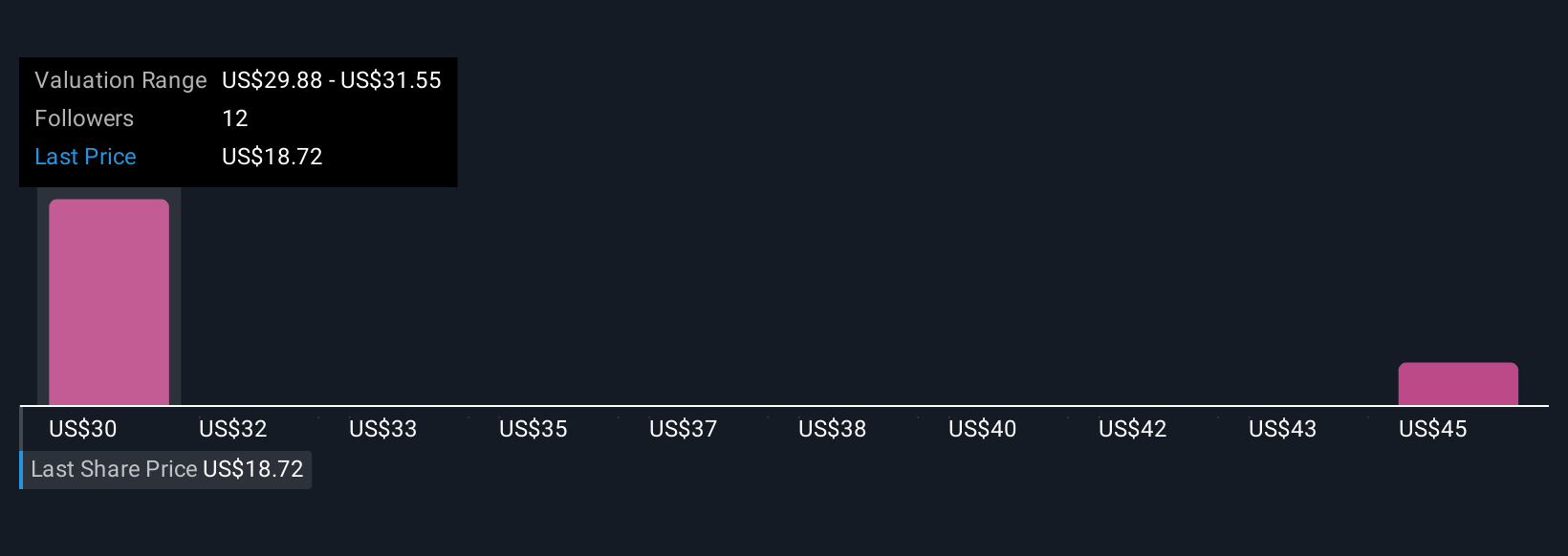

Three members of the Simply Wall St Community placed their fair value estimates for CoreCivic between US$29.88 and US$46.60 per share. While some see upside, reliance on continued federal contracts means results could shift quickly if policies change, so consider several viewpoints before deciding.

Explore 3 other fair value estimates on CoreCivic - why the stock might be worth just $29.88!

Build Your Own CoreCivic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CoreCivic research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CoreCivic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CoreCivic's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CXW

CoreCivic

Owns and operates partnership correctional, detention, and residential reentry facilities in the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives