- United States

- /

- Commercial Services

- /

- NYSE:CLH

Will Clean Harbors' (CLH) M&A Ambitions Offset Softer Earnings and Shape Its Long-Term Strategy?

Reviewed by Simply Wall St

- Clean Harbors reported its second quarter 2025 results, showing a year-over-year decline in net income to US$126.91 million and diluted earnings per share to US$2.36, despite steady revenues of US$1.55 billion.

- During the same announcement, management highlighted the company's strengthened balance sheet and an active pursuit of both bolt-on and larger merger and acquisition opportunities to support growth.

- We’ll explore how Clean Harbors’ focus on potential acquisitions amid softer earnings impacts the company's evolving long-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Clean Harbors Investment Narrative Recap

To be a shareholder of Clean Harbors, you need to believe in the long-term opportunity created by tightening environmental regulations and the company’s position as a leading hazardous waste manager. The recent quarterly update, with steady revenue but a dip in net income, does not materially change the fact that acquisition execution remains a key near-term catalyst, while capital intensity and evolving regulatory risks linger as the biggest current threats to the business model.

The company’s announcement during its second quarter earnings call, highlighting an active M&A pipeline and improved balance sheet, is the most relevant update for assessing Clean Harbors right now. With management emphasizing both bolt-on and transformational deals, this announcement signals continued prioritization of growth by external means, a critical context when considering the timeline and potential impact of new acquisitions on profit and cash flow trajectories.

Yet, despite today’s positive acquisition tone, investors should not overlook the risk that...

Read the full narrative on Clean Harbors (it's free!)

Clean Harbors' outlook anticipates $7.1 billion in revenue and $608.9 million in earnings by 2028. This is based on a projected 6.0% annual revenue growth rate, representing a $217.8 million increase in earnings from the current $391.1 million.

Uncover how Clean Harbors' forecasts yield a $259.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

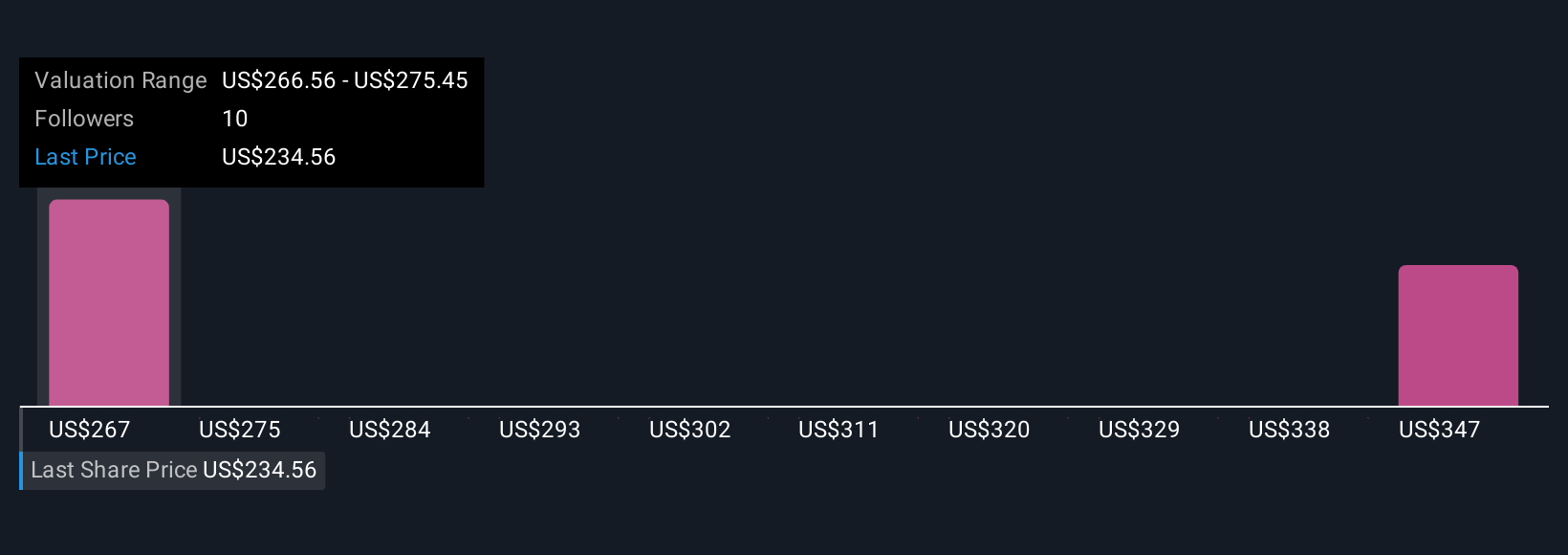

You have two fair value estimates from the Simply Wall St Community, ranging from US$259 to US$379.90 per share. Opinions on Clean Harbors’ future remain divided, especially as M&A activity could rapidly reshape its growth path and value, explore more perspectives to see how your own view fits in.

Explore 2 other fair value estimates on Clean Harbors - why the stock might be worth as much as 61% more than the current price!

Build Your Own Clean Harbors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clean Harbors research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Clean Harbors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clean Harbors' overall financial health at a glance.

No Opportunity In Clean Harbors?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLH

Clean Harbors

Provides environmental and industrial services in the United States and Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives