Brady Corporation (NYSE:BRC) has announced that it will pay a dividend of $0.235 per share on the 31st of July. This payment means that the dividend yield will be 1.4%, which is around the industry average.

See our latest analysis for Brady

Brady's Earnings Easily Cover The Distributions

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. However, Brady's earnings easily cover the dividend. This means that most of its earnings are being retained to grow the business.

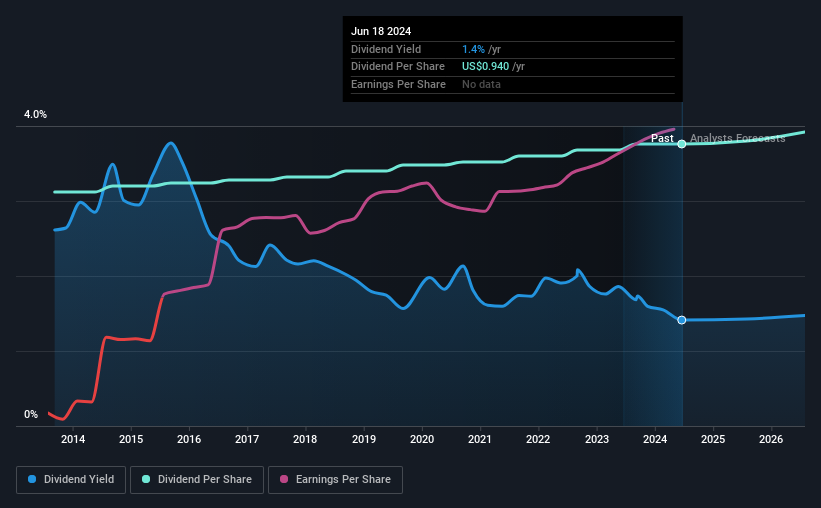

Looking forward, earnings per share is forecast to rise by 26.6% over the next year. If the dividend continues on this path, the payout ratio could be 19% by next year, which we think can be pretty sustainable going forward.

Brady Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The dividend has gone from an annual total of $0.78 in 2014 to the most recent total annual payment of $0.94. This implies that the company grew its distributions at a yearly rate of about 1.9% over that duration. Dividends have grown relatively slowly, which is not great, but some investors may value the relative consistency of the dividend.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. We are encouraged to see that Brady has grown earnings per share at 10% per year over the past five years. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

We Really Like Brady's Dividend

In summary, it is good to see that the dividend is staying consistent, and we don't think there is any reason to suspect this might change over the medium term. Distributions are quite easily covered by earnings, which are also being converted to cash flows. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 1 warning sign for Brady that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Brady might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRC

Brady

Manufactures and supplies identification solutions (IDS) and workplace safety (WPS) products to identify and protect premises, products, and people in the United States and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives