- United States

- /

- Professional Services

- /

- NYSE:BR

Broadridge Financial Solutions (BR): Exploring Valuation Opportunities After a 10% Total Return Year

Reviewed by Kshitija Bhandaru

See our latest analysis for Broadridge Financial Solutions.

Momentum has been quietly building for Broadridge Financial Solutions, with its solid fundamentals supporting a 10% total shareholder return over the past year. The latest share price is $233.69 and recent performance suggests the company continues to win steady investor confidence for both the short and long term.

If you're considering what other opportunities the market might hold, this could be the perfect time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With Broadridge trading below analysts’ price targets but coming off a strong year, investors now face a critical question: is the stock undervalued, or is the market already pricing in all of its future growth?

Most Popular Narrative: 16.3% Undervalued

Broadridge Financial Solutions is currently trading well below the consensus fair value, suggesting the market may be overlooking future profitability and strategic catalysts at the latest price of $233.69.

Broadridge's leadership in secure, scalable, and innovative transaction processing (including blockchain/tokenization and AI-enabled platforms such as OpsGPT and distributed ledger repo solutions) aligns with financial institutions' growing focus on security and the modernization of back-office operations. This enables new product launches, increases switching costs, and supports both revenue growth and improved operating margins.

Want to uncover what’s fueling this valuation? The narrative hinges on bold expectations around margin expansion, subscription revenues, and a bullish take on Broadridge’s future dominance in digital finance. Ready to see which assumptions drive the fair value? Dive in for the precise forecasts behind this price target.

Result: Fair Value of $279.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, macroeconomic uncertainty and declining event-driven revenues could dampen near-term earnings growth, which may challenge even optimistic expectations for Broadridge's momentum.

Find out about the key risks to this Broadridge Financial Solutions narrative.

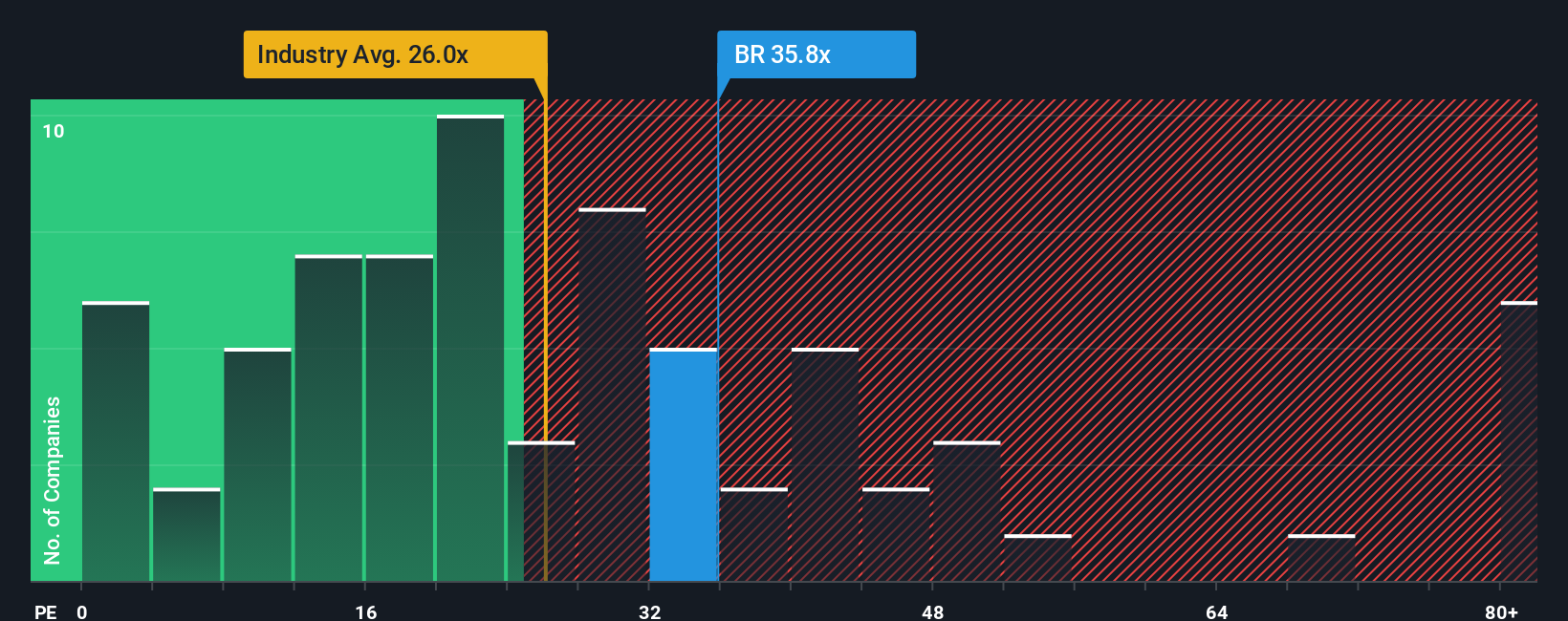

Another View: Industry Multiples Signal Caution

Broadridge’s current price-to-earnings ratio stands at 32.6x, which is noticeably higher than the industry average of 26.7x as well as the peer average of 21.5x. Even in comparison to its fair ratio of 29.2x, the stock appears expensive and may carry valuation risk if market expectations change.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadridge Financial Solutions Narrative

If you have a different perspective or prefer hands-on analysis, you can quickly dig into the numbers yourself and craft your own narrative in under three minutes. Do it your way.

A great starting point for your Broadridge Financial Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't leave profits on the table. Take control of your next move with proven investment themes that smart investors are already tracking.

- Tap into strong cash flows and unlock value by reviewing these 908 undervalued stocks based on cash flows that the market might be missing today.

- Get ahead of the curve with these 31 healthcare AI stocks to see how artificial intelligence is transforming the healthcare landscape with real growth opportunities.

- Maximize your income potential by choosing these 19 dividend stocks with yields > 3% that consistently offer yields above 3% and help strengthen your portfolio's returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadridge Financial Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BR

Broadridge Financial Solutions

Provides investor communications and technology-driven solutions for the financial services industry in the United States and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives