- United States

- /

- Professional Services

- /

- NYSE:BR

Broadridge Financial Solutions (BR): Assessing Valuation Following Digital Innovation and New Strategic Partnerships

Reviewed by Simply Wall St

If you’ve been keeping an eye on Broadridge Financial Solutions (BR), you may have noticed the flurry of activity in just the past week. The company’s newly announced partnerships and feature rollouts, including a collaboration with Wix for advisor websites and a major integration with Nitrogen, are all aimed at making life easier and more effective for financial advisors. Coupled with Broadridge’s alliance with Wedbush Securities to transform technology platforms across the wealth management sector, this wave of innovation is capturing the attention of investors who want to know whether these changes are early signals of competitive momentum or a necessary response to fast-evolving industry needs.

There is already evidence that these developments could be influencing how the market values Broadridge’s stock. Over the past year, shares have delivered a nearly 20% total return, and gains in 2024 show building momentum despite some short-term swings. While excitement has grown around Broadridge’s transformation efforts and strong annual gains, there have also been the usual ups and downs this month, with investors weighing the long-term potential of its technology investments against changes in market sentiment.

With Broadridge entering a new phase of digital leadership, some are considering whether there is a window for investors to buy the stock at an attractive valuation, or if the market is already pricing in these future growth bets.

Most Popular Narrative: 9.6% Undervalued

According to the most widely followed narrative, Broadridge Financial Solutions is considered to be trading below its estimated fair value. Analysts suggest there is still some upside in the current price based on forward-looking growth and profitability expectations, using a discount rate of 7.18%.

"Broadridge's leadership in secure, scalable, and innovative transaction processing (including blockchain/tokenization and AI-enabled platforms like OpsGPT and distributed ledger repo solutions) aligns with financial institutions' growing focus on security and the modernization of back-office operations. This enables new product launches, increases switching costs, and supports revenue growth and improved operating margins."

Want to know why some analysts believe Broadridge deserves a premium valuation despite rising headwinds? The secret lies in the ongoing transformation of the business model and bold forecasts for future profits. Wondering what future growth indicators underpin this fair value? Find out which surprising operational strengths are fueling these optimistic targets and why that might impact the stock’s next move.

Result: Fair Value of $279.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slowing event-driven revenues and longer sales cycles in key segments may act as catalysts, challenging the sustainability of Broadridge’s current growth narrative.

Find out about the key risks to this Broadridge Financial Solutions narrative.Another View: Is the Market Overlooking Something?

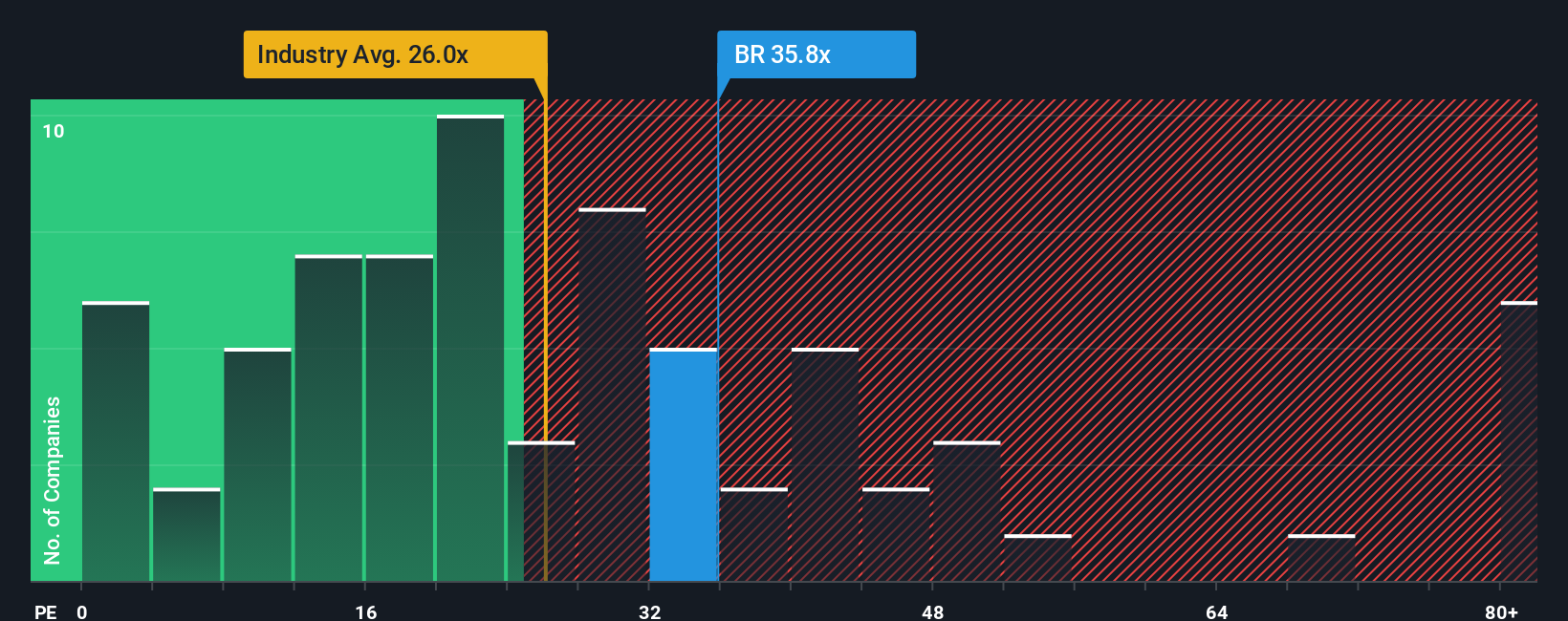

While some analysis highlights Broadridge trading below fair value, a closer look at its price-to-earnings ratio compared to the US Professional Services industry suggests the stock is expensive by this standard. Could market optimism be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadridge Financial Solutions Narrative

If you want to see the numbers for yourself or take your own approach, you can easily craft your own perspective in just a few minutes. Do it your way

A great starting point for your Broadridge Financial Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Unique Investment Opportunities?

Seize your advantage and supercharge your portfolio by hand-picking ideas most investors overlook. These tools put you a step ahead. Don't let smart opportunities pass you by.

- Tap into high-potential value plays by using our undervalued stocks based on cash flows for companies currently trading under their intrinsic worth.

- Jump on the AI revolution early by exploring AI penny stocks that are powering innovation across industries with intelligent technology solutions.

- Boost your passive income strategy with dividend stocks with yields > 3% and uncover stocks delivering robust yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadridge Financial Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BR

Broadridge Financial Solutions

Provides investor communications and technology-driven solutions for the financial services industry in the United States and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives