- United States

- /

- Professional Services

- /

- NYSE:BGSF

Why Investors Shouldn't Be Surprised By BGSF, Inc.'s (NYSE:BGSF) 29% Share Price Plunge

The BGSF, Inc. (NYSE:BGSF) share price has fared very poorly over the last month, falling by a substantial 29%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 37% share price drop.

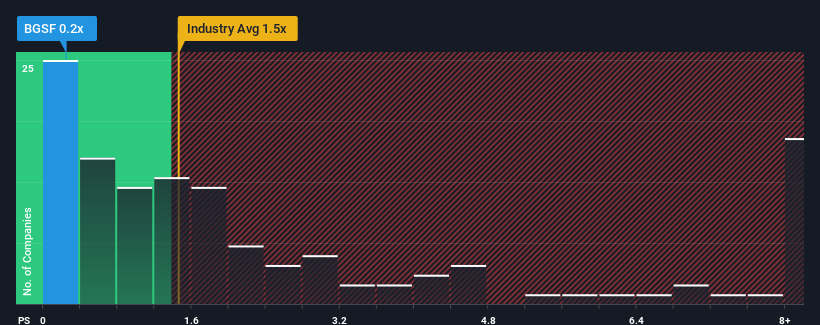

After such a large drop in price, BGSF's price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Professional Services industry in the United States, where around half of the companies have P/S ratios above 1.5x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for BGSF

What Does BGSF's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, BGSF's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on BGSF will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

BGSF's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. Even so, admirably revenue has lifted 65% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 2.8% as estimated by the one analyst watching the company. With the industry predicted to deliver 6.9% growth, the company is positioned for a weaker revenue result.

With this information, we can see why BGSF is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

BGSF's recently weak share price has pulled its P/S back below other Professional Services companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of BGSF's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with BGSF (at least 1 which is potentially serious), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if BGSF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BGSF

BGSF

Provides consulting, managed services, and professional workforce solutions in the United States.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives