- United States

- /

- Commercial Services

- /

- NYSE:BCO

How Investors May Respond To Brink's (BCO) Analyst Upgrades and Digital Services Expansion

Reviewed by Sasha Jovanovic

- In early October 2025, Brink's drew increased investor and analyst optimism following a series of earnings estimate upgrades and continued expansion in its ATM Managed Services and Digital Retail Solutions businesses.

- The company's active share repurchase program and efforts to diversify beyond traditional cash handling are strengthening confidence in its ability to adapt despite industry changes.

- We'll explore how analyst optimism tied to Brink's digital and ATM services expansion could shape its updated investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Brink's Investment Narrative Recap

To be a Brink’s shareholder, you need to believe in the company’s evolution from traditional armored transport toward higher-margin digital and ATM services, and its ability to generate growth even as cash usage trends shift globally. The latest surge in analyst optimism, driven by upgrades and strong momentum in ATM Managed Services and Digital Retail Solutions, meaningfully supports the short-term catalyst of earnings visibility, but the primary risk of a faster move away from cash remains unchanged by recent news.

The company’s most recent share buyback, with nearly 1 million shares repurchased for US$121.4 million between April and August 2025, closely ties to this upbeat sentiment. This announcement is directly relevant because it underlines Brink’s confidence in the value creation potential of its transformation in digital and ATM offerings, the same areas investors and analysts are now focused on as key growth engines.

However, investors should also be mindful of the challenge that would arise if digital payment adoption accelerates more quickly than anticipated…

Read the full narrative on Brink's (it's free!)

Brink's narrative projects $6.0 billion revenue and $755.1 million earnings by 2028. This requires 5.5% yearly revenue growth and a $593.4 million earnings increase from $161.7 million today.

Uncover how Brink's forecasts yield a $128.50 fair value, a 12% upside to its current price.

Exploring Other Perspectives

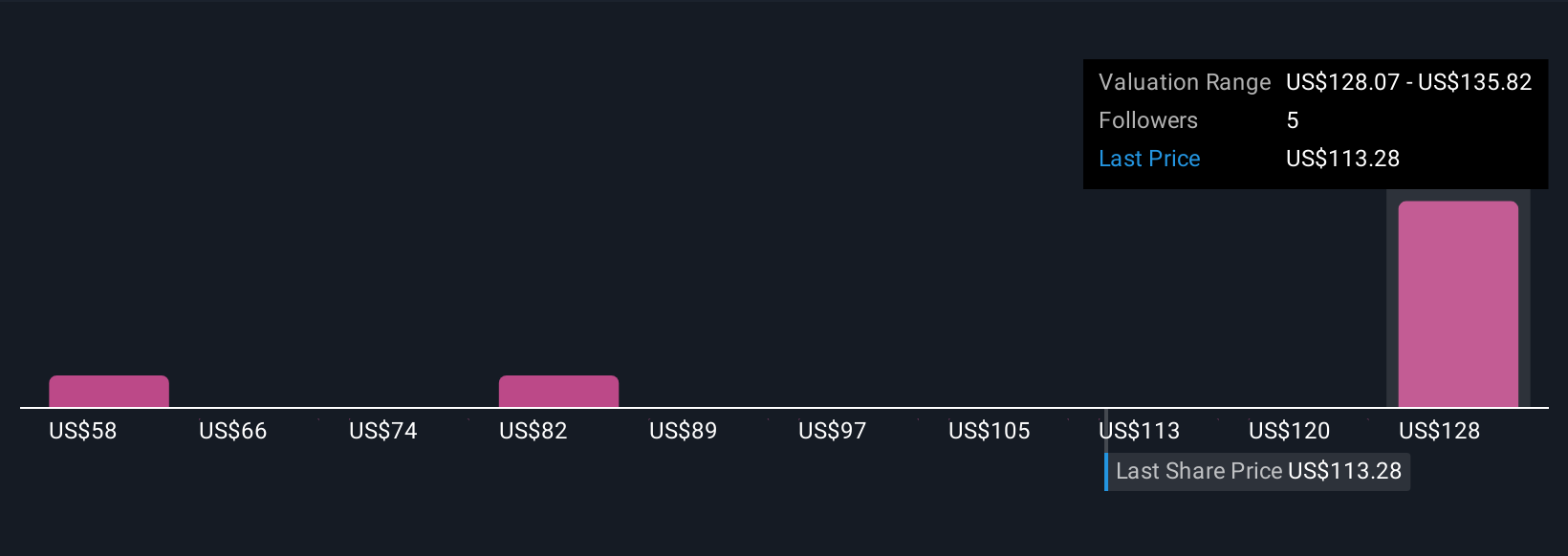

Simply Wall St Community members set fair values for Brink’s from US$58.27 up to US$135.82 across 5 independent analyses. With recent analyst catalysts centered on digital growth and share repurchases, you can see how opinions on performance and value stretch across a broad spectrum.

Explore 5 other fair value estimates on Brink's - why the stock might be worth 49% less than the current price!

Build Your Own Brink's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brink's research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Brink's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brink's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brink's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BCO

Brink's

Provides cash and valuables management, digital retail solutions, and automated teller machines (ATM) managed services in North America, Latin America, Europe, and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives