- United States

- /

- Professional Services

- /

- NYSE:BAH

Will Booz Allen Hamilton (BAH) Weather Federal Funding Uncertainty Better Than Its Government Consulting Peers?

Reviewed by Sasha Jovanovic

- Recent analyst commentary has raised concerns about Booz Allen Hamilton's heightened exposure to risks from a potential U.S. government shutdown, highlighting the possibility of an outlook revision if funding delays materialize or persist.

- This focus on Booz Allen's reliance on federal contracts has brought renewed attention to the company's vulnerability to government spending uncertainties compared to its industry peers.

- We'll explore what the risk of a government shutdown means for Booz Allen Hamilton's investment outlook and long-term contract stability.

Find companies with promising cash flow potential yet trading below their fair value.

Booz Allen Hamilton Holding Investment Narrative Recap

Owning Booz Allen Hamilton requires confidence that federal investment in digital transformation, AI, and cybersecurity will continue to support long-term growth, despite periods of revenue and earnings volatility linked to government spending cycles. The latest analyst commentary suggests the risk of a U.S. government shutdown remains the most pressing near-term issue, but for now this has not triggered a material change to the underlying growth catalysts or outlook for contract wins, given Booz Allen's record backlog and recent awards.

Among recent company announcements, the award of a US$1.58 billion contract for intelligence analysis related to countering weapons of mass destruction, secured in August 2025, underscores demand resilience for Booz Allen’s core services. While ongoing wins like this can support near-term performance and backlog, the risk that a lengthy government funding delay could interrupt backlog conversion and new award timing still weighs on investor confidence.

By contrast, investors should be aware that revenue recognition can be highly sensitive to sudden...

Read the full narrative on Booz Allen Hamilton Holding (it's free!)

Booz Allen Hamilton Holding's outlook anticipates $13.5 billion in revenue and $775.2 million in earnings by 2028. This is based on a projected annual revenue growth rate of 4.1%, but reflects a decrease in earnings of $224.8 million from the current $1.0 billion.

Uncover how Booz Allen Hamilton Holding's forecasts yield a $126.09 fair value, a 22% upside to its current price.

Exploring Other Perspectives

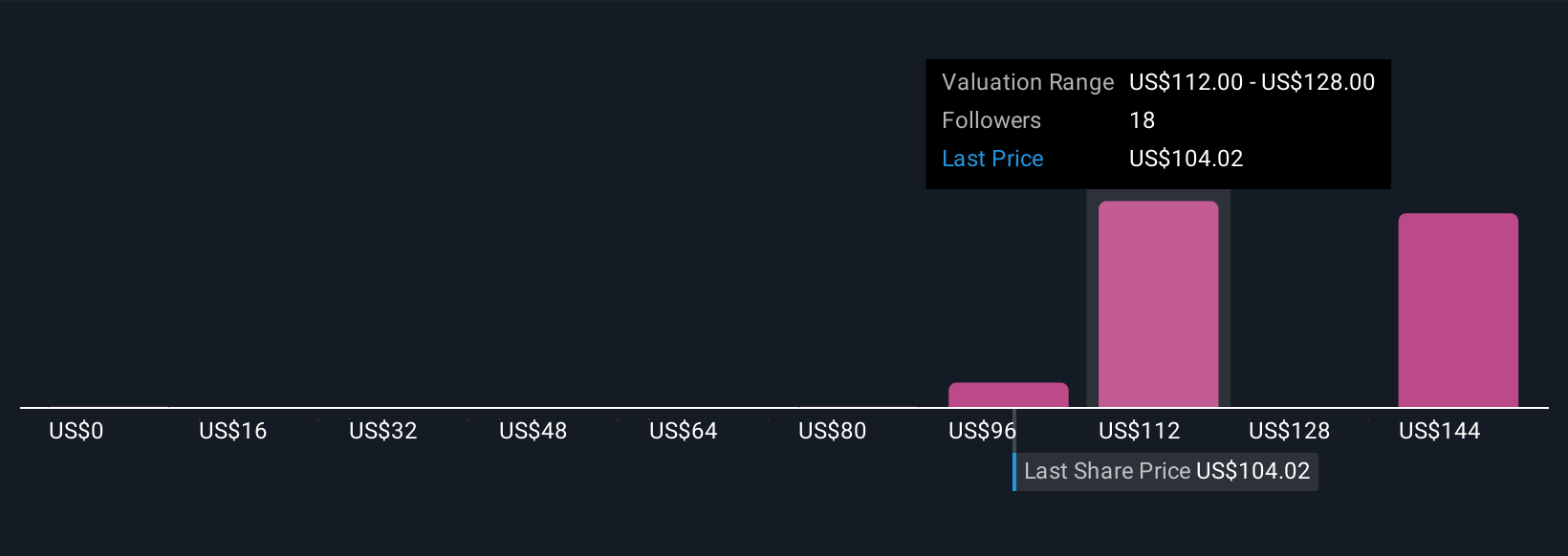

Nine fair value estimates from the Simply Wall St Community range from as low as US$16 to as high as US$160 per share. With government spending uncertainties currently front of mind, you can see how community members weigh risks and catalysts very differently.

Explore 9 other fair value estimates on Booz Allen Hamilton Holding - why the stock might be worth less than half the current price!

Build Your Own Booz Allen Hamilton Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Booz Allen Hamilton Holding research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Booz Allen Hamilton Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Booz Allen Hamilton Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Booz Allen Hamilton Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAH

Booz Allen Hamilton Holding

A technology company, provides technology solutions using artificial intelligence, cyber, and other technologies for government’s cabinet-level departments and commercial customers in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives