- United States

- /

- Professional Services

- /

- NYSE:AMTM

Amentum Holdings (AMTM): Evaluating Valuation After Strong Earnings Surprise and Major Contract Wins

Reviewed by Simply Wall St

Amentum Holdings delivered a strong earnings report for fiscal 2025, swinging to net income and beating expectations on both sales and profit. The company also secured key contracts in the space and nuclear sectors. In addition, it provided 2026 revenue guidance that closely matches market consensus.

See our latest analysis for Amentum Holdings.

Amentum Holdings has seen remarkable momentum this year, with a 1-month share price return of 36.6% and a year-to-date gain of 35.4%. This reflects renewed investor confidence after its strong earnings, contract wins, and steady 2026 outlook. The 1-year total shareholder return of 20.5% highlights that both recent and long-term performance are attracting attention as the company builds on its strategic expansion in digital and government engineering solutions.

If Amentum’s surge has you considering other movers in this sector, check out defense and aerospace standouts with our curated picks: See the full list for free.

But with shares soaring to new highs, the question becomes clear: is Amentum Holdings still trading at an attractive valuation, or has the market already priced in all of its future growth potential?

Price-to-Earnings of 108.3x: Is it justified?

At a last close price of $29.33, Amentum Holdings carries a price-to-earnings ratio of 108.3x, a multiple that positions it as significantly more expensive than its peer group in the professional services sector.

The price-to-earnings (P/E) ratio measures how much investors are paying for each dollar of a company's earnings. In Amentum’s case, such a high P/E suggests the market is placing aggressive value on its earnings potential, likely reflecting expectations for rapid profit growth and transformative contracts in digital and engineering solutions.

However, this optimism stands in sharp contrast with peer averages. Amentum’s P/E of 108.3x is much higher than both the peer group average at 20.2x and the US professional services industry average of 24.3x. Relative to the estimated fair P/E ratio of 45.6x, Amentum still appears richly valued. If market expectations do not materialize, this gap could narrow considerably.

Explore the SWS fair ratio for Amentum Holdings

Result: Price-to-Earnings of 108.3x (OVERVALUED)

However, slower revenue growth or a failure to secure major new contracts could quickly challenge the optimism reflected in Amentum Holdings’ current valuation.

Find out about the key risks to this Amentum Holdings narrative.

Another View: Discounted Cash Flow Tells a Different Story

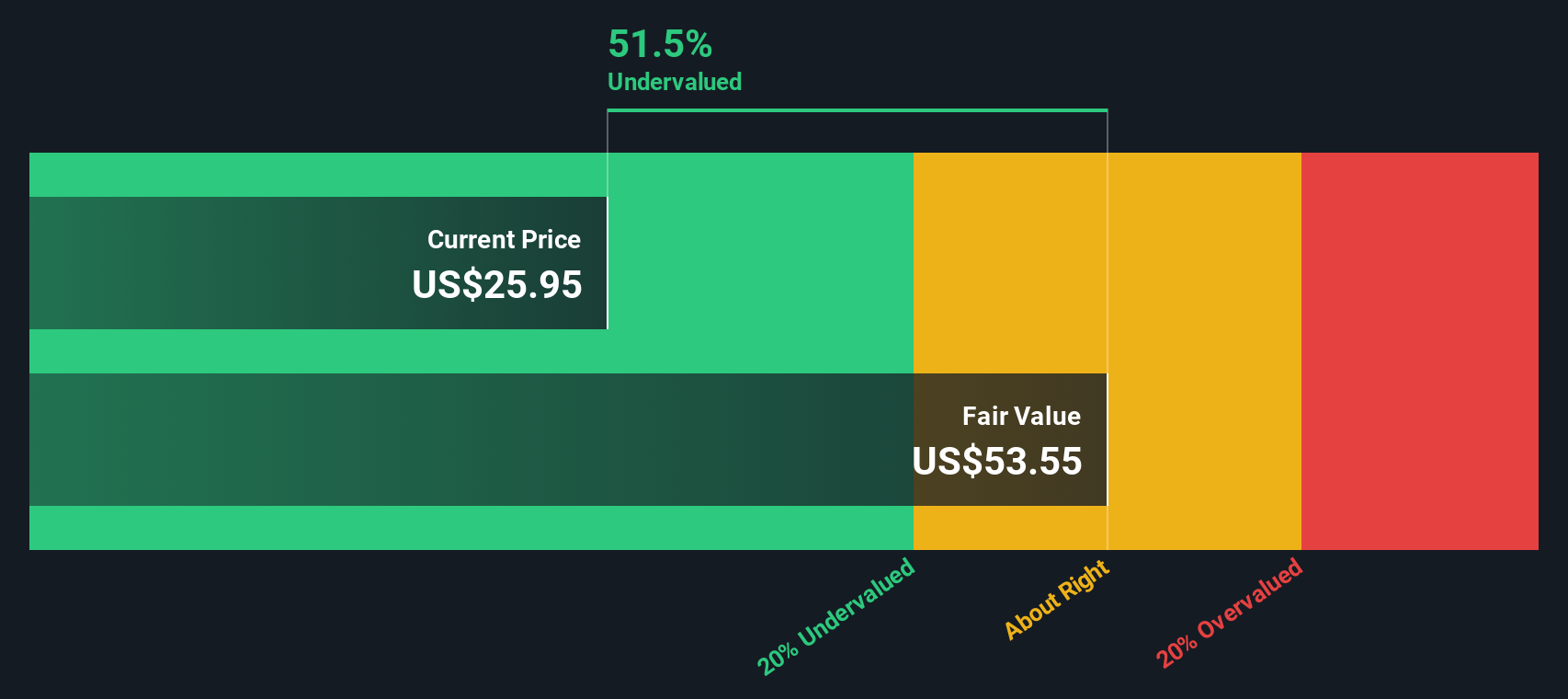

While Amentum Holdings looks expensive based on its price-to-earnings ratio, our SWS DCF model paints a contrasting picture. The shares are actually trading about 53% below our estimated fair value of $62.77. Could the market be overlooking the company’s long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amentum Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 933 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amentum Holdings Narrative

If you see things differently or want to delve deeper into Amentum Holdings’ numbers, you can quickly craft your own narrative in just a few minutes. Do it your way

A great starting point for your Amentum Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Staying ahead means acting on great opportunities before the crowd. The Simply Wall Street Screener uncovers fresh, compelling stocks you might otherwise miss.

- Boost your portfolio with reliable income by targeting high-yield picks via these 15 dividend stocks with yields > 3% that consistently offer attractive payout potential.

- Tap into the future of technology by exploring these 25 AI penny stocks driving advances in artificial intelligence, automation, and disruptive innovation.

- Join early movers and seek growth with these 3579 penny stocks with strong financials showing strong financials and the potential for outsized returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMTM

Amentum Holdings

Engages in the provision of engineering and technology solutions in the United States and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.