- United States

- /

- Commercial Services

- /

- NYSE:ACVA

ACV Auctions (ACVA): Analyst Optimism Grows as Amazon Autos Partnership Sparks Fresh Look at Valuation

Reviewed by Kshitija Bhandaru

ACV Auctions (ACVA) has drawn investor attention after announcing a new partnership with Amazon Autos. This development coincides with the company's ongoing expansion of its data services and a steadily growing share in the auto auction marketplace.

See our latest analysis for ACV Auctions.

The Amazon Autos partnership and recent analyst attention arrive as ACV Auctions’ share price has drifted lower in 2024, with a modest one-year total shareholder return of -0.47%. While long-term performance remains positive over three years, momentum is still searching for firm footing as investors weigh the company’s growth initiatives against a challenging market backdrop.

If you’re looking to discover more companies making waves in auto innovation, check out the full list of opportunities in our auto manufacturers screener in See the full list for free.

With analyst optimism rising and new partnerships in play, is ACV Auctions quietly trading at a bargain, or has the promise of future growth already been fully factored into the share price?

Most Popular Narrative: 48.8% Undervalued

With ACV Auctions trading at $10.10, the most widely followed narrative signals a fair value close to double that price. Before you jump to conclusions, here’s a direct glimpse into the narrative’s reasoning.

The ongoing integration of advanced AI and machine learning into ACV's vehicle inspection, pricing, and guarantee products positions the platform to further differentiate itself by offering real-time, highly accurate, and transparent transaction solutions. This is expected to continue driving above-industry growth in auction volumes, increase take rates, and support margin expansion.

Curious which carefully modeled revenue surge and bold profit projections put ACV Auctions’ fair value far above today’s price? Dive into the numbers and discover which assumptions about future sales, margins, and industry leadership are doing the heavy lifting in this narrative’s valuation puzzle.

Result: Fair Value of $19.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer than expected dealer volumes and persistent macroeconomic uncertainty could temper investor enthusiasm and challenge ACV Auctions’ bullish growth narrative in the near term.

Find out about the key risks to this ACV Auctions narrative.

Another View: Risk in the Market's Current Multiple

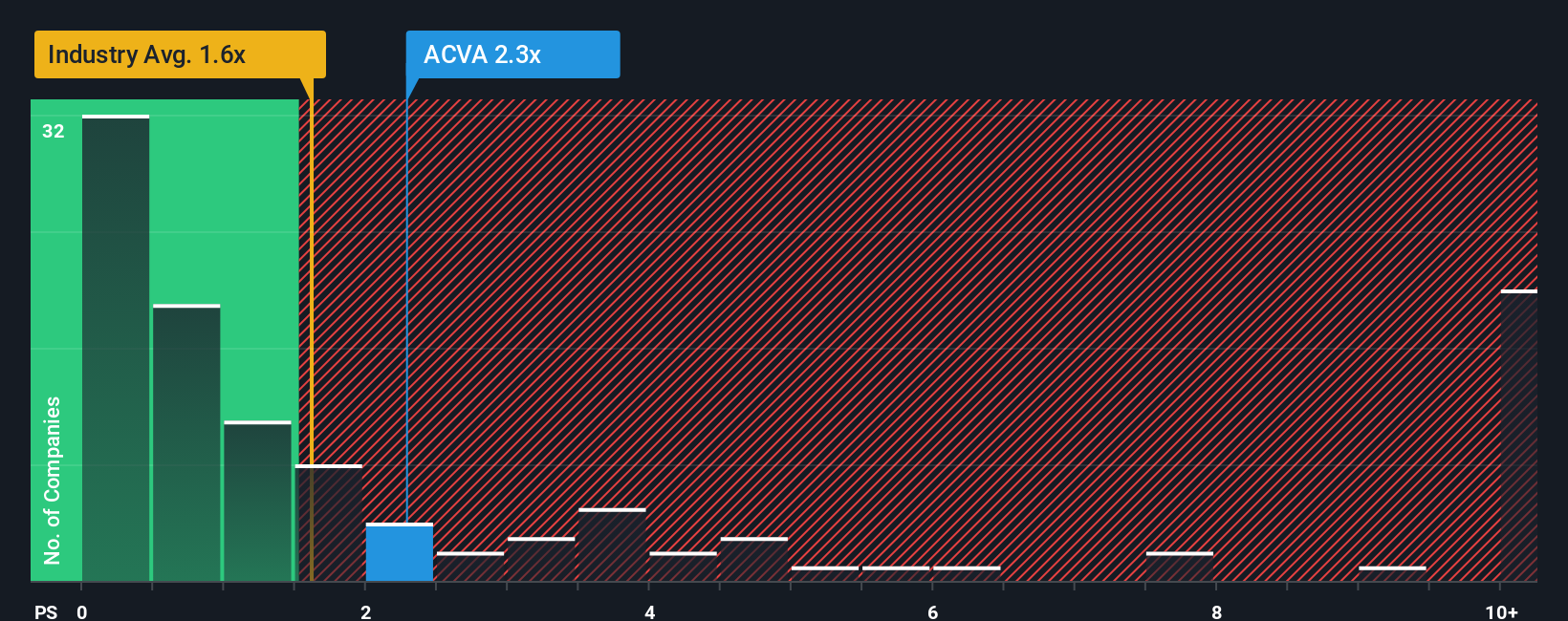

While the fair value estimate suggests ACV Auctions is undervalued, a look at the company’s price-to-sales ratio paints a riskier picture. At 2.5x, ACV’s valuation stands significantly above the industry average of 1.6x and a peer average of 1.3x. It also exceeds the fair ratio of 1.5x that markets might eventually settle on. This gap means investors could face downside if growth expectations are not met. Is the market’s optimism justified, or should caution prevail?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ACV Auctions Narrative

Prefer to draw your own conclusions? You can dig into the numbers and craft a personalized narrative for ACV Auctions in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding ACV Auctions.

Looking for More Investment Ideas?

Take charge of your next move with investment opportunities you might regret missing. Handpick your favorites and get ahead of the market curve now:

- Spot potential in undervalued companies and get the facts first with these 904 undervalued stocks based on cash flows.

- Tap into the exponential possibilities of digital currencies by browsing these 78 cryptocurrency and blockchain stocks.

- Capture high yields and dependable payouts through these 19 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACVA

ACV Auctions

Provides a wholesale auction marketplace to facilitate business-to-business used vehicle sales between a selling and buying dealership.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives